SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

[(Amendment No. ____)]

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] [ ] [X] [ ] [ ] |

Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material Pursuant to ss.240.14a-11(c)orss. 240.14a-12 |

| [X] [ ] |

No fee required Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) (2) (3) (4) (5) |

Title of each class of secruties to which transaction applies:_________________________ Aggregate number of securities to which transaction applies:________________________ Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 011 (set forth the amount on which the filing fee is calculated and state how it was determined): _________________________________________________________________________________________ Proposed maximum aggregate value of transaction:_______________________________ Total fee paid:___________________________________________________________ |

| [ ] [ ] |

|

Fee previously paid with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) (2) (3) (4) |

Amount Previously Paid:_______________________ Form, Schedule or Registration Statement No.:__________________________ Filing Party:_________________________________ Date Filed:__________________________________ |

CEDAR SHOPPING CENTERS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 15, 2004

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Cedar Shopping Centers, Inc. (the "Company") will be held at the offices of Stroock & Stroock & Lavan LLP, 180 Maiden Lane, 34th Floor, New York, NY 10038, on Tuesday, June 15, 2004 at 4:00 in the afternoon for the following purposes:

| 1. | To elect six Directors. |

| 2. | To approve the 2004 Stock Incentive Plan. |

| 3. | To approve the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending December 31, 2004. |

| 4. | To transact such other business as may properly come before the meeting, or any adjournment thereof. |

Stockholders of record at the close of business on April 23, 2004, shall be entitled to notice of, and to vote at, the meeting.

|

By order of the Board of Directors Leo S. Ullman Chairman of the Board |

Dated: April 29, 2004

Port Washington, NY

IMPORTANT: PLEASE FILL IN, DATE, SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY IN THE POSTAGE-PAID ENVELOPE PROVIDED TO ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE MEETING.

CEDAR SHOPPING CENTERS, INC.

44 SOUTH BAYLES AVENUE

PORT WASHINGTON, NEW YORK 11050

PROXY STATEMENT

The accompanying Proxy is solicited by the Board of Directors of Cedar Shopping Centers, Inc., a Maryland corporation (the "Company"), for use at the Annual Meeting of Stockholders (the "Meeting") to be held on June 15, 2004, at 4:00 in the afternoon, or any adjournment thereof, at which stockholders of record at the close of business on April 23, 2004 shall be entitled to vote. The cost of solicitation of proxies will be borne by the Company. The Company may use the services of its directors, officers, employees and others to solicit proxies, personally or by telephone; arrangements may also be made with brokerage houses and other custodians, nominees, fiduciaries and stockholders of record to forward solicitation material to the beneficial owners of stock held of record by such persons. The Company may reimburse such solicitors for reasonable out-of-pocket expenses incurred by them in soliciting, but no compensation will be paid for their services.

Each proxy executed and returned by a stockholder may be revoked at any time before it is voted by timely submission of written notice of revocation or by submission of a duly executed proxy bearing a later date (in either case directed to the Secretary of the Company) or, if a stockholder is present at the Meeting, he may elect to revoke his proxy and vote his shares personally.

There is being mailed herewith to each stockholder of record the Company's Annual Report to Stockholders for the fiscal year ended December 31, 2003. It is intended that this Proxy Statement and form of Proxy will first be sent or given to stockholders on or about April 29, 2004. The Company's website address is www.cedarshoppingcenters.com.

On April 23, 2004, the Company had outstanding and entitled to vote with respect to all matters to be acted upon at the meeting, 16,456,011 shares of Common Stock. Each holder of Common Stock is entitled to one vote for each share of stock held by such holder. The presence of holders representing a majority of all the votes entitled to be cast at the meeting will constitute a quorum at the meeting. In accordance with Maryland law, abstentions, but not broker non-votes, are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Each item on the agenda must receive the affirmative vote of a majority of the shares voted at the meeting in order to pass. Abstentions and broker non-votes are not counted in determining the votes cast with respect to any of the matters submitted to a vote of stockholders.

It is expected that the following business will be considered at the meeting and action taken thereon:

1. ELECTION OF DIRECTORS

Pursuant to the Certificate of Incorporation and Bylaws, as amended, the director nominees elected at this Meeting will be elected to serve one-year terms that expire upon the date of the next annual meeting or until their respective successors are duly elected and qualified. At the Company's 2003 annual meeting, the stockholders approved the declassification of its Board of Directors. As the result, the Board of Directors is no longer classified; however, this did not affect the director whose term extended beyond such meeting who will be allowed to serve until the expiration of the term for which he was elected.

It is intended that the accompanying form of Proxy will be voted for the nominees set forth below, each of whom is presently a director of the Company. If some unexpected occurrence should make necessary, in the Board of Directors' judgment, the substitution of some other person or persons for these nominees, shares will be voted for such other persons as the Board of Directors may select.

The Board of Directors is not aware that any nominee may be unable or unwilling to serve as a director. The following table sets forth certain information with respect to the nominees and also with respect to the director whose term of office will continue after this Meeting.

NOMINEES FOR ELECTION

Name |

Age |

Principal Occupation and Positions Held |

Served as a Director Since |

| James J. Burns | 64 | Mr. Burns has been Chief Financial Officer and Senior Vice President of Wellsford Real Properties, Inc. since December 2000. He joined Wellsford in October 1999 as Chief Accounting Officer upon his retirement from Ernst & Young in September 1999. Mr. Burns was previously a Senior Audit Partner with Ernst & Young's Kenneth Leventhal Real Estate Group for 22 years. Mr. Burns is also a director of One Liberty Properties, Inc., a net lease real estate investment trust with ownership interests in various types of properties. Mr. Burns is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants. | 2001 |

| Richard Homburg | 54 | Mr. Homburg was a director of the Company and chairman of the Company's Board of Directors from November 1999 to August 2000, and a director again since December 18, 2002. Mr. Homburg was born and educated in the Netherlands. Mr. Homburg was the president and CEO of Uni-Invest N.V., a publicly listed Dutch real estate fund, from 1991 until 2000. In 2002, an investment group purchased 100% of the shares of Uni-Invest N.V., taking it private, at which time it was one of the largest real estate funds in the Netherlands with assets of approximately $2.5 billion CDN. Mr. Homburg is chairman and CEO of Homburg Invest, Inc. and president of Homburg Invest USA, Inc. In addition to his varied business interests, Mr. Homburg has served on many boards. Previous positions held by Mr. Homburg include president and director of the Investment Property Owners of Nova Scotia, Evangeline Trust and World Trade Center in Eindhoven, the Netherlands, as well as director or advisory board member of other large charitable organizations. | 2002 |

| Everett B. Miller, III | 58 | Mr. Miller is vice president of alternative investments at YMCA Retirement Fund. In March 2003, Mr. Miller was appointed to the Real Estate Advisory Committee of the New York State Common Retirement Fund. Prior to his retirement from Commonfund Realty, Inc., a registered investment advisor, in May 2002, Mr. Miller was the Chief Operating Officer of Commonfund Realty from 1997 until May 2002. From January 1995 through March 1997, Mr. Miller was the Principal Investment Officer for Real Estate and Alternative Investment at the Office of the Treasurer of the State of Connecticut. Prior thereto, Mr. Miller was employed for 18 years at affiliates of Travelers Realty Investment Co., at which his last position was Senior Vice President. | 1998 |

| Leo S. Ullman | 64 | Mr. Ullman, president, chief executive officer, and chairman of the Board of Directors of the Company, has been involved in real estate property and asset management for more than 25 years. He was Chairman and President of SKR Management Corp., Chairman of Brentway Management LLC from 1994 (and its predecessors since 1978) and President of Cedar Bay Realty Advisors since its formation in 1998, until their mergers into the Company in 2003. Mr. Ullman was first elected as Chairman of the Company in 1998 and served in such position until November 1999. He was re-elected in December 2000. He also has been chief executive officer and president of the Company since April 1998. He has been a member of the New York Bar since 1966 and was in private legal practice until 1998. From 1984 until 1993, Mr. Ullman was a partner in the New York law firm, Reid & Priest, and served as an initial director of its real estate group. | 1998 |

| Brenda J. Walker | 51 | Ms. Walker has been vice president and a director of the Company since 1998, and served as the Company's Treasurer from April 1998 until November 1999. She was Vice President of SKR Management Corp. and Cedar Bay Realty Advisors and President of Brentway Management LLC from 1994 until their mergers into the Company in 2003. She was Vice President of API Management Services Corp. and API Asset Management, Inc. from 1992 through 1995. Ms. Walker has been involved in real estate property and asset management for more than twenty years. | 1998 |

| Roger M. Widmann | 64 | Mr. Widmann is a principal of the investment banking firm of Tanner & Co., Inc., which specializes in providing advice to corporations ranging from Fortune 200 companies to mid-sized firms. From 1986 to 1995, Mr. Widmann was a senior managing director of Chemical Securities Inc., a subsidiary of Chemical Banking Corporation (now JPMorgan Chase Corporation). Prior to joining Chemical Securities Inc., Mr. Widmann was a founder and managing director of First Reserve Corporation, the largest independent energy investing firm in the U.S. Previously, he was senior vice president with the investment banking firm of Donaldson, Lufkin & Jenrette, responsible for the firm's domestic and international investment banking business. He has also been a vice president with New Court Securities Corporation (now Rothschild, Inc.). Mr. Widmann is a senior moderator of the Executive Seminar in the Humanities at The Aspen Institute, is Chairman of Lydall, Inc. (NYSE), Manchester, Connecticut, a manufacturer of thermal, acoustical and filtration materials, is a director of Paxar Corporation, White Plains, New York, a manufacturer of labeling systems, and is president of the March of Dimes of Greater New York. | 2003 |

DIRECTOR WHOSE TERM OF OFFICE WILL

CONTINUE AFTER MEETING

Name |

Age |

Principal Occupation and Positions Held |

Year Term of Office Will Expire |

Served as a Director Since |

| J.A.M.H. der Kinderen | 64 | Mr. der Kinderen was Director of Investments of the Rabobank Pension Fund from 1984 through 1994. He has served, or currently serves, as Chairman of the Board or a member of the Board of the following: Noord Amerika Real Estate B.V. (1995-present), Noord Amerika Vast Goed B.V. (1985-present), Mass Mutual Pierson (M.M.P.) (1988-1997), Warner Building Corporation (1996 to date), GIF Vastgoed (1998 to date), Fellion Investments B.V. (2001 to date), N.V. Maatschappij Voot Trustzaken Ameuro (2002 to date) and van Boom & Slettenhaar Fondsen XI-XII-VIII-IX-X. | 2005 | 1998 |

Independent Directors

Pursuant to rules adopted by the New York Stock Exchange and applicable law, a majority of the Company's directors must be independent as specified therein. As the result, the Board undertook a review of director independence. During this review, the Board considered transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates, including those reported under "Certain Relationships and Related Transactions" below. The Board also examined transactions and relationships between directors or their affiliates and members of the Company's senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As the result of this review, the Board affirmatively determined each of Messrs. Burns, der Kinderen, Miller and Widmann are independent of the Company and its management. The Board determined that each of these independent directors did not have any material relationships with the Company. The directors who are not independent are Messrs. Ullman and Homburg and Ms. Walker.

Corporate Governance Principles and Committee ChartersOur board of directors has adopted a comprehensive set of corporate governance principles to reflect its commitment to corporate governance and the role of such principles in building and sustaining stockholder value. These principles are discussed more fully below and are set forth in our Code of Business Conduct and Ethics and the committee charters for our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. These documents are available on our website at www.cedarshoppingcenters.com or by written request to Investor Relations, 44 South Bayles Avenue, Port Washington, NY 11050.

Code of Business Conduct and Ethics

All of our employees, including our chief executive officer, chief financial officer and principal accounting officer, and our directors are required to comply with our code of business conduct and ethics. Our code is available on our website. It is our intention to disclose any amendments to, or waivers from, any provisions of this code as it applies to our chief executive officer, chief financial officer and principal accounting officer on our website within three business days of such amendment or waiver.

Audit Committee

The Board of Directors has established an audit committee consisting of James J. Burns, J.A.M.H. der Kinderen, and Everett B. Miller, III. The charter of the Audit Committee is attached to this proxy statement as Exhibit A and is also available on the Company's website. All the members of the Audit Committees are independent under the rules of the New York Stock Exchange and applicable law. Mr. Burns is qualified as an audit committee financial expert within the meaning of applicable law and the Board has determined that he has accounting and related financial management expertise under the rules of the New York Stock Exchange. The functions of this committee include the engaging and discharging of the independent auditors, reviewing with the independent auditors the plan and results of the auditing engagement and reviewing the independence of the independent auditors, including the range of audit and non-audit fees.

Compensation Committee

The Board of Directors has established a compensation committee consisting of J.A.M.H. der Kinderen, Everett B. Miller, III, and Roger M. Widmann, all of whom are independent. This committee reviews and approves the compensation and benefits of executive officers, administers and makes recommendations to the Board of Directors regarding executive compensation and stock incentive plans and produces an annual report on executive compensation for inclusion in the proxy statement.

Nominating Committee

The Board of Directors has established a Nominating/Corporate governance committee consisting of James J. Burns, J.A.M.H. der Kinderen, and Roger M. Widmann, all of whom are independent. This committee develops and recommends to the Board of Directors a set of corporate governance principles, adopts a code of ethics, adopts policies with respect to conflicts of interest, monitors compliance with corporate governance requirements of state and federal law and the rules and regulations of the New York Stock Exchange, establishes criteria for prospective members of the Board of Directors, conducts candidate searches and interviews, oversees and evaluates the board of directors and management, evaluates from time to time the appropriate size and composition of the Board of Directors and formally proposes the slate of directors to be elected at each annual meeting of stockholders.

Nomination of Directors

The Nominating/Corporate Governance Committee is responsible for the selection and nomination of the directors. The Committee has adopted a policy to consider nominees recommended by stockholders of the Company. Stockholders who wish to recommend a nominee should send nominations directly to the Nominating/Corporate Governance Committee at the principal executive offices of the Company, that include all information relating to such person that is required to be disclosed in solicitations of proxies for the election of directors, including the nominee's name, business experience and consent to be nominated for membership on our board of directors and to serve if elected by the stockholders. The recommendation must be received not later than the date for stockholder proposals set forth herein under "Other Matters—Stockholder Proposals." We did not receive for this Meeting any recommended nominees for director from any of our stockholders. We do not currently pay any fees to third parties to identify or evaluate or assist in identifying or evaluating potential nominees for director. The Nominating/Corporate Governance Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders.

Once the Nominating/Corporate Governance Committee has identified a prospective nominee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee's own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the Committee determines, in consultation with the Chairman of the Board and other Board members as appropriate, that additional consideration is warranted, it may request additional information about the prospective nominee's background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the standards and qualifications set out in the Company's guidelines, including:

| • | the ability of the prospective nominee to represent the interests of the shareholders of the Company; |

| • | the prospective nominee's standards of integrity, commitment and independence of thought and judgment; |

| • | the prospective nominee's ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee's service on other public company boards; |

| • | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board; and |

| • | the extent to which the prospective nominee helps the Board reflect the diversity of the Company's shareholders, employees, customers and communities. |

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Committee determines whether to interview the prospective nominee, and if warranted, one or more members of the Committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the Committee.

There are no differences in the manner in which the Nominating/Corporate Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder.

Board Meetings

In the fiscal year ended December 31, 2003, there were seven meetings of the Board of Directors, four meetings of the Audit Committee, two meetings of the Compensation Committee and no meetings of the Nominating/Corporate Governance Committee. Each Director of the Company attended in excess of 75% of the total number of meetings of the Board of Directors and committees on which he or she served, except for Mr. Homburg, who missed three Board meetings, and Mr. Matheson (a former director), who missed two Board meetings. Board members are encouraged to attend our annual meeting of stockholders. Four of our seven directors attended our 2003 annual meeting.

Communications with the Board

The Nominating/Corporate Governance Committee of the Board approved a process for handling letters received by the Company and addressed to non-management members of the Board. Stockholders and other parties interested in communicating with any directors of the Company (or the Board as a group), may do so by writing to the Secretary of the Company, at the Company's principal executive offices. He will review all such correspondence and regularly forward to the Board a summary of all such correspondence and copies of all correspondence that, in his opinion, deals with the functions of the Board or committees thereof or that he otherwise determines requires the Board's attention. The Board, or any member thereof, may at any time request that copies of all such correspondence be forwarded to the Board.

Correspondence relating to accounting, internal controls or auditing matters are handled by the Audit Committee in accordance with its procedures.

The non-management directors of our board meet in executive session several times during the year, generally at regularly scheduled meetings of the board of directors or as considered necessary or appropriate. A presiding director is chosen by the non-management directors to preside at each meeting and does not need to be the same director at each meeting.

Compensation of Directors

Independent directors' fees are $16,000 per year; meeting attendance fees are $1,000 for each board and committee meeting. Audit committee members also receive a flat fee of $4,000 per year, while other committee members receive a flat fee of $3,000 per year. The chairman of the audit committee receives $10,000 per year. The annual directors fees, at the option of each director, may be paid in cash or shares of the Company's common stock. In addition, commencing in 2004 each independent director will receive an annual grant of $20,000 of restricted stock which will vest on the third anniversary of the date of grant. For past services rendered as directors and subject to stockholder approval as set forth in proposal 2, each of Messrs. Burns, der Kinderen and Miller will receive a one-time grant of $50,000 of restricted stock which will vest 20% on the first anniversary of the grant date, with 40% vesting on each of the second and third anniversaries of the grant dates. The Company paid those independent directors who were members of the committee that approved the mergers with Cedar Bay Realty Advisors Inc., Brentway Management LLC and SKR Management Corp., fees of $25,000 each for service on the committee, plus an additional $5,000 to the committee chairperson.

Executive Compensation

The following table sets forth certain information regarding compensation paid by the Company to its Chief Executive Officer during 2003. Since the Company was externally advised prior to October 24, 2003, it did not pay any compensation to its executive officers for prior periods. Thus, no executive received more than $100,000 in salary and bonus during 2003.

SUMMARY COMPENSATION TABLE

Annual Compensation Long-Term Compensation

--------- ------- ---------- --------------------- -----------

Awards Payouts

--------------------- -----------

Securities

Other Restricted Under- All Other

Name And Principal Annual Stock Lying LTIP Compensation

Position Year Salary Bonus Compensation Award(s) Options/ Payouts ($)

($) ($) ($) ($) SARs(#) ($)

- ---------------------------- ---------- --------- ------- ---------- --------- ----------- ----------- -----------

Leo S. Ullman

President and Chief

Executive Officer...... 2003 65,000 -- -- -- -- -- --

- ---------------------------- ---------- --------- ------- ---------- --------- ----------- ----------- -----------

Employment Agreements With Executive Officers

Effective November 1, 2003, the Company entered into employment agreements, as amended, with Messrs. Ullman, O'Keeffe, Widowski and Richey and Ms. Walker. The annual base salary established for each of these officers pursuant to the employment agreements was $350,000, $250,000, $175,000, $175,000 and $200,000, respectively.

Each agreement is for a term of four years and provides that in the event of termination by the Company without cause or by the executive for good reason, the executive is entitled to receive from the Company within five days following termination:

| • | Any earned and unpaid base salary; |

| • | A cash payment of two and one-half times the executive's annual base salary and bonus; |

| • | Continuation of health insurance benefits; and |

| • | Acceleration of vesting of all options. |

| Good reason means: |

| • | Material breach by the Company of the employment agreement; |

| • | A material reduction in the executive's duties or responsibilities; |

| • | The relocation of the executive or the headquarters of the Company to any location outside of the New York City metropolitan area; and |

| • | A change in control. |

Each employment agreement also provides that each executive will not compete with the Company for a period of one year after the termination of the executive's employment, unless employment is terminated by the Company without cause or by the executive for good reason.

Option Grants

No options were granted by the Company during the fiscal year ended December 31, 2003. The following table sets forth certain information with respect to option exercises and option values for the fiscal year ended December 31, 2003.

AGGREGATED OPTION/SAR EXERCISES IN 2003 AND

DECEMBER 31, 2003 OPTION/SAR VALUES

Number of Securities

Shares Underlying Unexercised Value of Unexercised in-the-

Acquired on Value Options/SARs at Money Options/SARs at

Name Exercise(#) Realized($) December 31, 2003(#) December 31, 2003($)(1)

- -------------- ------------- ------------ ---------------------------- -----------------------------

Exercisable Unexercisable Exercisable Unexercisable

----------- ------------- ----------- -------------

Leo S. Ullman 0 -- 3,333 0 6,400 0

__________________

(1) Calculated based on the closing price per

share of the Company's common stock of $12.42 on December 31, 2003.

Stock Option Plan

In October 2003, The Company amended the 1998 Stock Option Plan (the "Amended Plan") for the purpose of attracting and retaining executive officers, directors and other key employees. Two million (2,000,000) of the Company's authorized shares of common stock have been reserved for issuance under the Amended Plan. The Amended Plan is administered by the compensation committee, who determine, among other things, the number of shares subject to each grant, the vesting period for each grant and the exercise price (subject to applicable regulations with respect to incentive stock options) for the options.

The following table sets forth information regarding the existing compensation plans and individual compensation arrangements pursuant to which the Company's equity securities are authorized for issuance to employees or non-employees (such as directors, consultants, advisors, vendors, customers, suppliers, or lenders) in exchange for consideration in the form of goods and services.

A B C

------------------ ------------------ ---------------------

Number of

Number of Securities

Securities to be Remaining Available

Issued Upon Weighted-Average for Future

Exercise of Exercise Price Issuances Under

Outstanding of Outstanding Equity Compensation

Options, Options, Plans (Excluding

Warrants and Warrants and Securities

Plan Category Rights Rights in Column A)

- ------------- ------------------ ------------------ ---------------------

Equity compensation plans approved by 16,666 $10.50 1,983,334

security holders.............................

Equity compensation plans not approved by 83,332 $13.50 --

security holders.............................

Total........................................ 99,998 1,983,334

Compensation Committee Interlocks and Insider Participation

Everett B. Miller, Roger M. Widmann and J.A.M.H. der Kinderen are members of the Compensation Committee. None of the executive officers of the Company has served on the Board of Directors or compensation committee of any other entity that has had any of such entity's officers serve either on the Company's Board of Directors or Compensation Committee.

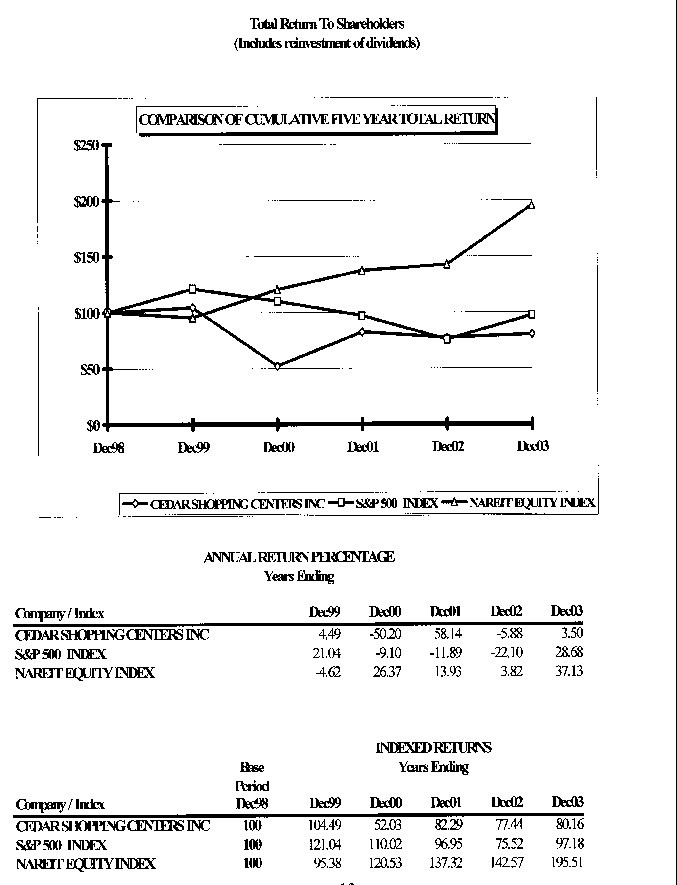

Stockholder Return Performance Presentation

The following line graph sets forth for the period of January 1, 1998 through December 31, 2003, a comparison of the percentage change in the cumulative total stockholder return on the Company's common stock compared to the cumulative total return of the Standard & Poor's ("S&P") 500 Stock Index and the National Association of Real Estate Investment Trusts Equity REIT Total Return Index.

The graph assumes that the shares of the Company's common stock were bought at the price of $100 per share and that the value of the investment in each of the Company's common stock and the indices was $100 at the beginning of the period. The graph further assumes the reinvestment of dividends when paid. All share and price information have been adjusted to reflect a 2-for-1 stock split effective July 7, 2003 and a 1-for-6 reverse stock split effective October 19, 2003.

Security Ownership of Certain Beneficial Owners and Management

The following is a schedule of all persons who, to the knowledge of the Company, beneficially owned more than 5% of the outstanding common stock of the Company as of December 31, 2003:

Number of Shares Percent

Name and Address Beneficially Owned of Stock

Neuberger Berman, Inc. (1) 1,850,250 11.2%

605 Third Avenue

New York, NY 10158

K G. Redding & Associates, LLC (2) 1,406,800 8.5%

One North Wacker Drive

Chicago, IL 60606

Cohen & Steers Capital Management, Inc. 1,380,000 8.4%

757 Third Avenue

New York, NY 10017

Security Capital Research & Management Inc. (2) 1,183,900 7.2%

11 South LaSalle Street

Chicago, IL 60603

FMR Corp. (3) 1,082,800 6.6%

82 Devonshire Street

Boston, MA 02109

Security Capital Preferred Growth Incorporated 1,000,000 6.1%

11 South LaSalle Street

Chicago, IL 60603

____________

| (1) | According to a Schedule 13G, Neuberger Berman may be deemed to be a beneficial owner since it has shared power to make decisions and in some cases the sole power to vote; however, it does not have any economic interest in the securities of its clients who are the actual owners. Neuberger Berman, LLC and Neuberger Berman Management Inc., both of which are 100% owned by Neuberger Berman, Inc., are deemed beneficial owners of certain of these shares. |

| (2) | According to a Schedule 13G, all these shares are owned by investment advisory clients, no one of which owns more than 5% of the Company's outstanding shares of common stock. |

| (3) | According to a Schedule 13G, Fidelity Management & Research Company, a wholly-owned subsidiary of FMR Corp. and a registered investment advisor, is the beneficial owner of 951,400 shares as the result of acting as an investment advisor. The ownership of one investment company, Real Estate Invest Portfolio, amounted to 860,900 shares. Edward C. Johnson 3rd, Chairman of FMR Corp., and FMC Corp. through their control of Fidelity, have sole power to dispose of 951,400 shares. |

The following table sets forth information concerning the security ownership of directors and executive officers as of March 31, 2004:

Number of Shares Percent

Name Beneficially Owned(1) of Stock(2)

- ---- -------------------- ----------

Leo S. Ullman (3) 614,355 3.7%

James J. Burns (4) 3,333 *

Richard Homburg (5) 50,000 *

J.A.M.H. der Kinderen (4) 3,336 *

Everett B. Miller III (4) 3,336 *

Brenda J. Walker (6) 124,078 *

Roger M. Widmann (7) 1,000 *

Directors and executive officers as a group (10 persons)(8) 1,036,996 6.2%

__________

* Less than 1%

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options currently exercisable or exercisable within 60 days of the date hereof, are deemed outstanding for computing the percentage of the person holding such options but are not deemed outstanding for computing the percentage of any other person. |

| (2) | Percentage amount assumes the exercise by such persons of all options to acquire shares of common stock or exchange of limited partnership interests in Cedar Shopping Centers Partnership, L.P. for shares of common stock and no exercise or exchange by any other person. |

| (3) | Includes options to purchase 3,333 shares of common stock and 277,334 limited partnership interests in Cedar Shopping Centers Partnership, L.P. exchangeable for an equal number of shares of common stock of the Company. |

| (4) | Includes options to purchase 3,333 shares of common stock. |

| (5) | Consists of shares owned by Homburg Invest USA Inc., a wholly-owned subsidiary of Homburg Invest, Inc., which is owned 49.29% by Uni-Invest Holdings N.V., a company controlled by Richard Homburg and 14.48% by Homburg Euro Inc., a company controlled by Mr. Homburg for the benefit of a family trust. Mr. Homburg may be deemed to be the beneficial owner of all shares of common stock owned by Homburg USA and Homburg Invest. He disclaims beneficial ownership of these shares. |

| (6) | Includes options to purchase 3,333 shares of common stock and 69,333 limited partnership interests in Cedar Shopping Centers Partnership, L.P. exchangeable for an equal number of shares of common stock of the Company. |

| (7) | Does not include 1,000 shares of common stock owned by Mr. Widmann's wife as to which he disclaims beneficial ownership. |

| (8) | Includes 16,665 shares of common stock issuable on exercise of options and 346,667 limited partnership interests. |

Audit Committee Report

The Audit Committee is comprised of James J. Burns, J.A.M.H. der Kinderen, and Everett B. Miller, III, all of whom are independent directors as defined by Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange Listing Standards. The Audit Committee operates under a written charter, which was adopted by the Board. The Audit Committee appoints the Company's independent accountants.

Management is responsible for the Company's internal controls and financial reporting process. The independent accountants are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In this context, the Audit Committee has met and held discussions with management and the independent accountants. Management represented to the Audit Committee that its consolidated financial statements were prepared in accordance with generally accepted accounting principles. Additionally, the Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent accountants. The Audit Committee discussed with the independent accountants matters required to be discussed by the Statement on Auditing Standards No. 61 (communication with Audit Committees).

The Company's independent accountants provided to the Audit Committee the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants the independent accountant's independence.

Based upon the Audit Committee's discussion with management and the independent accountants, the Audit Committee's review of the representations of management and the report of the independent accountants to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2003, filed with the Securities and Exchange Commission.

Audit Committee

James J. Burns

J.A.M.H. der Kinderen

Everett B. Miller, III

Compensation Committee Report on Executive Compensation

The Compensation Committee currently consists of Everett B. Miller, J.A.M.H. der Kinderen and Roger M. Widmann. The Compensation Committee is responsible for determining the level of compensation paid to the Chief Executive Officer, approving the level of compensation paid to the Company's other executive officers, determining awards under, and administering, the Stock Option Plan and 2004 Stock Incentive Plan and reviewing and establishing any and all other executive compensation plans adopted from time to time by the Company. The Company's philosophy for compensating executive officers is designed to attract, retain, motivate and reward key executives in the Company's highly competitive industry.

The amount of compensation to be paid to an executive officer is generally based upon the Compensation Committee's subjective analyses of each individual's performance, contributions to the Company and responsibilities to be undertaken on behalf of the Company. In 2003, the Board of Directors approved employment agreements for the executive officers, including the Chief Executive Officer. In the employment agreements, the salary for each officer was established. The Board did not use any specific qualitative or quantitative measures or factors in assessing individual performance. The Board reviewed the Company's earnings, stock performance, industry position and salaries paid by its competitors. In reviewing these criteria, the Board determined that salaries paid by the Company to its executive officers were comparable and appropriate.

Stock-based compensation is also an important element of the Company's compensation program. The 2004 Stock Incentive Plan was adopted and approved by the Board of Directors to allow the Company to grant different types of awards, including options to purchase shares of the Company. The Compensation Committee determines in its sole discretion, subject to the terms and conditions of the 2004 Stock Incentive Plan, the size of a particular award based upon its subjective assessment of the individual's performance, responsibility and functions and how this performance may have contributed to the Company's performance. The Compensation Committee believes awards pursuant to the 2004 Stock Incentive Plan align the interests of management with those of the Company's stockholders by emphasizing long-term stock ownership and increases in stockholder value. Management will be benefited under such plan only if the other shareholders of the Company also benefit. The purpose of the 2004 Stock Incentive Plan is to encourage executives and others to acquire a larger proprietary interest in the Company, thereby further stimulating their active interest in the development and financial success of the Company. The number of awards that the Compensation Committee will grant to executive officers will be based on individual performance and level of responsibility. Since stock or option awards are tied to the future performance of the Company's Common Stock, they will provide value only if the price of the Company's Common Stock exceeds the exercise or grant price of the options or stock.

The Chief Executive Officer's salary for 2003 was based on the Board's subjective analysis of his performance and contributions to the Company. The Board used its knowledge of salaries paid by competitors of the Company to their chief executive officers, as well as the performance of the Company's competitors.

The Internal Revenue Code of 1986, as amended, was amended in 1993 with respect to the ability of publicly-held corporations such as the Company to deduct compensation in excess of $1,000,000 per individual, other than performance-based compensation. The Compensation Committee continues to evaluate maximizing the deductibility of executive compensation, while retaining the discretion it deems necessary to compensate executive officers.

The Compensation Committee

J.A.M.H. der Kinderen

Everett B. Miller, III

Roger M. Widmann

Certain Relationships and Related Transactions

Public Offering

During the fourth quarter of 2003, the Company completed a public offering (the "Offering") of 15.5 million shares of its common stock at a price of $11.50 per share pursuant to a registration statement filed with the Securities and Exchange Commission, and realized approximately $162.9 million after underwriting fees and offering costs. At the time of the public offering, the Company's shares were listed on the New York Stock Exchange.

Advisor Fees and Advisor Merger

Prior to the Offering, Cedar Bay Realty Advisors Inc. ("CBRA"), Brentway Management LLC ("Brentway"), and SKR Management Corp. ("SKR") (collectively, the "Advisors") managed the operations and property of the Company. Effective October 24, 2003, the Advisors were merged into the Company or the Company's operating partnership. As consideration for the mergers, we issued an aggregate of 693,333 shares of our common stock (valued at the public offering price of $11.50 per share) and 346,667 units of the operating partnership at the same value.

As a result of the above, each of Messrs. Ullman, O'Keeffe, Richey, Widowski and Ms. Walker received 546,337, 150,725, 48,986, 37,681 and 120,579 shares and/or units, respectively.

An independent committee of our board consisting of disinterested directors retained a financial advisor who advised them as to the fairness of the consideration to be paid in connection with the mergers of our advisors from a financial perspective and of the purchase price for the repurchase from Cedar Bay Company of their units. The independent committee and the board approved the mergers. Members of the independent committee received $25,000 in fees for serving on the committee, while the chairman received an additional $5,000. The mergers were approved by our stockholders at our annual meeting held on October 9, 2003.

Prior to consummation of the mergers, we were an externally-advised REIT. With the exception of a few non-management employees at certain of our centers, we had no employees and relied on CBRA and its affiliates to manage our affairs. Pursuant to the terms of an administrative and advisory agreement, CBRA provided us with management, acquisition, leasing and advisory services, accounting systems, professional and support personnel, and office facilities. Mr. Ullman, our chairman, chief executive officer and president, was also the principal stockholder of CBRA. Ms. Walker, our vice president and director, Mr. O'Keeffe, our chief financial officer, and Mr. Widowski, our secretary, were also officers of CBRA.

The advisory agreement provided that it may be terminated (a) for cause upon not less than sixty days' prior written notice, and (b) by vote of at least 75% of the independent directors at the end of the third or fourth year of its five-year term in the event gross assets fail to increase by 15% per annum.

Pursuant to the advisory agreement, effective as of January 1, 2002, CBRA earned a disposition or acquisition fee, as applicable, equal to 1% of the sale/purchase price; no other fees would be payable in connection with such transactions.

For the year ended December 31, 2003, $508,500 in acquisition fees were charged to us by CBRA.

Property Management Services

Brentway provided property management, leasing, construction management and loan placement services to our real properties pursuant to a management agreement dated April 1998 between Brentway and us and individual management agreements between Brentway and each of our properties. Brentway was owned by Mr. Ullman and Ms. Walker, who were also chairman and president of Brentway, respectively. The term of the management agreement was for one year and was automatically renewed annually for additional one-year periods subject to the right of either party to cancel the management agreement upon sixty days' written notice. Under the management agreement, Brentway was obligated to provide property management services, which included leasing and collection of rent, maintenance of books and records, establishment of bank accounts and payment of expenses, maintenance and operation of property, reporting and accounting for us regarding property operations, and maintenance of insurance.

As discussed above, Brentway had entered into individual management agreements with each entity holding title to the properties owned by us. Such individual management agreements were required by the properties' first mortgage lenders and in some instances by the individual partnership agreements.

The following is a schedule of management, administrative, advisory, legal and leasing fees charged by CBRA or its affiliates to us for the year ended December 31, 2003:

Management Fees...............................................(1) $ 712,000

Construction Management.......................................(2) 2,000

Leasing Fees..................................................(3) 67,000

Administrative and Advisory...................................(4) 664,000

Legal.........................................................(5) 207,000

----------------

$1,652,000

____________

| (1) | Management fees were calculated at 3%-4% of gross revenues collected. |

| (2) | Construction management fees were calculated at 5% of construction costs. |

| (3) | Leasing fees were calculated at 4%-4.5% of a new tenants' base rent. |

| (4) | Annual administrative and advisory fees were equal to 3/4 of 1% of the estimated current value of our real estate assets plus 1/4 of 1% of the estimated current value of all our other assets. |

| (5) | Legal fees were paid to an affiliate of CBRA for the services provided by Stuart H. Widowski, in-house counsel. |

Legal Services

SKR was wholly-owned by Mr. Ullman. Mr. Widowski, through SKR, provided certain legal services to us and our properties at rates that we believe to be less than those prevailing in the market.

Transactions with Cedar Bay Company

Cedar Bay Company received $9.0 million of the proceeds from the Offering in connection with our repurchase of all of the units of the operating partnership owned by Cedar Bay Company, representing a price of $15.87 per unit. An independent committee of our board, consisting of independent directors, retained a financial advisor that advised them as to the fairness of the consideration to be paid to Cedar Bay Company for the repurchase of their units. Prior to the repurchase Cedar Bay Company owned 78% of our common stock and units on a fully-diluted basis. Upon consummation of the Offering, Cedar Bay Company owned less than 1% of our common stock.

Purchase of 20% interest in API Red Lion Shopping Center Associates, L.P.

On May 31, 2002, Cedar-RL, LLC, a newly formed special purpose, wholly-owned subsidiary of the operating partnership, purchased from Silver Circle Management Corp., or Silver Circle, an affiliate of Mr. Ullman and Cedar Bay Company, a 20% interest in API Red Lion Shopping Center Associates, a partnership owned by Mr. Ullman (as limited partner with an 8% ownership interest) and Silver Circle (as sole general partner with a 92% ownership interest). The purchase price was $1,182,857. The Company issued to Cedar Bay Company a promissory note in the original principal amount of $887,000, payable in three equal annual installments. Repayment of the current installment was deferred until October 31, 2003. The outstanding balance of this note was repaid with $887,000 of the proceeds from the Offering.

Also on May 31, 2002, Silver Circle and Mr. Ullman sold an aggregate 69% limited partnership interest in API Red Lion Shopping Center Associates, L.P. to Philadelphia ARC-Cedar LLC, an unrelated party, for $4,360,500. As a result of such transactions, Mr. Ullman no longer had an ownership interest in API Red Lion Shopping Center Associates. The proceeds of sale of Mr. Ullman's interest in API Red Lion Shopping Center Associate, L.P. were used in their entirety to repay certain loans to Silver Circle. Mr. Ullman and Ms. Walker are officers of Silver Circle, but have no ownership interest in that entity.

The purchase price was based on a third party appraisal of the Red Lion Shopping Center property.

The Board of directors obtained a fairness opinion from an investment banking firm with respect to the purchase of the partnership interest in API Red Lion Associates, L.P. by the operating partnership.

Acquisition of Interests in Shopping Centers

Certain affiliates of Cedar Bay Company owned a 50% interest in The Point Shopping Center. The Company used $2.4 million of the proceeds from the Offering to purchase this 50% interest. The purchase price for this interest was arrived at through negotiation with Cedar Bay Company.

Certain affiliates of Cedar Bay Company owned Golden Triangle Shopping Center. The Company used $1.6 million of the proceeds from the October 23, 2003 stock offering to purchase this property and the Company assumed a $9.8 million first mortgage. The purchase price for this interest was arrived at through negotiation with Cedar Bay Company.

Loan for South Philadelphia Shopping Plaza

In connection with the Company's lease agreement to obtain operating control of South Philadelphia Shopping Plaza, in August 2003, an affiliate of Cedar Bay Company loaned the Company $750,000 to make a portion of the deposit in connection with the proposed transaction. The loan matured in October 2003 and bore interest at a rate of 15%. The proceeds from the Offering were used to repay this loan.

Transactions with Homburg USA and Homburg Invest

Subscription Agreement

On December 18, 2002, the Company entered into a subscription agreement with Homburg USA pursuant to which the Company issued in a private placement to Homburg USA 3,300 preferred units at a purchase price of $909.09 per preferred unit, for an aggregate purchase price of $3.0 million. On January 2, 2003, Homburg USA converted 552 preferred units into 46,000 shares of common stock in the Company. In order to maintain the Company's status as a REIT, in June 2003, Homburg USA exchanged the 46,000 shares of common stock for 552 preferred units. The Company used $3.96 million of the proceeds from the Offering to redeem the preferred units owned by Homburg USA in accordance with the terms relating to such units.

Pursuant to the subscription agreement, Mr. Richard Homburg was appointed as a director. The Company also agreed to seek approval of its stockholders to issue to Homburg USA 45,666 additional shares of common stock in the Company at a purchase price of $10.9098 per share, to cause 548 preferred units to be redeemed at their purchase price, and to cause the balance of the 2,200 preferred units to be convertible into common stock in the Company at $12.27 per share. The proposal was approved by stockholders at the annual meeting held on October 9, 2003. Since the preferred units were redeemed from the proceeds of the Offering, the issuance of additional shares to Homburg USA and the preferred units conversion rights have been cancelled.

Standstill Agreement

On or about January 18, 2002, Homburg Invest, a Canadian corporation listed on the Toronto Stock Exchange, acquired from Mr. Homburg, a Canadian national, and/or affiliated persons, 50,000 shares of common stock in the Company, then representing in excess of 20% of outstanding common stock. The Company's charter and bylaws in effect at that time prohibited the acquisition of more than 3.5% of common stock without the consent of the Board of Directors. The Company, Homburg Invest, and Mr. Homburg entered into a standstill agreement pursuant to which Homburg Invest Inc., Mr. Homburg, and their respective affiliates agreed not to purchase more than an aggregate of 29.9% of common stock in the Company for a period of five (5) years, not to commence or support a tender offer during that period, and to vote for certain persons to serve as the Company's directors. The Company also agreed to support the election of two designees of Homburg Invest Inc. to the Board of Directors. Mr. Homburg is the current director designated by Homburg Invest. Upon consummation of the Offering, Homburg Invest owned less than 1% of common stock in the Company and the standstill agreement was terminated.

Acquisition of Interests in Shopping Centers

Homburg Invest supplied substantially all the equity (through purchasing joint venture interests) in connection with the acquisition by the Company of Pine Grove Shopping Center, Swede Square Shopping Center and Wal-Mart Shopping Center. Homburg Invest received a 10% origination fee for providing the equity in each acquisition. Under the partnership agreement for each property, Homburg Invest received a 12% preferential return on its investment. The Company had the option to buy Homburg Invest's interest in the Wal-Mart Shopping Center for 120% of Homburg Invest's original investment plus the 12% preferential return. In the case of Pine Grove and Swede Square, the Company had the option to buy Homburg Invest's interest if Homburg Invest received a 15% annualized rate of return. The Company exercised this option and used the proceeds from the Offering to repurchase Homburg Invest's interests. Accordingly, Homburg Invest received approximately $6.5 million in the aggregate as of October 31, 2003 in exchange for its interest in the Pine Grove Shopping Center, Swede Square Shopping Center and Wal-Mart Shopping Center.

In addition, Homburg Invest jointly and severally with the Company guaranteed $6.4 million of loans obtained to acquire the Valley Plaza Shopping Center and Wal-Mart Shopping Center. Pursuant to the terms of the guarantees, Homburg Invest received approximately $325,000 in fees from the third-party lender.

Loan for South Philadelphia Shopping Plaza

In connection with the Company's lease agreement to obtain operating control of South Philadelphia Shopping Plaza, in August 2003, Homburg Invest loaned the Company $1.1 million to make a portion of the deposit in connection with the proposed transaction. The loan was to mature in one year and bore interest at a rate of 9%, and had a 10% origination fee and a 20% exit fee. Proceeds from the October 23, 2003 offering were used to repay this loan and a $220,000 exit fee. Homburg Invest received approximately $220,000 in exit fees upon repayment of the loan. The Company obtained a back-up facility for this transaction from a Netherlands entity in the event the public offering did not occur. This facility was not utilized and the Company paid a break-up fee, of which $100,000 was paid to Homburg Invest.

Transactions with Mr. Ullman

44 South Bayles Avenue

The Company's principal executive offices are located at 44 South Bayles Avenue, Port Washington, New York. Mr. Ullman owns 24% of this building through general and limited partner interests. The lease, at rentals consistent with other leases in the building, expires on October 31, 2007. Rent is currently approximately $171,000 and escalates annually, up to approximately $182,000 in the final year of the lease.

Loan

Mr. Ullman loaned CBRA $150,000, which CBRA loaned to the Company, to pay certain of the Company's obligations. The loan did not bear interest and had no fees. The loan was repaid from the proceeds of the Offering.

Shore Mall Option

The Company received a ten-year option to acquire the Shore Mall, in Egg Harbor Township, New Jersey, a 620,000 square foot shopping center, anchored by Boscov's, Circuit City, Value City and Burlington Coat Factory from Rickson Corp., N.V., an affiliate of Cedar Bay Company, and Mr. Ullman. The option, which is subject to a right of first refusal of a former owner, expires in 2013, and provides that the purchase price will be the appraised value at the time the option is exercised. The option provides the Company with a right of first refusal if the owner receives a bona fide third-party offer. If the Company does not exercise its option in connection with a bona fide third party offer, the option will terminate. The Company will manage this property during the option period. An affiliate of Cedar Bay Company owns 92% of this property and Mr. Ullman owns 8%.

The Company provides property management, leasing, construction management and legal services to the Shore Mall property and receives fees at standard rates from the Shore Mall property until that property is acquired by the Company (or sold or otherwise disposed of by the existing owners).

Section 16(a) Beneficial Ownership Reporting Compliance

The Company believes that during 2003 its officers, directors and holders of more than 10% of its common stock complied with all filing requirements under Section 16(a) of the Securities Exchange Act of 1934. In making this disclosure, the Company has relied solely on written representations of its directors, officers and holders of more than 10% of the Company's common stock and on copies of reports that have been filed with the Securities and Exchange Commission.

2. PROPOSAL TO APPROVE THE 2004 STOCK INCENTIVE PLAN.

On March 23, 2004, the Board of Directors approved the Cedar Shopping Centers, Inc. 2004 Stock Incentive Plan (the "2004 Stock Incentive Plan"), subject to the approval of the shareholders of the Company at this Meeting, in order to provide an incentive to its (and any of its subsidiaries') officers, employees, consultants and directors and to encourage them to devote their abilities and industry to the success of the Company's business enterprise.

The 2004 Stock Incentive Plan provides for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, restricted shares, performance units and performance shares (collectively, "Awards").

The following is a summary of certain provisions of the 2004 Stock Incentive Plan and is qualified in its entirety by reference to the specific language of the 2004 Stock Incentive Plan, a copy of which is attached as Exhibit B.

Administration

The 2004 Stock Incentive Plan is administered by the Compensation Committee (the "Committee") of the Board of Directors, which is composed of at least two members of the Board of Directors, each of whom satisfies the requirements for a "non-employee director" within the meaning of Rule 16b-3 promulgated under Section 16(b) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and to the extent compliance with Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") is desired, an "outside director" within the meaning of regulations promulgated under Section 162(m) of the Code. Pursuant to the 2004 Stock Incentive Plan, the Committee selects participants to whom Awards will be granted and determines the type, size, terms and conditions of Awards, including the per share purchase price and vesting provisions of stock options and the restrictions or performance criteria relating to restricted shares and performance Awards, except that all determinations regarding any Award granted to a non-employee director will be made by the Board of Directors. The Committee also administers, construes and interprets the 2004 Stock Incentive Plan.

At March 31, 2004, 43 employees of the Company were eligible to participate in the 2004 Stock Incentive Plan. No Awards have been granted under the 2004 Stock Incentive Plan.

Securities Offered

The maximum number of shares of common stock of the Company that the Company may issue pursuant to the 2004 Stock Incentive Plan is 850,000. The maximum number of shares that may be made the subject of Awards granted to any participant during the term of the 2004 Stock Incentive Plan or any calendar year may not exceed 250,000 shares. In the event of certain changes in capitalization of the Company, the Committee may adjust the maximum number and class of shares with respect to which Awards may be granted under the 2004 Stock Incentive Plan, the maximum number of shares with respect to which Awards may be granted to any participant during the term of the 2004 Stock Incentive Plan or any calendar year, the number and class of shares which are subject to outstanding Awards granted under the 2004 Stock Incentive Plan, and if applicable, the purchase price therefor. In addition, if any Award expires or terminates without having been exercised, the shares subject to that Award again become available for grant under the 2004 Stock Incentive Plan. On April 21, 2004, the closing price of a share of common stock of the Company was $12.65.

Eligibility

All of the Company's (and any of its subsidiaries') officers, employees, consultants and directors are eligible to receive Awards under the 2004 Stock Incentive Plan. Awards under the 2004 Stock Incentive Plan are granted at the sole discretion of the Committee. The granting of an Award does not confer upon the participant any right to continue in the employ or service of the Company or affect any right or power of the Company to terminate the services of such participant at any time.

Awards

Stock Options

The Committee may grant to participants options to purchase shares of common stock of the Company. Subject to the provisions of the Code, and in the sole discretion of the Committee, options may either be incentive stock options (within the meaning of Section 422 of the Code, and referred to herein as "ISOs") or nonqualified stock options. The per share purchase price (i.e., the exercise price) under each option is established by the Committee at the time the option is granted. The per share exercise price of any option will be determined by the Committee, but in the case of any ISO it may not be less than 100% of the fair market value of a share of common stock of the Company on the date the option is granted, or 110% in the case of an ISO granted to a participant who owns more than 10% of the total combined voting power of all classes of shares of the Company (a "Ten-Percent Shareholder"). Options may be exercisable at such times and in such installments as determined by the Committee. The Committee may accelerate the exercisability of any option at any time. The term of each option granted pursuant to the 2004 Stock Incentive Plan will be determined by the Committee, provided, however, that no option may be exercisable after the expiration of ten years from its grant date (five years in the case of an ISO granted to a Ten-Percent Shareholder). Each option granted pursuant to the 2004 Stock Incentive Plan will be evidenced by a written agreement setting forth the terms and conditions applicable to such option, including, but not limited to: (i) the exercise price, (ii) the term, (iii) the vesting schedule, (iv) the amount of shares subject to such option, and (v) the effect of a termination or change in the employment or service status of the optionee, in each case, as determined by the Committee and in accordance with the 2004 Stock Incentive Plan.

Unless permitted by the Committee, options are not transferable by the optionee other than by will or the laws of descent and distribution and may be exercised during the optionee's lifetime only by the optionee or the optionee's guardian or legal representative. The purchase price for shares acquired pursuant to the exercise of an option must be paid (i) in cash, (ii) by transferring shares to the Company, or (iii) a combination of the foregoing, upon such terms and conditions as determined by the Committee. Notwithstanding the foregoing, the Committee has the discretion to determine the form of payment acceptable in respect of the exercise of an option, including establishing cashless exercise procedures, which provide for the simultaneous exercise of an option and sale of the underlying share. Upon a "change in control" (as determined under the 2004 Stock Incentive Plan) of the Company, all options outstanding under the 2004 Stock Incentive Plan will become immediately and fully exercisable.

Stock Appreciation Rights

The 2004 Stock Incentive Plan permits the granting of stock appreciation rights ("SARs") to participants in connection with the grant of an option or as a freestanding right. A SAR permits the grantee to receive, upon exercise, cash and/or shares of common stock of the Company, at the discretion of the Committee, equal in value to an amount determined by multiplying: (i) the excess, if any, of (A) for SARs granted in connection with the grant of an option, the per share fair market value on the date preceding the exercise date over the per share purchase price under the related option, or (B) for SARs not granted in connection with the grant of an option, the per share fair market value on the date preceding the exercise date over the per share fair market value on the grant date of the SAR by (ii) the number of shares as to which such SAR is being exercised.

SARs granted in connection with an option cover the same shares of common stock as those covered by such option and are generally subject to the same terms. A SAR granted in connection with an ISO is exercisable only if the fair market value of a share of common stock of the Company on the exercise date exceeds the purchase price specified in the related ISO agreement. Freestanding SARs may be granted on such terms and conditions as shall be determined by the Committee, but may not have a term of greater than ten years. Upon a "change in control" (as determined under the 2004 Stock Incentive Plan) of the Company, all SARs will become immediately and fully exercisable.

Restricted Shares

The terms of a restricted share Award, including the restrictions placed on such shares of common stock of the Company and the time or times at which such restrictions will lapse, will be determined by the Committee at the time the Award is made. The Committee may determine at the time an Award of restricted shares is granted that dividends paid on such restricted shares may be paid to the grantee or deferred and, if deferred, whether such dividends will be reinvested in shares of common stock of the Company. Deferred dividends (together with any interest accrued thereon) will be paid upon the lapsing of restrictions on restricted shares or forfeited upon the forfeiture of restricted shares. Each restricted share Award granted pursuant to the 2004 Stock Incentive Plan will be evidenced by a written agreement setting forth the terms and conditions applicable to such Award, including, but not limited to, the effect of a termination or change in the employment or service status of the grantee. Upon a "change in control" (as determined under the 2004 Stock Incentive Plan) of the Company, the restrictions on restricted shares will lapse and all such shares will become fully vested.

Performance Units and Performance Shares

Performance units and performance shares may be awarded at such times as the Committee may determine and the vesting of performance units and performance shares is based upon the attainment of specified performance objectives by the Company and/or a subsidiary or all subsidiaries of the Company within the specified performance period (the "Performance Cycle"). Performance objectives and the length of the Performance Cycle for performance units and performance shares may be determined by the Committee at the time the Award is made. Performance objectives may be expressed in terms of earnings per share, pre-tax profits, net earnings or net worth, return on equity or assets, any combination of those objectives or any other standards determined appropriate by the Committee at the time the Award is made. Prior to the end of a Performance Cycle, the Committee may, in its discretion, adjust the performance objectives to reflect certain changes in capitalization of the Company, a change in the tax rate or book tax rate of the Company or any subsidiary of the Company, or any other event which may materially affect the performance of the Company or a subsidiary of the Company. Each performance unit or performance share Award granted pursuant to the 2004 Stock Incentive Plan will be evidenced by a written agreement setting forth the terms and conditions applicable to such Award, including, but not limited to, the effect of a termination or change in the employment or service status of the grantee. Each performance unit will represent one share of common stock of the Company and payments in respect of vested performance units will be made in cash, common stock of the Company or restricted shares or any combination of the foregoing. The Committee may determine the total number of performance shares subject to an Award and the time or times at which the performance shares will be issued to the grantee at the time the Award is made. In addition, the Committee may determine (a) the time or times at which the awarded but not issued performance shares will be issued to the grantee and (b) the time or times at which awarded and issued performance shares will become vested or forfeited by the grantee, in either case based upon the attainment of specified performance objectives within the Performance Cycle. At the time the Award of performance shares is made, the Committee may determine that dividends be paid or deferred on the performance shares issued. Deferred dividends (together with any interest accrued thereon) will be paid upon the lapsing of restrictions on performance shares or forfeited upon the forfeiture of performance shares. Upon a "change in control" (as determined under the 2004 Stock Incentive Plan) of the Company, (i) a percentage of performance units, as determined by the Committee at the time an Award of performance units is made, will become vested and the grantee will be entitled to receive a cash payment equal to the per share fair market value multiplied by the number of performance units which become vested, and (ii) with respect to performance shares, all restrictions will lapse with respect to a percentage of the performance shares, as determined by the Committee at the time the Award of performance shares is made.

Additional Information

The 2004 Stock Incentive Plan provides that in satisfaction of the federal, state and local income taxes and other amounts as may be required by law to be withheld with respect to an Award, the optionee or grantee may make a written election to have withheld a portion of the shares of common stock of the Company issuable to him or her having an aggregate fair market value equal to the withholding taxes.

The Committee has the authority at the time a grant of an option or other type of Award is made to award designated optionees or grantees tax bonuses that will be paid on the exercise of such option or payment of such other type of Award. The Committee will have full authority to determine the amount of any such tax bonus and the terms and conditions affecting the vesting and payment thereof.

The 2004 Stock Incentive Plan will terminate on the day preceding the tenth anniversary of its effective date. The Board of Directors may terminate or amend the 2004 Stock Incentive Plan at any time, except that (i) no such amendment or termination may adversely affect outstanding Awards, and (ii) to the extent necessary under applicable law or securities exchange rule, no amendment will be effective unless approved by shareholders.

Certain Federal Income Tax Consequences

Stock Options

In general, an optionee will not recognize taxable income upon grant or exercise of an ISO and the Company will not be entitled to any business expense deduction with respect to the grant or exercise of an ISO. However, upon the exercise of an ISO, the excess of the fair market value on the date of the exercise of the shares of common stock of the Company received over the exercise price of the shares of the common stock will be treated as an adjustment to alternative minimum taxable income. In order for the exercise of an ISO to qualify for the foregoing tax treatment, the optionee generally must be an employee of the Company or a subsidiary of the Company from the date the ISO is granted through the date three months before the date of exercise, except in the case of death or disability, where special rules apply.

If the optionee has held the shares of common stock of the Company acquired upon exercise of an ISO for at least two years after the date of grant and for at least one year after the date of exercise, upon disposition of such shares by the optionee, the difference, if any, between the sale price of such shares and the exercise price of the option will be treated as long-term capital gain or loss. If the optionee does not satisfy these holding period requirements, the optionee will recognize ordinary income at the time of the disposition of the shares, generally in an amount equal to the excess of the fair market value of the shares at the time the option was exercised over the exercise price of the option. The balance of gain realized, if any, will be long-term or short-term capital gain, depending on whether or not the shares were sold more than one year after the option was exercised. If the optionee sells the shares prior to the satisfaction of the holding period requirements but at a price below the fair market value of the shares at the time the option was exercised, the amount of ordinary income will be limited to the excess of the amount realized on the sale over the exercise price of the option. Subject to the discussion below with respect to Section 162(m) of the Code, the Company will be allowed a business expense deduction to the extent the optionee recognizes ordinary income.

In general, an optionee to whom a nonqualified stock option is granted will recognize no income at the time of the grant of the option. Upon exercise of a nonqualified stock option, the optionee will recognize ordinary income in an amount equal to the amount by which the fair market value of the shares on the date of exercise exceeds the exercise price of the option (special rules may apply in the case of an optionee who is subject to Section 16(b) of the Exchange Act). Subject to the discussion below with respect to Section 162(m) of the Code, the Company will be entitled to a business expense deduction in the same amount and at the same time as the optionee recognizes ordinary income.

Stock Appreciation Rights

Upon exercise of a SAR, the optionee will recognize ordinary income in an amount equal to the cash or fair market value of the shares of common stock of the Company received on the exercise date. Subject to the discussion below with respect to Section 162(m) of the Code, the Company will be entitled to a business expense deduction in the same amount and at the same time as the optionee of a SAR recognizes ordinary income.

Restricted Shares