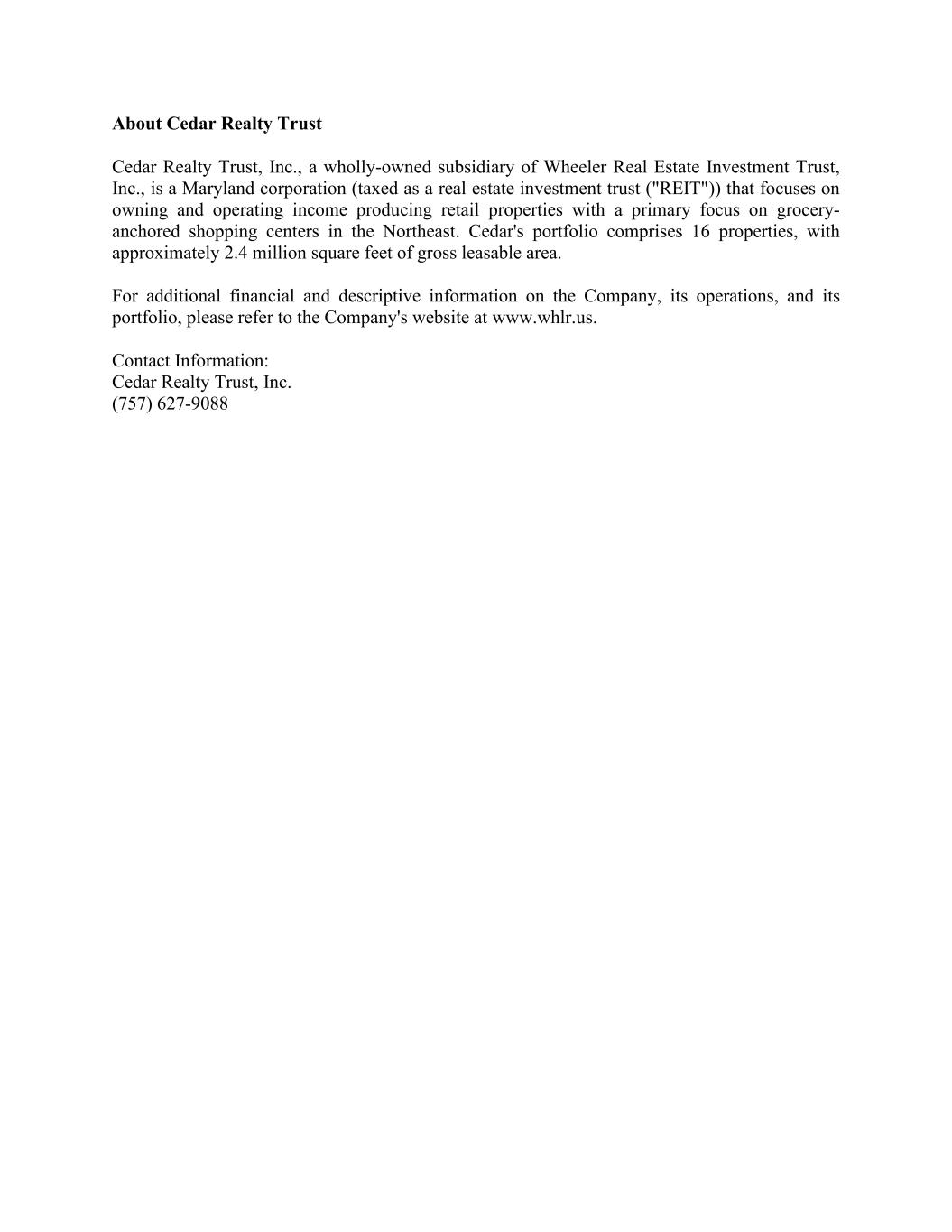

Exhibit 99.1 Cedar Realty Trust Announces Tax Information for 2024 Distributions Virginia Beach, Virginia – January 21, 2025 - Cedar Realty Trust, Inc. (the "Company") (NYSE:CDRpB)(NYSE:CDRpC) today announced the federal income tax treatment of its 2024 distributions to the holders of its preferred shares. Total Section Distribution Ordinary 199A Nondividend Record Date Payable Date Per Share Dividends Dividends Distribution 2/9/2024 2/20/2024 $0.453125 $0.000000 $0.000000 $0.453125 5/10/2024 5/20/2024 $0.453125 $0.000000 $0.000000 $0.453125 8/9/2024 8/20/2024 $0.453125 $0.000000 $0.000000 $0.453125 11/8/2024 11/20/2024 $0.453125 $0.000000 $0.000000 $0.453125 Totals $1.812500 $0.000000 $0.000000 $1.812500 Total Section Distribution Ordinary 199A Nondividend Record Date Payable Date Per Share Dividends Dividends Distribution 2/9/2024 2/20/2024 $0.406250 $0.000000 $0.000000 $0.406250 5/10/2024 5/20/2024 $0.406250 $0.000000 $0.000000 $0.406250 8/9/2024 8/20/2024 $0.406250 $0.000000 $0.000000 $0.406250 11/8/2024 11/20/2024 $0.406250 $0.000000 $0.000000 $0.406250 Totals $1.625000 $0.000000 $0.000000 $1.625000 CUSIP: 150602506 Series B Preferred Stock Series C Preferred Stock Symbol: CDRpB Symbol: CDRpC CUSIP: 150602407 Shareholders are advised to consult their tax advisor about the specific tax treatment of 2024 dividends.

About Cedar Realty Trust Cedar Realty Trust, Inc., a wholly-owned subsidiary of Wheeler Real Estate Investment Trust, Inc., is a Maryland corporation (taxed as a real estate investment trust ("REIT")) that focuses on owning and operating income producing retail properties with a primary focus on grocery- anchored shopping centers in the Northeast. Cedar's portfolio comprises 16 properties, with approximately 2.4 million square feet of gross leasable area. For additional financial and descriptive information on the Company, its operations, and its portfolio, please refer to the Company's website at www.whlr.us. Contact Information: Cedar Realty Trust, Inc. (757) 627-9088