CEDAR SHOPPING CENTERS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 20, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Cedar Shopping Centers, Inc. (the "Company") will be held at the offices of Stroock & Stroock & Lavan LLP, 180 Maiden Lane, 34th Floor, New York, NY 10038, on Friday, May 20, 2005 at 4:00 in the afternoon for the following purposes:

| 1. | To elect seven Directors. |

| 2. | To approve the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2005. |

| 3. | To transact such other business as may properly come before the meeting, or any adjournment thereof. |

Stockholders of record at the close of business on April 7, 2005, shall be entitled to notice of, and to vote at, the meeting.

By order of the Board of Directors

Leo S. Ullman

Chairman of the Board

Dated: April 11, 2005

Port Washington, NY

IMPORTANT: PLEASE FILL IN, DATE, SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY IN THE POSTAGE-PAID ENVELOPE PROVIDED TO ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE MEETING.

CEDAR SHOPPING CENTERS, INC.

44 SOUTH BAYLES AVENUE

PORT WASHINGTON, NEW YORK 11050

PROXY STATEMENT

The accompanying Proxy is solicited by the Board of Directors of Cedar Shopping Centers, Inc., a Maryland corporation (the "Company"), for use at the Annual Meeting of Stockholders (the "Meeting") to be held on May 20, 2005, at 4:00 in the afternoon, or any adjournment thereof, at which stockholders of record at the close of business on April 7, 2005 shall be entitled to vote. The cost of solicitation of proxies will be borne by the Company. The Company may use the services of its directors, officers, employees and others to solicit proxies, personally or by telephone; arrangements may also be made with brokerage houses and other custodians, nominees, fiduciaries and stockholders of record to forward solicitation material to the beneficial owners of stock held of record by such persons. The Company may reimburse such solicitors for reasonable out-of-pocket expenses incurred by them in soliciting, but no compensation will be paid for their services.

Each proxy executed and returned by a stockholder may be revoked at any time before it is voted by timely submission of written notice of revocation or by submission of a duly executed proxy bearing a later date (in either case directed to the Secretary of the Company) or, if a stockholder is present at the Meeting, he may elect to revoke his proxy and vote his shares personally.

There is being mailed herewith to each stockholder of record the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2004. It is intended that this Proxy Statement and form of Proxy will first be sent or given to stockholders on or about April 11, 2005. The Company’s website address is www.cedarshoppingcenters.com.

On April 7, 2005, the Company had outstanding and entitled to vote with respect to all matters to be acted upon at the meeting, 21,975,169 shares of Common Stock. Each holder of Common Stock is entitled to one vote for each share of stock held by such holder. The presence of holders representing a majority of all the votes entitled to be cast at the meeting will constitute a quorum at the meeting. In accordance with Maryland law, abstentions, but not broker non-votes, are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Each item on the agenda must receive the affirmative vote of a majority of the shares voted at the meeting in order to pass. Abstentions and broker non-votes are not counted in determining the votes cast with respect to any of the matters submitted to a vote of stockholders.

It is expected that the following business will be considered at the meeting and action taken thereon:

1. ELECTION OF DIRECTORS

Pursuant to the Certificate of Incorporation and Bylaws, as amended, the director nominees elected at this Meeting will be elected to serve one-year terms that expire upon the date of the next annual meeting or until their respective successors are duly elected and qualified.

It is intended that the accompanying form of Proxy will be voted for the nominees set forth below, each of whom is presently a director of the Company. If some unexpected occurrence should make necessary, in the Board of Directors’ judgment, the substitution of some other person or persons for these nominees, shares will be voted for such other persons as the Board of Directors may select.

The Board of Directors is not aware that any nominee may be unable or unwilling to serve as a director. The following table sets forth certain information with respect to the nominees.

NOMINEES FOR ELECTION

Name |

Age |

Principal Occupation and Positions Held |

Served as a Director Since |

| James J. Burns | 65 | Mr. Burns, a director since 2001 and a member of the Audit (Chair) and Nominating/Corporate Governance Committees, has been chief financial officer and senior vice president of Wellsford Real Properties, Inc. since December 2000. He joined Wellsford in October 1999 as chief accounting officer upon his retirement from Ernst & Young in September 1999. At Ernst & Young, Mr. Burns was a senior audit partner in the E&Y Kenneth Leventhal Real Estate Group for 22 years. Since 2000, Mr. Burns has also served as a director of One Liberty Properties, Inc., a REIT listed on the New York Stock Exchange. Mr. Burns is a certified public accountant and a member of the American Institute of Certified Public Accountants. Mr. Burns received a B.A and M.B.A. from Baruch College of the City University of New York. | 2001 |

| J.A.M.H. der Kinderen | 65 | Mr. der Kinderen, a director since 1998 and a member of the Audit, Compensation and Nominating/Corporate Governance (Chair) Committees, was the director of investments from 1984 through 1994 for Rabobank Pension Fund, and has been or is chairman and/or a member of the board of the following entities: Noord Amerika Real Estate B.V. (from 1995 to 2004); Noord Amerika Vast Goed B.V. (from 1985 to 2004); Mass Mutual Pierson (M.M.P.) (from 1988 to 1997); Warner Building Corporation (since 1996); GIM Bastgoed I-II-III (since 1998); Fellion Investments B.V. (since 2001); N.V. Maatschappij voor Trustzaken Ameuro (since 2002); and Boom & Slettenhaar Fondsen VI-VII-VIII-IX-X-XI (since 2001). Mr. der Kinderen received a Drs. degree in Economics from the University of Utrecht. | 1998 |

| Richard Homburg | 55 | Mr. Homburg, a director since 1999, and chairman from November 1999 to August 2000, was born and educated in the Netherlands. Mr. Homburg was the president and CEO of Uni-Invest N.V., a publicly-listed Dutch real estate fund, from 1991 until 2000. In 2002, an investment group purchased 100% of the shares of Uni-Invest N.V., taking it private, at which time it was one of the largest real estate funds in the Netherlands with assets of approximately $2.5 billion CDN. Mr. Homburg is chairman and CEO of Homburg Invest Inc. and president of Homburg Invest USA Inc. (a wholly-owned subsidiary of Homburg Invest Inc.). In addition to his varied business interests, Mr. Homburg has served on many boards. Previous positions held by Mr. Homburg include president and director of the Investment Property Owners of Nova Scotia, Evangeline Trust and World Trade Center in Eindhoven, the Netherlands, as well as director or advisory board member of other large charitable organizations. Mr. Homburg was named 2004 Entrepreneur of the Year for the Atlantic Provinces by Ernst & Young LLP. | 2002 |

| Everett B. Miller, III | 59 | Mr. Miller, a director since 1998 and a member of the Audit, Compensation and Nominating/Corporate Governance Committees, is vice president of alternative investments at YMCA Retirement Fund. In March 2003, Mr. Miller was appointed to the Real Estate Advisory Committee of the New York State Common Retirement Fund. Prior to his retirement in May 2002 from Commonfund Realty, Inc., a registered investment advisor, Mr. Miller was the chief operating officer of that company from 1997 until May 2002. From January 1995 through March 1997, Mr. Miller was the Principal Investment Officer for Real Estate and Alternative Investment at the Office of the Treasurer of the State of Connecticut. Prior thereto, Mr. Miller was employed for eighteen years at affiliates of Travelers Realty Investment Co., at which his last position was senior vice president. Mr. Miller received a B.S. from Yale University. | 1998 |

| Leo S. Ullman | 65 | Mr. Ullman, chief executive officer, president and chairman of the board of directors, has been involved in real estate property and asset management for approximately twenty-five years. He was chairman and president of the real estate management companies which were merged into the Company in 2003, and their respective predecessors and affiliates, since 1978. Mr. Ullman was first elected as the Company's chairman in April 1998 and served until November 1999. He was re-elected in December 2000. Mr. Ullman also has been chief executive officer and president from April 1998 to date. He has been a member of the New York Bar since 1966 and was in private legal practice until 1998. From 1984 until 1993, he was a partner in the New York law firm of Reid & Priest (now Thelen, Reid & Priest), and served as initial director of its real estate group. Mr. Ullman received an A.B. from Harvard University, an M.B.A. from the Columbia University Graduate School of Business and a J.D. from the Columbia University School of Law where he was a Harlan Fiske Stone scholar. He has lectured and written several books, monographs and articles on investment in US real estate, and is a former adjunct professor of business at the NYU Graduate School of Business. | 1998 |

| Brenda J. Walker | 52 | Ms. Walker has been vice president and director since 1998, and was treasurer from April 1998 until November 1999. She was president of Brentway Management LLC and vice president of SKR Management Corp. from 1994, vice president of API Management Services Corp. and API Asset Management, Inc. from 1992 through 1995, and vice president of Cedar Bay Realty Advisors, Inc. from 1998. Ms. Walker has been involved in real estate property and asset management for more than twenty years. Ms. Walker received a B.A. from Lincoln University. | 1998 |

| Roger M. Widmann | 65 | Mr. Widmann, a director since October 2003 and a member of the Compensation Committee (Chair), was a principal of the investment banking firm of Tanner & Co., Inc. from 1997 to 2004. From 1986 to 1995, Mr. Widmann was a senior managing director of Chemical Securities, Inc., a subsidiary of Chemical Banking Corporation (now JPMorgan Chase Corporation). Prior to joining Chemical Securities, Inc., Mr. Widmann was a founder and managing director of First Reserve Corporation, the largest independent energy investing firm in the U.S. Previously, he was senior vice president with the investment banking firm of Donaldson, Lufkin & Jenrette, responsible for the firm's domestic and international investment banking business. He had also been a vice president with New Court Securities (now Rothschild, Inc.). He was a director of Lydall, Inc. (NYSE), Manchester, CT, a manufacturer of thermal, acoustical and filtration materials, from 1974 to 2004, and its chairman from 1998 to 2004. He is a director of Paxar Corporation, White Plains, NY, a leading manufacturer of labeling systems. He is also a senior moderator of the Executive Seminar in the Humanities at The Aspen Institute, and is a board member of the March of Dimes of Greater New York and of Oxfam America. Mr. Widmann received an A.B. from Brown University and a J.D. from Columbia University. | 2003 |

Independent Directors

Pursuant to rules adopted by the New York Stock Exchange and applicable law, a majority of the Company’s directors must be independent as specified therein. As a result, the Board undertook a review of director independence. During this review, the Board considered transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates, including those reported under "Certain Relationships and Related Transactions" below. The Board also examined transactions and relationships between directors or their affiliates and members of the Company’s senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As the result of this review, the Board affirmatively determined that each of Messrs. Burns, der Kinderen, Miller and Widmann are independent of the Company and its management. The Board determined that each of these independent Directors did not have any material relationships with the Company. The directors who are not independent are Messrs. Ullman and Homburg and Ms. Walker.

Corporate Governance Principles and Committee Charters

Our Board of Directors has adopted a comprehensive set of corporate governance principles to reflect its commitment to corporate governance and the role of such principles in building and sustaining stockholder value. These principles are discussed more fully below and are set forth in our Code of Business Conduct and Ethics and the committee charters for our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. These documents are available on our website at www.cedarshoppingcenters.com or by written request to Investor Relations, 44 South Bayles Avenue, Port Washington, NY 11050.

Code of Business Conduct and Ethics

All of our employees, including our chief executive officer, chief financial officer and principal accounting officer, and our Directors are required to comply with our Code of Business Conduct and Ethics. Our code is available on our website. It is our intention to disclose any amendments to, or waivers from, any provisions of this Code as it applies to our chief executive officer, chief financial officer and principal accounting officer on our website within three business days of such amendment or waiver.

Audit Committee

The Board of Directors has established an Audit Committee consisting of James J. Burns, J.A.M.H. der Kinderen, and Everett B. Miller, III. The charter of the Audit Committee is available on the Company’s website. All the members of the Audit Committee are independent under the rules of the New York Stock Exchange and applicable law. Mr. Burns is qualified as an audit committee financial expert within the meaning of applicable law and the Board has determined that he has accounting and related financial management expertise under the rules of the New York Stock Exchange. The functions of this committee include the engaging and discharging of the independent auditors, reviewing with the independent auditors the plan and results of the auditing engagement and reviewing the independence of the independent auditors, including the range of audit and non-audit fees.

Compensation Committee

The Board of Directors has established a Compensation Committee consisting of J.A.M.H. der Kinderen, Everett B. Miller, III, and Roger M. Widmann, all of whom are independent. This committee reviews and approves the compensation and benefits of executive officers, administers and makes recommendations to the Board of Directors regarding executive compensation and stock incentive plans and produces an annual report on executive compensation for inclusion in the proxy statement.

Nominating Committee

The Board of Directors has established a Nominating/Corporate Governance Committee consisting of James J. Burns, J.A.M.H. der Kinderen, and Roger M. Widmann, all of whom are independent. This committee develops and recommends to the Board of Directors a set of corporate governance principles, adopts a code of ethics, adopts policies with respect to conflicts of interest, monitors compliance with corporate governance requirements of state and federal law and the rules and regulations of the New York Stock Exchange, establishes criteria for prospective members of the Board of Directors, conducts candidate searches and interviews, oversees and evaluates the Board of Directors and management, evaluates from time to time the appropriate size and composition of the Board of Directors and formally proposes the slate of Directors to be elected at each Annual Meeting of Stockholders.

Nomination of Directors

The Nominating/Corporate Governance Committee is responsible for the selection and nomination of the Directors. The Committee has adopted a policy to consider nominees recommended by stockholders of the Company. Stockholders who wish to recommend a nominee should send nominations directly to the Nominating/Corporate Governance Committee at the principal executive offices of the Company, that include all information relating to such person that is required to be disclosed in solicitations of proxies for the election of directors, including the nominee’s name, business experience and consent to be nominated for membership on our Board of Directors and to serve if elected by the stockholders. The recommendation must be received not later than the date for stockholder proposals set forth herein under "Other Matters—Stockholder Proposals." We did not receive for this Meeting any recommended nominees for Director from any of our stockholders. We do not currently pay any fees to third parties to identify or evaluate or assist in identifying or evaluating potential nominees for director. The Nominating/Corporate Governance Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders.

Once the Nominating/Corporate Governance Committee has identified a prospective nominee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the Committee determines, in consultation with the Chairman of the Board and other Board members as appropriate, that additional consideration is warranted, it may request additional information about the prospective nominee’s background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the standards and qualifications set out in the Company’s guidelines, including:

| • | the ability of the prospective nominee to represent the interests of the shareholders of the Company; |

| • | the prospective nominee's standards of integrity, commitment and independence of thought and judgment; |

| • | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; |

| • | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board; and |

| • | the extent to which the prospective nominee helps the Board reflect the diversity of the Company’s shareholders, employees, customers and communities. |

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Committee determines whether to interview the prospective nominee, and if warranted, one or more members of the Committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the Committee.

There are no differences in the manner in which the Nominating/Corporate Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder.

Board Meetings

In the fiscal year ended December 31, 2004, there were 15 meetings of the Board of Directors, 6 meetings of the Audit Committee, 3 meetings of the Compensation Committee and no meetings of the Nominating/Corporate Governance Committee. Each Director of the Company attended in excess of 75% of the total number of meetings of the Board of Directors and committees on which he or she served. Board members are encouraged to attend our Annual Meeting of Stockholders. All of our Directors attended our 2004 Annual Meeting.

Communications with the Board

The Nominating/Corporate Governance Committee of the Board approved a process for handling letters received by the Company and addressed to non-management members of the Board. Stockholders and other parties interested in communicating with any Directors of the Company (or the Board as a group), may do so by writing to the Secretary of the Company, at the Company’s principal executive offices. He will review all such correspondence and regularly forward to the Board a summary of all such correspondence and copies of all correspondence that, in his opinion, deals with the functions of the Board or committees thereof or that he otherwise determines to require the Board’s attention. The Board, or any member thereof, may at any time request that copies of all such correspondence be forwarded to the Board.

Correspondence relating to accounting, internal controls or auditing matters is handled by the Audit Committee in accordance with its procedures.

The non-management directors of our Board meet in executive session several times during the year, generally at regularly scheduled meetings of the Board of Directors or as considered necessary or appropriate. A presiding Director is chosen by the non-management Directors to preside at each meeting and does not need to be the same Director at each meeting.

Compensation of Directors

Independent Directors’ fees are $16,000 per year; meeting attendance fees are $1,000 for each Board and Committee meeting. Audit Committee members also receive a flat fee of $4,000 per year, while other committee members receive a flat fee of $3,000 per year. The chairman of the Audit Committee receives $10,000 per year. The annual Directors fees, at the option of each Director, may be paid in cash or shares of the Company’s common stock. In addition, commencing in 2004 each Director (other than Directors who are members of management) will receive an annual grant of $20,000 of restricted stock which will vest on the third anniversary of the date of grant. As the result, in 2004, each such director received a grant of 1,600 restricted shares. In addition, in consideration for past services, each of Messrs. Burns, der Kinderen and Miller received in 2004 a one-time grant of $50,000 of restricted stock, or 3,990 shares each, which will vest over three years.

Executive Compensation

The following table sets forth certain information regarding compensation paid by the Company to its chief executive officer and to each of its four most highly compensated executive officers whose salary and bonus for 2004 exceeded $100,000. Since the Company was externally advised prior to October 24, 2003, it did not pay any compensation to its executive officers for prior periods.

Summary Compensation Table

Long-Term

Annual Compensation Compensation

------------------------------ --------------

Other

Annual

Comp- All Other

Salary Bonus ensation Stock Compensation

Name and Principal Position Year ($) ($)(1) ($) Options (#) ($)

- ---------------------------- ---- ----- ------- --------- ------------ --------------

Leo S. Ullman 2004 350,000 227,500(2)

President and Chief Executive 2003 65,000

Officer

Thomas J. O'Keeffe 2004 250,000 155,000(2)

Chief Financial Officer 2003 47,000 1,733,338

Brenda J. Walker 2004 200,000 55,000(2)

Vice President 2003 38,000 589,329

Stuart H. Widowski 2004 225,000 30,000(2)

General Counsel, Secretary 2003 33,000 433,332

Thomas B. Richey 2004 175,000 100,000(2)

Vice President 2003 33,000 563,339

______________

| (1) | The bonus for 2003 was paid in connection with the Company's public offering in October 2003. The bonus was paid in shares of common stock of the Company valued at $11.50 per share. The shares are held by a Rabbi Trust for the benefit of the employees. |

| (2) | Of the bonuses for 2004, certain amounts were paid in cash, with the balance paid by purchases in the open market of shares of common stock of the Company by the Rabbi Trust for the benefit of the employees. |

Employment Agreements With Executive Officers

Effective November 1, 2003, the Company entered into employment agreements, as amended, with Messrs. Ullman, O'Keeffe, Widowski and Richey and Ms. Walker. The annual base salary established for each of these officers pursuant to the employment agreements was $350,000, $250,000, $225,000, $175,000 and $200,000, respectively.

Each agreement is for a term of four years and provides that in the event of termination by the Company without cause or by the executive for good reason, the executive is entitled to receive from the Company within five days following termination:

| • | Any earned and unpaid base salary; |

| • | A cash payment of two and one-half times the executive's annual base salary and bonus; |

| • | Continuation of health insurance benefits; and |

| • | Acceleration of vesting of all options. |

Good reason means:

| • | Material breach by the Company of the employment agreement; |

| • | A material reduction in the executive's duties or responsibilities; |

| • | The relocation of the executive or the headquarters of the Company to any location outside of the New York City metropolitan area; and |

| • | A change in control. |

Each employment agreement also provides that each executive will not compete with the Company for a period of one year after the termination of the executive’s employment, unless employment is terminated by the Company without cause or by the executive for good reason.

Option Grants

No options were granted by the Company during the fiscal year ended December 31, 2004. The following table sets forth certain information with respect to option exercises and option values for the fiscal year ended December 31, 2004.

AGGREGATED OPTION/SAR EXERCISES IN 2004 AND

DECEMBER 31, 2004 OPTION/SAR VALUES

Number of Securities

Shares Underlying Unexercised Value of Unexercised in-the-

Acquired on Value Options/SARs at Money Options/SARs at

Name Exercise(#) Realized($) December 31, 2004(#) December 31, 2004($)(1)

- ------------------ ------------- ------------- Exercisable Unexercisable Exercisable Unexercisable

----------- ------------- ----------- -------------

Leo S. Ullman 0 -- 3,333 -- 12,665 --

Thomas O'Keeffe 0 -- 0 -- -- --

Brenda J. Walker 0 -- 3,333 -- 12,665 --

Thomas B. Richey 0 -- 0 -- -- --

Stuart H. Widowski 0 -- 0 -- -- --

_______________

| (1) | Calculated based on the closing price per share of the Company's common stock of $14.30 on December 31, 2004. |

Stock Plans

The Company has in effect the 2004 Stock Incentive Plan (the "Incentive Plan") and the 1998 Stock Option Plan (the "Option Plan"). Under the Incentive Plan, a total of 850,000 shares of common stock may be issued. In connection with the adoption of the Incentive Plan, the Company agreed that it would not issue any more options under the Option Plan. The Plans are administered by the compensation committee, who determine, among other things, the number of shares subject to each grant, the vesting period for each grant and the exercise price (subject to applicable regulations with respect to incentive stock options) for the awards.

The following table sets forth information regarding the existing compensation plans and individual compensation arrangements pursuant to which the Company’s equity securities are authorized for issuance to employees or non-employees (such as directors, consultants, advisors, vendors, customers, suppliers, or lenders) in exchange for consideration in the form of goods and services.

A B C

------------------ ------------------ ---------------------

Number of Number of Securities

Securities to be Remaining Available

Issued Upon Weighted-Average for Future

Exercise of Exercise Price Issuances Under

Outstanding of Outstanding Equity Compensation

Options, Options, Plans (Excluding

Warrants and Warrants and Securities

Plan Category Rights Rights in Column A)

- ------------- ------------------ ------------------ ---------------------

Equity compensation plans approved by 16,665 $10.50 830,030

security holders.............................

Equity compensation plans not approved by 83,333 $13.50 --

security holders.............................

Total........................................ 99,998 830,030

Compensation Committee Interlocks and Insider Participation

Everett B. Miller, Roger M. Widmann and J.A.M.H. der Kinderen are members of the Compensation Committee. None of the executive officers of the Company has served on the Board of Directors or Compensation Committee of any other entity that has had any of such entity’s officers serve either on the Company’s Board of Directors or Compensation Committee.

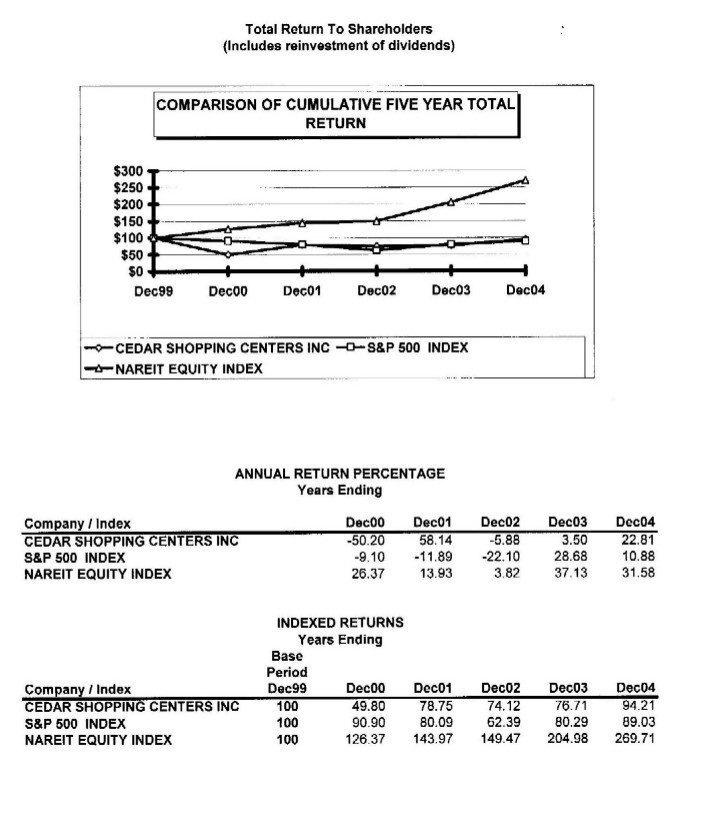

Stockholder Return Performance Presentation

The following line graph sets forth for the period of January 1, 2000 through December 31, 2004, a comparison of the percentage change in the cumulative total stockholder return on the Company’s common stock compared to the cumulative total return of the Standard & Poor’s ("S&P") 500 Stock Index and the National Association of Real Estate Investment Trusts Equity REIT Total Return Index.

The graph assumes that the shares of the Company’s common stock were bought at the price of $100 per share and that the value of the investment in each of the Company’s common stock and the indices was $100 at the beginning of the period. The graph further assumes the reinvestment of dividends when paid. All share and price information have been adjusted to reflect a 2-for-1 stock split effective July 7, 2003 and a 1-for-6 reverse stock split effective October 19, 2003.

Security Ownership of Certain Beneficial Owners and Management

The following is a schedule of all persons who, to the knowledge of the Company, beneficially owned more than 5% of the outstanding common stock of the Company as of February 15, 2005:

Number of Shares Percent

Name and Address Beneficially Owned of Stock

- ---------------- ------------------ --------

Equity One, Inc. 1,889,000 9.8%

1696 Northeast Miami Gardens Drive

North Miami Beach, FL 33179

Cohen & Steers Capital Management, Inc. 1,818,900 9.4%

757 Third Avenue

New York, NY 10017

Barclays Global Investors, N.A. 1,310,210 6.8%

45 Fremont Street

San Francisco, CA 94105

Snyder Capital Management, L.P. and 1,289,200 6.7%

Snyder Capital Management, Inc. (1)

350 California Street, Suite 1460

San Francisco, CA 94104

ABN AMRO Asset Management 1,162,450 6.0%

161 N. Clark Street, 9th

Chicago, IL 60601

Clarion CRA Securities, L.P. 1,136,800 5.9%

259 Radnor-Chester Road, Suite 205

Radnor, PA 19087

__________________

| (1) | According to a Schedule 13G, these shares are owned under shared dispositive power. Moreover, the direct parent company of Snyder Capital Management, L.P. ("SCMLP"), and Snyder Capital Management, Inc. ("SCMI"), is IXIS Asset Management North America, L.P. ("IXIS"), which is ultimately owned by three large affiliated French financial services firms. SCMI and IXIS operate under an understanding that all investment and voting decisions regarding managed accounts are to be made by SCMI and SCMLP and not by IXIS or any entity controlling it. Accordingly, SCMI and SCMLP do not consider IXIS Asset Management North America or any entity controlling it to have any direct or indirect control over the securities held in managed accounts. |

The following table sets forth information concerning the security ownership of directors and executive officers as of March 31, 2005:

Number of Shares Percent

Name Beneficially Owned(1) of Stock(2)

- ---- --------------------- -----------

Leo S. Ullman (3) 570,355 2.9%

James J. Burns (4) 8,923 *

Richard Homburg (5) 51,600 *

J.A.M.H. der Kinderen (4) 8,956 *

Everett B. Miller III (4) 8,956 *

Brenda J. Walker (6) 124,078 *

Roger M. Widmann (7) 2,600 *

Thomas J. O'Keeffe 150,725 *

Thomas B. Richey 48,986 *

Stuart J. Widowski 37,847 *

Directors and executive officers as a group (10 persons) (8) 1,013,026 5.1%

______________

* Less than 1%

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options currently exercisable or exercisable within 60 days of the date hereof, are deemed outstanding for computing the percentage of the person holding such options but are not deemed outstanding for computing the percentage of any other person. |

| (2) | Percentage amount assumes the exercise by such persons of all options to acquire shares of common stock or exchange of limited partnership interests in Cedar Shopping Centers Partnership, L.P. for shares of common stock and no exercise or exchange by any other person. |

| (3) | Includes options to purchase 3,333 shares of common stock and 277,334 limited partnership interests in Cedar Shopping Centers Partnership, L.P. exchangeable for an equal number of shares of common stock of the Company ("OP Units"). |

| (4) | Includes options to purchase 3,333 shares of common stock. |

| (5) | Includes 50,000 shares owned by Homburg Invest USA Inc., a wholly-owned subsidiary of Homburg Invest, Inc., which is owned 49.29% by Uni-Invest Holdings N.V., a company controlled by Richard Homburg and 14.48% by Homburg Euro Inc., a company controlled by Mr. Homburg for the benefit of a family trust. Mr. Homburg may be deemed to be the beneficial owner of all shares of common stock owned by Homburg USA and Homburg Invest. He disclaims beneficial ownership of these shares. |

| (6) | Includes options to purchase 3,333 shares of common stock and 69,333 OP Units. |

| (7) | Does not include 1,000 shares of common stock owned by Mr. Widmann's wife as to which he disclaims beneficial ownership. |

| (8) | Includes 16,665 shares of common stock issuable on exercise of options and 346,667 OP Units. |

Audit Committee Report

The Audit Committee is comprised of James J. Burns, J.A.M.H. der Kinderen, and Everett B. Miller, III, all of whom are independent directors as defined by Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange Listing Standards. The Audit Committee operates under a written charter, which was adopted by the Board. The Audit Committee appoints the Company’s independent accountants.

Company management has primary responsibility for preparing the Company’s financial statements and the financial reporting process, including establishing and maintaining adequate internal control over financial reporting and evaluating the effectiveness of internal control over financial reporting. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

In this context, during 2004 the Audit Committee met six times and held separate discussions with management, the Company’s internal auditors and the independent accountants. Management represented to the Audit Committee that its consolidated financial statements were prepared in accordance with generally accepted accounting principles. Additionally, the Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent accountants. The Audit Committee discussed with the independent accountants matters required to be discussed by the Statement on Auditing Standards No. 61 (communication with Audit Committees).

The Committee received and reviewed a report prepared by Ernst & Young LLP describing the firm’s internal quality control procedures and any material issues raised by the firm’s most recent internal quality-control review and peer review of the firm. The Company’s independent accountants provided to the Audit Committee the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants the independent accountant’s independence.

In discharging its duties, the Committee met with management of the Company and Ernst & Young LLP and reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 2004. The Committee also discussed with Ernst & Young LLP the critical accounting policies and practices used in the preparation of the Company’s audited financial statements. Management and Ernst & Young LLP have represented to the Committee that the audited financial statements for the year ended December 31, 2004 were prepared in accordance with generally accepted accounting principles.

Based on the review and discussions with management, the internal auditors and Ernst & Young LLP, and subject to the limitations on the role and responsibilities of the Committee referred to above and in the Audit Committee Charter, the Committee has recommended to the Board of Directors the inclusion of the audited financial statements of the Company in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004.

Audit Committee

James J. Burns

J.A.M.H. der Kinderen

Everett B. Miller, III

Compensation Committee Report on Executive Compensation

The Compensation Committee currently consists of Everett B. Miller, J.A.M.H. der Kinderen and Roger M. Widmann. The Compensation Committee is responsible for determining the level of compensation paid to the Chief Executive Officer, approving the level of compensation paid to the Company’s other executive officers, determining awards under, and administering, the Stock Option Plan and 2004 Stock Incentive Plan and reviewing and establishing any and all other executive compensation plans adopted from time to time by the Company. The Company’s philosophy for compensating executive officers is designed to attract, retain, motivate and reward key executives in the Company’s highly competitive industry.

The amount of compensation to be paid to an executive officer is generally based upon the Compensation Committee’s subjective analyses of each individual’s performance, contributions to the Company and responsibilities to be undertaken on behalf of the Company. The Committee retained an outside compensation consulting firm to assist it in evaluating compensation. In 2003, the Board of Directors approved employment agreements for the executive officers, including the Chief Executive Officer. In the employment agreements, the salary for each officer was established. The Board did not use any specific qualitative or quantitative measures or factors in assessing individual performance. The Board reviewed the Company’s earnings, stock performance, industry position and salaries paid by its competitors. In reviewing these criteria, the Board determined that salaries paid by the Company to its executive officers were comparable and appropriate.

Stock-based compensation is also an important element of the Company’s compensation program. The 2004 Stock Incentive Plan was adopted and approved by the Board of Directors to allow the Company to grant different types of awards, including options to purchase shares of the Company. The Compensation Committee determines in its sole discretion, subject to the terms and conditions of the 2004 Stock Incentive Plan, the size of a particular award based upon its subjective assessment of the individual’s performance, responsibility and functions and how this performance may have contributed to the Company’s performance. The Compensation Committee believes awards pursuant to the 2004 Stock Incentive Plan align the interests of management with those of the Company’s stockholders by emphasizing long-term stock ownership and increases in stockholder value. Management will be benefited under such plan only if the other shareholders of the Company also benefit. The purpose of the 2004 Stock Incentive Plan is to encourage executives and others to acquire a larger proprietary interest in the Company, thereby further stimulating their active interest in the development and financial success of the Company. The number of awards that the Compensation Committee will grant to executive officers will be based on individual performance and level of responsibility. Since stock or option awards are tied to the future performance of the Company’s Common Stock, they will provide value in the future only if the price of the Company’s Common Stock exceeds the exercise or grant price of the options or stock.

The Chief Executive Officer’s salary for 2004 was established pursuant to the terms of his employment agreement which was based on the Compensation Committee’s subjective analysis of his performance and contributions to the Company. The Compensation Committee used its knowledge of salaries paid by competitors of the Company to their chief executive officers, as well as the performance of the Company’s competitors.

The Internal Revenue Code of 1986, as amended, was amended in 1993 with respect to the ability of publicly-held corporations such as the Company to deduct compensation in excess of $1,000,000 per individual, other than performance-based compensation. The Compensation Committee continues to evaluate maximizing the deductibility of executive compensation, while retaining the discretion it deems necessary to compensate executive officers.

The Compensation Committee

J.A.M.H. der Kinderen

Everett B. Miller, III

Roger M. Widmann

Certain Relationships and Related Transactions

The Company’s principal executive offices are located at 44 South Bayles Avenue, Port Washington, New York. Mr. Ullman owns 24% of this building through general and limited partner interests. The lease, at rentals consistent with other leases in the building, expires on February 28, 2010. Rent is currently approximately $215,000 and escalates annually, up to approximately $238,000 in the final year of the lease.

The Company received a ten-year option to acquire the Shore Mall, in Egg Harbor Township, New Jersey, a 620,000 square foot shopping center, anchored by Boscov’s, Value City and Burlington Coat Factory, from Rickson Corp., N.V., an affiliate of Cedar Bay Company, and Mr. Ullman. The option, which is subject to a right of first refusal of a former owner, expires in 2013, and provides that the purchase price will be the appraised value at the time the option is exercised. The option provides the Company with a right of first refusal if the owner receives a bona fide third-party offer. If the Company does not exercise its option in connection with a bona fide third party offer, the option will terminate. The Company will manage this property during the option period. An affiliate of Cedar Bay Company owns 92% of this property and Mr. Ullman owns 8%.

The Company provides property management, leasing, construction management and legal services to the Shore Mall property and expects to continue to receive fees at standard rates from the Shore Mall property until that property is either acquired by the Company or sold or otherwise disposed of by the existing owners.

Mr. Ullman's son, Frank C. Ullman, is employed as an assistant vice president and received total compensation in 2004 of $121,000.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company believes that during 2004 its officers, directors and holders of more than 10% of its common stock complied with all filing requirements under Section 16(a) of the Securities Exchange Act of 1934. In making this disclosure, the Company has relied solely on written representations of its directors, officers and holders of more than 10% of the Company’s common stock and on copies of reports that have been filed with the Securities and Exchange Commission.

2. APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Company has selected Ernst & Young LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2005. A representative of Ernst & Young LLP is expected to be present at the meeting with the opportunity to make a statement if such representative so desires and to respond to appropriate questions.

Audit and Non-Audit Fees

The following table presents fees for professional audit services rendered by Ernst & Young LLP for the audit of the Company’s financial statements for the years ended December 31, 2003 and 2004 and fees billed for other services rendered by such firm during the periods:

2004 2003

Actual Fees Actual Fees

----------------- ------------

Audit fees (1)

Audit of consolidated financial statements $ 350,000 $ 185,000

Timely quarterly reviews 45,000 34,500

SEC filings, including comfort letters, consents

and comments letters 61,140 1,449,550

----------------- ------------

Total Audit Fees $ 456,140 $1,669,050

Audit Related Fees (2)

Audits and accounting consultations in connection

with acquisitions 70,162 --

----------------- ------------

Total Audit-Related Fees 526,302 --

----------------- ------------

Tax Fees (2)

Tax return preparation 0 100,000

E&P Study on Cedar Bay Realty Advisors and SKR

Management 0 39,000

----------------- ------------

Total Tax Fees 0 139,000

----------------- ------------

All Other Fees 52,500 --

----------------- ------------

Total Fees $ 578,802 $1,808,050

================= ============

____________

| (1) | Includes fees and expenses related to the annual audit and interim reviews, notwithstanding when the fees and expenses were billed or when the services rendered. |

| (2) | Includes fees and expenses for services rendered from January through December, notwithstanding when the fees and expenses were billed. |

All audit related services, tax services and other services were pre-approved by the Audit Committee, which concluded that the provision of such services by the Company’s auditors was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The policy of the Audit Committee provides for pre-approval of the yearly audits, quarterly reviews and tax compliance on an annual basis. As individual engagements arise, they are approved on a case-by-case basis. The Audit Committee may delegate to one or more of its members pre-approval authority with respect to permitted services.

Audit Committee Consideration of these Fees

The Company’s Audit Committee has considered whether the provisions of the services covered under the categories of "Audit Related Fees" and "All Other Fees" are compatible with maintaining the independence of Ernst & Young LLP.

The Board of Directors of the Company recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company.

3. OTHER MATTERS

Stockholder Proposals

Proposals of stockholders intended to be presented at the Company’s 2006 Annual Meeting of Stockholders must be received by the Company on or prior to December 12, 2005 to be eligible for inclusion in the Company’s Proxy Statement and form of Proxy to be used in connection with such meeting. Any notice of shareholder proposals received after this date is considered untimely.

OTHER BUSINESS

At the date of this Proxy Statement, the only business which the Board of Directors intends to present or knows that others will present at the Meeting is that hereinabove set forth. If any other matter or matters are properly brought before the meeting, or any adjournment thereof, it is the intention of the persons named in the accompanying form of Proxy to vote the Proxy on such matters in accordance with their judgment.

Leo S. Ullman

Chairman of the Board

Dated: April 11, 2005

CEDAR SHOPPING CENTERS, INC.

2005 ANNUAL MEETNG OF STOCKHOLDERS – MAY 20, 2005

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of Cedar Shopping Centers, Inc., a Maryland corporation, hereby appoints Leo S. Ullman and Brenda J. Walker and each of them the proxies of the undersigned with full power of substitution to vote at the Annual Meeting of Stockholders of the Company to be held at 4:00 PM on May 20, 2005, and at any adjournment or adjournments thereof (the "Meeting"), with all the power which the undersigned would have if personally present, hereby revoking any proxy heretofore given. The undersigned hereby acknowledges receipt of the proxy statement for the Meeting and instructs the proxies to vote as directed on the reverse side.

(Continued and to be signed on the reverse side)

ANNUAL MEETING OF STOCKHOLDERS OF

CEDAR SHOPPING CENTERS, INC.

MAY 20, 2005

PLEASE DATE, SIGN AND MAIL

YOUR PROXY CARD IN THE

ENVELOPE PROVIDED AS SOON AS POSSIBLE.

- Please detach along perforated line and mail in the envelope provided. -

- ----------------------------------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------------------------------

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF

DIRECTORS AND "FOR" PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE.

PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE [X]

1. To elect 7 nominees for Directors:

| NOMINEES: |

| [ ] [ ] [ ] |

FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT (see instructions below) |

( ) ( ) ( ) ( ) ( ) ( ) ( ) |

James J. Burns J.A.M.H. der Kinderen Richard Homburg Everett B. Miller, III Leo S. Ullman Brenda J. Walker Roger Widmann |

| INSTRUCTION: | To withhold authority to vote for any individual nominee(s), mark "FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as show here. (X) |

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. [ ]

| 2. 3. |

To ratify the appointment of Ernst & Young LLP as independent registered public accounting firm for the fiscal year ending December 31, 2005 With discretionary authority upon such other matters as may properly come before the Meeting |

FOR AGAINST ABSTAIN [ ] [ ] [ ] |

THIS PROXY, WHEN PROPERLY SIGNED, WILL BE VOTED IN THE MANNER DIRECTED, IF NO SPECIFICATION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE NOMINEES SET FORTH HEREIN, FOR THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP FOR THE FISCAL YEAR ENDING DECEMBER 31, 2005, AND IN THE DISCRETION OF THE PROXY HOLDERS AS TO ANY OTHER MATTERS WHICH MAY PROPERLY COME BEFORE THE MEETING.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

MARK HERE IF YOU PLAN TO ATTEND THE MEETING [ ]

| Signature of Stockholder

Signature of Stockholder |

Date:

Date: |

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.