Exhibit 99.2

Supplemental Financial

Information

September 30, 2011

(unaudited)

Cedar Realty Trust, Inc.

(formerly known as Cedar Shopping

Centers, Inc.)

44 South Bayles Avenue

Port Washington, NY

11050-3765

Tel: (516) 767-6492 Fax:

(516) 767-6497

www.cedarrealtytrust.com

CEDAR REALTY TRUST, INC.

Supplemental Financial Information

September 30, 2011

(unaudited)

TABLE OF CONTENTS

| |

|

|

|

|

|

Consolidated Financial Information |

|

|

|

|

Consolidated Balance Sheets |

|

|

3 |

|

Consolidated Statements of Operations |

|

|

4 |

|

Supporting Schedules to Consolidated Statements |

|

|

5 |

|

Funds from Operations and Additional Disclosures |

|

|

6 |

|

Earnings Before Interest, Taxes, Depreciation and Amortization |

|

|

7 |

|

Summary of Outstanding Debt |

|

|

8-9 |

|

Summaries of Debt Maturities |

|

|

10 |

|

|

|

|

|

|

Consolidated

Operating Portfolio Information |

|

|

|

|

Real Estate Summary |

|

|

11-13 |

|

Leasing Activity |

|

|

14 |

|

Tenant Concentration |

|

|

15 |

|

Lease Expirations |

|

|

16 |

|

Same-Property Analysis |

|

|

17 |

|

Significant 2011 Acquisitions and Dispositions |

|

|

18 |

|

|

|

|

|

|

Unconsolidated Cedar/RioCan Joint Venture |

|

|

|

|

Combined Balance Sheets |

|

|

20 |

|

Combined Statements of Operations |

|

|

21 |

|

Real Estate Summary |

|

|

22 |

|

| Summary of Outstanding Debt |

|

|

23 |

|

Summary of Debt Maturities |

|

|

24 |

|

|

|

|

|

|

Properties Held for Sale/Conveyance |

|

|

|

|

Real Estate Summary |

|

|

26-27 |

|

Summary of Outstanding Debt |

|

|

28 |

|

Summary of Debt Maturities |

|

|

29 |

|

|

|

|

|

|

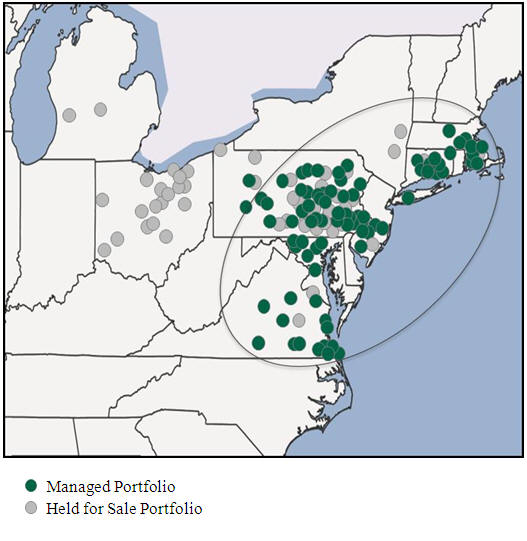

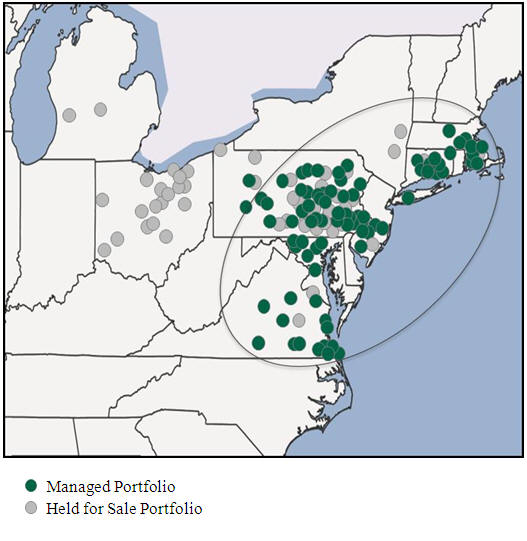

Portfolio Map |

|

|

30 |

|

|

|

|

|

|

Non-GAAP Financial Disclosures |

|

|

31 |

|

Forward-Looking Statements

The information contained in this Supplemental Financial Information is unaudited and does not

purport to disclose all items required by accounting principles generally accepted in the United

States (“GAAP”). In addition, statements made or incorporated by reference herein may include

certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of

1934 and Section 21E of the Securities Exchange Act of 1934 and, as such, may involve known and

unknown risks, uncertainties and other factors which may cause the Company’s actual results,

performance or achievements to be materially different from future results, performance or

achievements expressed or implied by such forward-looking statements. Forward-looking statements,

which are based on certain assumptions and describe the Company’s future plans, strategies and

expectations, are generally identifiable by use of the words “may”, “will”, “should”, “estimates”,

“projects”, “anticipates”, “believes”, “expects”, “intends”, “future”, and words of similar import,

or the negative thereof. Factors which could have a material adverse effect on the operations and

future prospects of the Company include, but are not limited to, those set forth under the headings

“Risk Factors” in the Company’s Annual Report on Form 10-K and “Forward-Looking Statements” in the

Company’s Quarterly Report on Form 10-Q. Accordingly, the information contained herein should be

read in conjunction with the Company’s Form 10-K for the year ended December 31, 2010 and Form 10-Q

for the quarter ended September 30, 2011.

2

CEDAR REALTY TRUST, INC.

Consolidated Balance Sheets

| |

|

|

|

|

|

|

|

|

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2011 |

|

|

2010 |

|

Assets: |

|

|

|

|

|

|

|

|

Real estate |

|

|

|

|

|

|

|

|

Land |

|

$ |

271,907,000 |

|

|

$ |

261,673,000 |

|

Buildings and improvements |

|

|

1,088,396,000 |

|

|

|

1,028,443,000 |

|

|

|

|

|

|

|

|

|

|

|

1,360,303,000 |

|

|

|

1,290,116,000 |

|

Less accumulated depreciation |

|

|

(183,274,000 |

) |

|

|

(157,803,000 |

) |

|

|

|

|

|

|

|

Real estate, net |

|

|

1,177,029,000 |

|

|

|

1,132,313,000 |

|

Real estate held for sale/conveyance |

|

|

242,844,000 |

|

|

|

348,743,000 |

|

Investment in unconsolidated joint ventures |

|

|

45,087,000 |

|

|

|

52,466,000 |

|

Cash and cash equivalents |

|

|

11,642,000 |

|

|

|

14,166,000 |

|

Restricted cash |

|

|

13,750,000 |

|

|

|

12,493,000 |

|

Receivables |

|

|

28,730,000 |

|

|

|

26,387,000 |

|

Other assets and deferred charges, net |

|

|

37,463,000 |

|

|

|

33,867,000 |

|

Assets relating to real estate held for sale/conveyance |

|

|

2,322,000 |

|

|

|

2,052,000 |

|

|

|

|

|

|

|

|

Total assets |

|

$ |

1,558,867,000 |

|

|

$ |

1,622,487,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and equity: |

|

|

|

|

|

|

|

|

Mortgage loans payable |

|

$ |

590,965,000 |

|

|

$ |

550,525,000 |

|

Mortgage loans payable — real estate held for

sale/conveyance |

|

|

148,114,000 |

|

|

|

156,991,000 |

|

Secured revolving credit facilities |

|

|

166,317,000 |

|

|

|

132,597,000 |

|

Accounts payable and accrued liabilities |

|

|

36,080,000 |

|

|

|

29,026,000 |

|

Unamortized intangible lease liabilities |

|

|

36,423,000 |

|

|

|

40,253,000 |

|

Liabilities relating to real estate held for sale/conveyance |

|

|

6,909,000 |

|

|

|

7,571,000 |

|

|

|

|

|

|

|

|

Total liabilities |

|

|

984,808,000 |

|

|

|

916,963,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited partners’ interest in Operating Partnership |

|

|

4,715,000 |

|

|

|

7,053,000 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

Cedar Realty Trust, Inc. shareholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock |

|

|

158,575,000 |

|

|

|

158,575,000 |

|

Common stock and other shareholders’ equity |

|

|

348,441,000 |

|

|

|

471,491,000 |

|

|

|

|

|

|

|

|

Total Cedar Realty Trust, Inc. shareholders’ equity |

|

|

507,016,000 |

|

|

|

630,066,000 |

|

|

|

|

|

|

|

|

Noncontrolling interests: |

|

|

|

|

|

|

|

|

Minority interests in consolidated joint ventures |

|

|

56,793,000 |

|

|

|

62,050,000 |

|

Limited partners’ interest in Operating Partnership |

|

|

5,535,000 |

|

|

|

6,355,000 |

|

|

|

|

|

|

|

|

Total noncontrolling interests |

|

|

62,328,000 |

|

|

|

68,405,000 |

|

|

|

|

|

|

|

|

Total equity |

|

|

569,344,000 |

|

|

|

698,471,000 |

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

1,558,867,000 |

|

|

$ |

1,622,487,000 |

|

|

|

|

|

|

|

|

3

CEDAR REALTY TRUST, INC.

Consolidated Statements of Operations

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

| |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rents |

|

$ |

26,504,000 |

|

|

$ |

24,384,000 |

|

|

$ |

78,156,000 |

|

|

$ |

77,565,000 |

|

Expense recoveries |

|

|

6,271,000 |

|

|

|

5,735,000 |

|

|

|

20,365,000 |

|

|

|

19,637,000 |

|

Other |

|

|

685,000 |

|

|

|

1,591,000 |

|

|

|

2,138,000 |

|

|

|

1,926,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

|

33,460,000 |

|

|

|

31,710,000 |

|

|

|

100,659,000 |

|

|

|

99,128,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating, maintenance and management |

|

|

6,430,000 |

|

|

|

5,674,000 |

|

|

|

20,780,000 |

|

|

|

18,993,000 |

|

Real estate and other property-related taxes |

|

|

4,147,000 |

|

|

|

3,986,000 |

|

|

|

12,307,000 |

|

|

|

12,151,000 |

|

General and administrative |

|

|

2,899,000 |

|

|

|

2,421,000 |

|

|

|

8,115,000 |

|

|

|

6,738,000 |

|

Management transition charges |

|

|

— |

|

|

|

— |

|

|

|

6,530,000 |

|

|

|

— |

|

Impairment charges |

|

|

7,419,000 |

|

|

|

155,000 |

|

|

|

7,419,000 |

|

|

|

2,272,000 |

|

Acquisition transaction costs and terminated projects |

|

|

— |

|

|

|

2,043,000 |

|

|

|

1,169,000 |

|

|

|

3,365,000 |

|

Depreciation and amortization |

|

|

9,801,000 |

|

|

|

8,846,000 |

|

|

|

27,844,000 |

|

|

|

26,942,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses |

|

|

30,696,000 |

|

|

|

23,125,000 |

|

|

|

84,164,000 |

|

|

|

70,461,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

2,764,000 |

|

|

|

8,585,000 |

|

|

|

16,495,000 |

|

|

|

28,667,000 |

|

Non-operating income and expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, including amortization of

deferred financing costs |

|

|

(10,475,000 |

) |

|

|

(10,523,000 |

) |

|

|

(31,155,000 |

) |

|

|

(33,174,000 |

) |

Write-off of deferred financing costs |

|

|

— |

|

|

|

(2,552,000 |

) |

|

|

— |

|

|

|

(2,552,000 |

) |

Interest income |

|

|

41,000 |

|

|

|

3,000 |

|

|

|

216,000 |

|

|

|

12,000 |

|

Unconsolidated joint ventures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in income (loss) |

|

|

327,000 |

|

|

|

(288,000 |

) |

|

|

1,152,000 |

|

|

|

547,000 |

|

Write-off of investment |

|

|

— |

|

|

|

— |

|

|

|

(7,961,000 |

) |

|

|

— |

|

Gain on sale of land parcel |

|

|

130,000 |

|

|

|

— |

|

|

|

130,000 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-operating income and expense |

|

|

(9,977,000 |

) |

|

|

(13,360,000 |

) |

|

|

(37,618,000 |

) |

|

|

(35,167,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before discontinued operations |

|

|

(7,213,000 |

) |

|

|

(4,775,000 |

) |

|

|

(21,123,000 |

) |

|

|

(6,500,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

619,000 |

|

|

|

318,000 |

|

|

|

2,821,000 |

|

|

|

1,408,000 |

|

Impairment charges |

|

|

(64,671,000 |

) |

|

|

(34,000 |

) |

|

|

(87,287,000 |

) |

|

|

(3,276,000 |

) |

Gain on sales |

|

|

— |

|

|

|

— |

|

|

|

502,000 |

|

|

|

170,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total discontinued operations |

|

|

(64,052,000 |

) |

|

|

284,000 |

|

|

|

(83,964,000 |

) |

|

|

(1,698,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(71,265,000 |

) |

|

|

(4,491,000 |

) |

|

|

(105,087,000 |

) |

|

|

(8,198,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less, net loss (income) attributable to noncontrolling

interests: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minority interests in consolidated joint ventures |

|

|

3,285,000 |

|

|

|

194,000 |

|

|

|

3,332,000 |

|

|

|

(194,000 |

) |

Limited partners’ interest in Operating Partnership |

|

|

1,455,000 |

|

|

|

196,000 |

|

|

|

2,294,000 |

|

|

|

488,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net loss (income) attributable to noncontrolling

interests |

|

|

4,740,000 |

|

|

|

390,000 |

|

|

|

5,626,000 |

|

|

|

294,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Cedar Realty Trust, Inc. |

|

|

(66,525,000 |

) |

|

|

(4,101,000 |

) |

|

|

(99,461,000 |

) |

|

|

(7,904,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred distribution requirements |

|

|

(3,580,000 |

) |

|

|

(2,679,000 |

) |

|

|

(10,621,000 |

) |

|

|

(6,617,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common shareholders |

|

$ |

(70,105,000 |

) |

|

$ |

(6,780,000 |

) |

|

$ |

(110,082,000 |

) |

|

$ |

(14,521,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per common share attributable to common shareholders (basic

and diluted): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(0.09 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.40 |

) |

|

$ |

(0.20 |

) |

Discontinued operations |

|

|

(0.96 |

) |

|

$ |

0.00 |

|

|

$ |

(1.27 |

) |

|

|

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(1.05 |

) |

|

$ |

(0.10 |

) |

|

$ |

(1.67 |

) |

|

$ |

(0.23 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

66,800,000 |

|

|

|

65,835,000 |

|

|

|

66,253,000 |

|

|

|

62,999,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

66,800,000 |

|

|

|

65,835,000 |

|

|

|

66,253,000 |

|

|

|

63,025,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

CEDAR REALTY TRUST, INC.

Supporting Schedules to Consolidated Statements

Balance Sheets Detail

| |

|

|

|

|

|

|

|

|

| |

|

September 30, 2011 |

|

|

December 31, 2010 |

|

Investment in unconsolidated joint ventures |

|

|

|

|

|

|

|

|

Cedar/RioCan |

|

$ |

45,087,000 |

|

|

$ |

46,618,000 |

|

Philadelphia redevelopment property |

|

|

— |

|

|

|

5,848,000 |

|

|

|

|

|

|

|

|

|

|

$ |

45,087,000 |

|

|

$ |

52,466,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables |

|

|

|

|

|

|

|

|

Rents and other tenant receivables, net |

|

$ |

9,456,000 |

|

|

$ |

7,048,000 |

|

Straight-line rents |

|

|

13,335,000 |

|

|

|

12,471,000 |

|

Loans and other receivables, and joint

venture settlements |

|

|

5,939,000 |

|

|

|

6,868,000 |

|

|

|

|

|

|

|

|

|

|

$ |

28,730,000 |

|

|

$ |

26,387,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets and deferred charges, net |

|

|

|

|

|

|

|

|

Lease origination costs, net |

|

$ |

13,496,000 |

|

|

$ |

13,282,000 |

|

Prepaid expenses |

|

|

9,922,000 |

|

|

|

5,258,000 |

|

Financing costs, net |

|

|

6,688,000 |

|

|

|

9,623,000 |

|

Investments and cumulative mark-to-market

adjustments

related to stock-based compensation |

|

|

3,421,000 |

|

|

|

2,101,000 |

|

Property and other deposits |

|

|

1,370,000 |

|

|

|

1,527,000 |

|

Leasehold improvements, furniture and fixtures |

|

|

1,037,000 |

|

|

|

525,000 |

|

Intangible lease assets |

|

|

820,000 |

|

|

|

— |

|

Other, net |

|

|

709,000 |

|

|

|

1,551,000 |

|

|

|

|

|

|

|

|

|

|

$ |

37,463,000 |

|

|

$ |

33,867,000 |

|

|

|

|

|

|

|

|

Statements of Operations Detail

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

| |

|

2011 |

|

|

2010 |

|

Rents |

|

|

|

|

|

|

|

|

Base rents |

|

$ |

24,122,000 |

|

|

$ |

22,418,000 |

|

Percentage rent |

|

|

301,000 |

|

|

|

223,000 |

|

Straight-line rents |

|

|

191,000 |

|

|

|

65,000 |

|

Amortization of intangible lease

liabilities |

|

|

1,890,000 |

|

|

|

1,678,000 |

|

|

|

|

|

|

|

|

|

|

$ |

26,504,000 |

|

|

$ |

24,384,000 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Nine months ended September 30, |

|

| |

|

2011 |

|

|

2010 |

|

Rents |

|

|

|

|

|

|

|

|

Base rents |

|

$ |

72,200,000 |

|

|

$ |

69,716,000 |

|

Percentage rent |

|

|

686,000 |

|

|

|

538,000 |

|

Straight-line rents |

|

|

946,000 |

|

|

|

1,259,000 |

|

Amortization of intangible lease

liabilities |

|

|

4,324,000 |

|

|

|

6,052,000 |

|

|

|

|

|

|

|

|

|

|

$ |

78,156,000 |

|

|

$ |

77,565,000 |

|

|

|

|

|

|

|

|

5

CEDAR REALTY TRUST, INC.

Funds from Operations and Additional Disclosures

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

| |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

Net loss attributable to the Company’s common shareholders |

|

$ |

(70,105,000 |

) |

|

$ |

(6,780,000 |

) |

|

$ |

(110,082,000 |

) |

|

$ |

(14,521,000 |

) |

Real estate depreciation and amortization |

|

|

11,393,000 |

|

|

|

11,831,000 |

|

|

|

32,926,000 |

|

|

|

35,486,000 |

|

Noncontrolling interests: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited partners’ interest |

|

|

(1,455,000 |

) |

|

|

(196,000 |

) |

|

|

(2,294,000 |

) |

|

|

(488,000 |

) |

Minority interests in consolidated joint ventures |

|

|

(3,285,000 |

) |

|

|

(194,000 |

) |

|

|

(3,332,000 |

) |

|

|

194,000 |

|

Minority interests’ share of FFO applicable to

consolidated joint ventures |

|

|

418,000 |

|

|

|

(1,340,000 |

) |

|

|

(2,146,000 |

) |

|

|

(4,717,000 |

) |

Impairment charges and write-off of joint venture interest |

|

|

70,210,000 |

|

|

|

189,000 |

|

|

|

100,371,000 |

|

|

|

5,548,000 |

|

Gain on sales of discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

(502,000 |

) |

|

|

(170,000 |

) |

Equity in (income) loss of unconsolidated joint ventures |

|

|

(327,000 |

) |

|

|

288,000 |

|

|

|

(1,152,000 |

) |

|

|

(547,000 |

) |

FFO from unconsolidated joint ventures |

|

|

1,374,000 |

|

|

|

146,000 |

|

|

|

4,438,000 |

|

|

|

1,566,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds From Operations (“FFO”) |

|

|

8,223,000 |

|

|

|

3,944,000 |

|

|

|

18,227,000 |

|

|

|

22,351,000 |

|

Adjustments for items affecting comparability: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management transition charges and employee termination

costs |

|

|

— |

|

|

|

— |

|

|

|

6,875,000 |

|

|

|

— |

|

Accelerated write-off of deferred financing costs |

|

|

— |

|

|

|

2,552,000 |

|

|

|

— |

|

|

|

2,552,000 |

|

Stock-based compensation mark-to-market adjustments |

|

|

(39,000 |

) |

|

|

(2,000 |

) |

|

|

(740,000 |

) |

|

|

(377,000 |

) |

Acquisition transaction costs and terminated projects,

including

Company share from the Cedar/RioCan joint venture (a) |

|

|

11,000 |

|

|

|

2,991,000 |

|

|

|

1,477,000 |

|

|

|

4,782,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring Funds From Operations (“Recurring FFO”) |

|

$ |

8,195,000 |

|

|

$ |

9,485,000 |

|

|

$ |

25,839,000 |

|

|

$ |

29,308,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO per diluted share: |

|

$ |

0.12 |

|

|

$ |

0.06 |

|

|

$ |

0.26 |

|

|

$ |

0.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring FFO per diluted share: |

|

$ |

0.12 |

|

|

$ |

0.14 |

|

|

$ |

0.37 |

|

|

$ |

0.45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of diluted common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares |

|

|

69,759,000 |

|

|

|

65,835,000 |

|

|

|

68,368,000 |

|

|

|

63,025,000 |

|

OP Units |

|

|

1,415,000 |

|

|

|

1,892,000 |

|

|

|

1,415,000 |

|

|

|

1,941,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

71,174,000 |

|

|

|

67,727,000 |

|

|

|

69,783,000 |

|

|

|

64,966,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Disclosures (Pro-Rata Share): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Straight-line rents |

|

$ |

313,000 |

|

|

$ |

150,000 |

|

|

$ |

1,282,000 |

|

|

$ |

1,335,000 |

|

Amortization of intangible lease liabilities |

|

|

2,097,000 |

|

|

|

1,957,000 |

|

|

|

5,007,000 |

|

|

|

6,597,000 |

|

Non-real estate amortization |

|

|

1,172,000 |

|

|

|

1,610,000 |

|

|

|

3,414,000 |

|

|

|

4,133,000 |

|

Stock-based compensation other than mark-to-market adjustments |

|

|

978,000 |

|

|

|

856,000 |

|

|

|

4,789,000 |

|

|

|

2,446,000 |

|

Maintenance capital expenditures |

|

|

1,123,000 |

|

|

|

1,321,000 |

|

|

|

2,176,000 |

|

|

|

2,906,000 |

|

Development and redevelopment capital expenditures |

|

|

12,911,000 |

|

|

|

3,659,000 |

|

|

|

25,461,000 |

|

|

|

13,889,000 |

|

Capitalized interest and financing costs |

|

|

895,000 |

|

|

|

597,000 |

|

|

|

2,036,000 |

|

|

|

2,210,000 |

|

NOI attributable to RioCan properties prior to dates of transfer |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,905,000 |

|

| |

|

|

| (a) |

|

The amounts for the three and nine months ended September 30, 2010 are principally fees

paid to the Company’s investment advisor related to Cedar/RioCan joint venture transactions. The

Company’s share of acquisition costs from the Cedar/RioCan joint venture are $11,000, $773,000,

$183,000 and $892,000, respectively. |

6

CEDAR REALTY TRUST, INC.

Earnings Before Interest, Taxes, Depreciation and Amortization

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

| |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

EBITDA Calculation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) from continuing operations |

|

$ |

(7,213,000 |

) |

|

$ |

(4,775,000 |

) |

|

$ |

(21,123,000 |

) |

|

$ |

(6,500,000 |

) |

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense and amortization of financing costs, net |

|

|

10,475,000 |

|

|

|

10,523,000 |

|

|

|

31,155,000 |

|

|

|

33,174,000 |

|

Accelerated write-off of deferred financing costs |

|

|

— |

|

|

|

2,552,000 |

|

|

|

— |

|

|

|

2,552,000 |

|

Depreciation and amortization |

|

|

9,801,000 |

|

|

|

8,846,000 |

|

|

|

27,844,000 |

|

|

|

26,942,000 |

|

Minority interests share of consolidated joint venture EBITDA |

|

|

(3,204,000 |

) |

|

|

(3,084,000 |

) |

|

|

(9,560,000 |

) |

|

|

(9,863,000 |

) |

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

619,000 |

|

|

|

318,000 |

|

|

|

2,821,000 |

|

|

|

1,408,000 |

|

Interest expense and amortization of financing costs,

net |

|

|

2,469,000 |

|

|

|

2,036,000 |

|

|

|

6,866,000 |

|

|

|

6,134,000 |

|

Depreciation and amortization |

|

|

1,645,000 |

|

|

|

3,034,000 |

|

|

|

5,236,000 |

|

|

|

8,695,000 |

|

Pro-rata share attributable to Cedar/RioCan joint venture: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,068,000 |

|

|

|

333,000 |

|

|

|

3,096,000 |

|

|

|

692,000 |

|

Interest expense |

|

|

968,000 |

|

|

|

467,000 |

|

|

|

2,786,000 |

|

|

|

833,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

|

16,628,000 |

|

|

|

20,250,000 |

|

|

|

49,121,000 |

|

|

|

64,067,000 |

|

Adjustments for items affecting comparability: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation mark-to-market adjustments |

|

|

(39,000 |

) |

|

|

(2,000 |

) |

|

|

(740,000 |

) |

|

|

(377,000 |

) |

Impairment charges and write-off of investment in unconsolidated

joint venture |

|

|

7,419,000 |

|

|

|

155,000 |

|

|

|

15,380,000 |

|

|

|

2,272,000 |

|

Management transition charges |

|

|

— |

|

|

|

— |

|

|

|

6,530,000 |

|

|

|

— |

|

Acquisition transaction costs and terminated projects, including

Company share from the Cedar/RioCan joint venture (a) |

|

|

11,000 |

|

|

|

2,816,000 |

|

|

|

1,352,000 |

|

|

|

4,257,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

24,019,000 |

|

|

$ |

23,219,000 |

|

|

$ |

71,643,000 |

|

|

$ |

70,219,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA annualized |

|

$ |

96,076,000 |

|

|

$ |

92,876,000 |

|

|

$ |

95,524,000 |

|

|

$ |

93,625,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-rata share of outstanding debt (b) |

|

$ |

854,337,000 |

|

|

$ |

747,291,000 |

|

|

$ |

854,337,000 |

|

|

$ |

747,291,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed charges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

$ |

12,671,000 |

|

|

$ |

11,404,000 |

|

|

$ |

36,642,000 |

|

|

$ |

36,776,000 |

|

Interest expense — consolidated minority interests share |

|

|

(1,675,000 |

) |

|

|

(1,706,000 |

) |

|

|

(4,983,000 |

) |

|

|

(5,034,000 |

) |

Interest expense — unconsolidated Cedar/RioCan joint venture |

|

|

968,000 |

|

|

|

467,000 |

|

|

|

2,786,000 |

|

|

|

833,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense |

|

$ |

11,964,000 |

|

|

$ |

10,165,000 |

|

|

$ |

34,445,000 |

|

|

$ |

32,575,000 |

|

Preferred dividend requirements |

|

|

3,580,000 |

|

|

|

2,679,000 |

|

|

|

10,621,000 |

|

|

|

6,617,000 |

|

Pro-rata share of scheduled mortgage repayments |

|

|

2,237,000 |

|

|

|

1,892,000 |

|

|

|

6,554,000 |

|

|

|

5,503,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed charges |

|

$ |

17,781,000 |

|

|

$ |

14,736,000 |

|

|

$ |

51,620,000 |

|

|

$ |

44,695,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt and Coverage Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt to Adjusted EBITDA |

|

|

8.9 |

x |

|

|

8.0 |

x |

|

|

8.9 |

x |

|

|

8.0 |

x |

Interest coverage ratio (Adjusted EBIDTA / Interest expense ) |

|

|

2.0 |

x |

|

|

2.3 |

x |

|

|

2.1 |

x |

|

|

2.2 |

x |

Fixed charge coverage ratio (Adjusted EBITDA / Fixed charges ) |

|

|

1.4 |

x |

|

|

1.6 |

x |

|

|

1.4 |

x |

|

|

1.6 |

x |

| |

|

|

| (a) |

|

The Company’s share of acquisition costs from the Cedar/RioCan joint venture are

$11,000, $773,000, $183,000 and $892,000, respectively. |

| |

| (b) |

|

Includes debt from properties “held for sale/conveyance.” |

7

CEDAR REALTY TRUST, INC.

Summary of Outstanding Debt

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stated contract amounts |

|

| |

|

Percent |

|

|

Maturity |

|

Interest |

|

|

September 30, |

|

|

December 31, |

|

| Property |

|

Owned |

|

|

Date |

|

rate (a) |

|

|

2011 |

|

|

2010 |

|

Fixed-rate mortgages: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Properties: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Point |

|

|

100 |

% |

|

Sep 2012 |

|

|

7.6 |

% |

|

$ |

16,413,000 |

|

|

$ |

16,807,000 |

|

Carll’s Corner |

|

|

100 |

% |

|

Nov 2012 |

|

|

5.6 |

% |

|

|

5,689,000 |

|

|

|

5,786,000 |

|

Washington Center Shoppes |

|

|

100 |

% |

|

Dec 2012 |

|

|

5.9 |

% |

|

|

8,355,000 |

|

|

|

8,452,000 |

|

LA Fitness Facility |

|

|

100 |

% |

|

Jan 2013 |

|

|

5.4 |

% |

|

|

5,568,000 |

|

|

|

5,666,000 |

|

Fairview Plaza |

|

|

100 |

% |

|

Feb 2013 |

|

|

5.7 |

% |

|

|

5,283,000 |

|

|

|

5,370,000 |

|

Academy Plaza |

|

|

100 |

% |

|

Mar 2013 |

|

|

7.3 |

% |

|

|

8,958,000 |

|

|

|

9,139,000 |

|

General Booth Plaza |

|

|

100 |

% |

|

Aug 2013 |

|

|

6.1 |

% |

|

|

5,095,000 |

|

|

|

5,166,000 |

|

Kempsville Crossing |

|

|

100 |

% |

|

Aug 2013 |

|

|

6.1 |

% |

|

|

5,754,000 |

|

|

|

5,841,000 |

|

Port Richmond Village |

|

|

100 |

% |

|

Aug 2013 |

|

|

6.5 |

% |

|

|

14,227,000 |

|

|

|

14,428,000 |

|

Smithfield Plaza |

|

|

100 |

% |

|

Aug 2013 |

|

|

6.1 |

% |

|

|

3,277,000 |

|

|

|

3,317,000 |

|

Suffolk Plaza |

|

|

100 |

% |

|

Aug 2013 |

|

|

6.1 |

% |

|

|

4,322,000 |

|

|

|

4,395,000 |

|

Virginia Little Creek |

|

|

100 |

% |

|

Aug 2013 |

|

|

6.1 |

% |

|

|

4,612,000 |

|

|

|

4,680,000 |

|

Timpany Plaza |

|

|

100 |

% |

|

Jan 2014 |

|

|

6.1 |

% |

|

|

7,954,000 |

|

|

|

8,067,000 |

|

Trexler Mall |

|

|

100 |

% |

|

May 2014 |

|

|

5.5 |

% |

|

|

20,677,000 |

|

|

|

20,993,000 |

|

Coliseum Marketplace |

|

|

100 |

% |

|

Jul 2014 |

|

|

6.1 |

% |

|

|

11,515,000 |

|

|

|

11,642,000 |

|

Fieldstone Marketplace |

|

|

20 |

% |

|

Jul 2014 |

|

|

6.0 |

% |

|

|

17,735,000 |

|

|

|

17,945,000 |

|

King’s Plaza |

|

|

100 |

% |

|

Jul 2014 |

|

|

6.0 |

% |

|

|

7,574,000 |

|

|

|

7,678,000 |

|

Liberty Marketplace |

|

|

100 |

% |

|

Jul 2014 |

|

|

6.1 |

% |

|

|

8,718,000 |

|

|

|

8,865,000 |

|

Yorktowne Plaza |

|

|

100 |

% |

|

Jul 2014 |

|

|

6.0 |

% |

|

|

19,817,000 |

|

|

|

20,092,000 |

|

Mechanicsburg Giant |

|

|

100 |

% |

|

Nov 2014 |

|

|

5.5 |

% |

|

|

9,069,000 |

|

|

|

9,274,000 |

|

Elmhurst Square Shopping

Center |

|

|

100 |

% |

|

Dec 2014 |

|

|

5.4 |

% |

|

|

3,912,000 |

|

|

|

3,970,000 |

|

Newport Plaza |

|

|

100 |

% |

|

Jan 2015 |

|

|

6.0 |

% |

|

|

5,501,000 |

|

|

|

5,583,000 |

|

New London Mall |

|

|

40 |

% |

|

Apr 2015 |

|

|

4.9 |

% |

|

|

27,365,000 |

|

|

|

27,365,000 |

|

Carbondale Plaza |

|

|

100 |

% |

|

May 2015 |

|

|

6.4 |

% |

|

|

4,884,000 |

|

|

|

4,951,000 |

|

Oak Ridge Shopping Center |

|

|

100 |

% |

|

May 2015 |

|

|

5.5 |

% |

|

|

3,365,000 |

|

|

|

3,407,000 |

|

Pine Grove Plaza |

|

|

100 |

% |

|

Sep 2015 |

|

|

5.0 |

% |

|

|

5,604,000 |

|

|

|

5,688,000 |

|

Groton Shopping Center |

|

|

100 |

% |

|

Oct 2015 |

|

|

5.3 |

% |

|

|

11,709,000 |

|

|

|

11,843,000 |

|

Wal-Mart Center |

|

|

100 |

% |

|

Nov 2015 |

|

|

5.1 |

% |

|

|

5,607,000 |

|

|

|

5,690,000 |

|

Jordan Lane |

|

|

100 |

% |

|

Dec 2015 |

|

|

5.5 |

% |

|

|

12,688,000 |

|

|

|

12,860,000 |

|

Oakland Mills |

|

|

100 |

% |

|

Jan 2016 |

|

|

5.5 |

% |

|

|

4,771,000 |

|

|

|

4,835,000 |

|

Smithfield Plaza |

|

|

100 |

% |

|

May 2016 |

|

|

6.2 |

% |

|

|

6,912,000 |

|

|

|

6,976,000 |

|

West Bridgewater |

|

|

100 |

% |

|

Sep 2016 |

|

|

6.2 |

% |

|

|

10,752,000 |

|

|

|

10,848,000 |

|

Carman’s Plaza |

|

|

100 |

% |

|

Oct 2016 |

|

|

6.2 |

% |

|

|

33,500,000 |

|

|

|

33,500,000 |

|

Hamburg Commons |

|

|

100 |

% |

|

Oct 2016 |

|

|

6.1 |

% |

|

|

5,038,000 |

|

|

|

5,101,000 |

|

Meadows Marketplace |

|

|

20 |

% |

|

Nov 2016 |

|

|

5.6 |

% |

|

|

10,046,000 |

|

|

|

10,172,000 |

|

San Souci Plaza |

|

|

40 |

% |

|

Dec 2016 |

|

|

6.2 |

% |

|

|

27,200,000 |

|

|

|

27,200,000 |

|

Camp Hill Shopping Center |

|

|

100 |

% |

|

Jan 2017 |

|

|

5.5 |

% |

|

|

65,000,000 |

|

|

|

65,000,000 |

|

Golden Triangle |

|

|

100 |

% |

|

Feb 2018 |

|

|

6.0 |

% |

|

|

20,467,000 |

|

|

|

20,702,000 |

|

East Chestnut |

|

|

100 |

% |

|

Apr 2018 |

|

|

5.2 |

% |

|

|

1,645,000 |

|

|

|

1,704,000 |

|

Townfair Center |

|

|

100 |

% |

|

Jul 2018 |

|

|

5.2 |

% |

|

|

16,450,000 |

|

|

|

|

|

Gold Star Plaza |

|

|

100 |

% |

|

May 2019 |

|

|

7.3 |

% |

|

|

1,982,000 |

|

|

|

2,123,000 |

|

Kingston Plaza |

|

|

100 |

% |

|

Jul 2019 |

|

|

5.3 |

% |

|

|

514,000 |

|

|

|

522,000 |

|

Halifax Plaza |

|

|

100 |

% |

|

Apr 2020 |

|

|

6.3 |

% |

|

|

4,195,000 |

|

|

|

4,252,000 |

|

Swede Square |

|

|

100 |

% |

|

Nov 2020 |

|

|

5.5 |

% |

|

|

10,488,000 |

|

|

|

10,588,000 |

|

Colonial Commons |

|

|

100 |

% |

|

Feb 2021 |

|

|

5.5 |

% |

|

|

27,842,000 |

|

|

|

— |

|

Virginia Little Creek |

|

|

100 |

% |

|

Sep 2021 |

|

|

8.0 |

% |

|

|

351,000 |

|

|

|

367,000 |

|

Metro Square |

|

|

100 |

% |

|

Nov 2029 |

|

|

7.5 |

% |

|

|

8,805,000 |

|

|

|

8,964,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Fixed-Rate Mortgages |

|

|

|

|

|

4.5 years |

|

|

5.9 |

% |

|

|

527,205,000 |

|

|

|

487,814,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

weighted average

|

|

|

|

|

|

|

|

|

8

CEDAR REALTY TRUST, INC.

Summary of Outstanding Debt (Continued)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stated contract amounts |

|

| |

|

Percent |

|

|

Maturity |

|

|

Interest |

|

|

September 30, |

|

|

December 31, |

|

| Property |

|

Owned |

|

|

Date |

|

|

rate (a) |

|

|

2011 |

|

|

2010 |

|

Variable-rate mortgages: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Upland Square |

|

|

60 |

% |

|

Nov 2011 (b) |

|

|

3.5 |

% |

|

|

63,768,000 |

|

|

|

62,577,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total mortgages at stated contract amounts |

|

|

|

|

|

4.0 years |

|

|

5.6 |

% |

|

|

590,973,000 |

|

|

|

550,391,000 |

|

| |

|

|

|

|

|

weighted average

|

|

|

|

|

|

|

|

|

Unamortized discount/premium |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8,000 |

) |

|

|

134,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total mortgage debt (including unamortized discount/premium) |

|

|

|

|

|

|

590,965,000 |

|

|

|

550,525,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revolving Credit Facilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stabilized properties |

|

|

100 |

% |

|

Jan 2012 |

|

|

5.5 |

% |

|

|

74,035,000 |

|

|

|

29,535,000 |

|

Development properties |

|

|

100 |

% |

|

Jun 2012 |

|

|

2.4 |

% |

|

|

92,282,000 |

|

|

|

103,062,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.5 years |

|

|

3.8 |

% |

|

|

166,317,000 |

|

|

|

132,597,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

weighted average

|

|

|

|

|

|

|

|

|

Total Consolidated Debt (Excluding Held

for Sale/Conveyance Mortgage

Debt) |

|

|

|

|

|

3.3 years |

|

|

5.2 |

% |

|

$ |

757,282,000 |

|

|

|

683,122,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

weighted average

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-rata share of total debt reconciliation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total consolidated debt (excluding held for sale/conveyance mortgage debt) |

|

|

$ |

757,282,000 |

|

|

$ |

683,122,000 |

|

| Less pro-rata share attributable to consolidated joint venture minority interests |

|

|

|

(54,739,000 |

) |

|

|

(54,735,000 |

) |

| Plus pro-rata share attributable to properties held for sale/conveyance (c) |

|

|

|

88,002,000 |

|

|

|

91,260,000 |

|

| Plus pro-rata share attributable to the unconsolidated Cedar/RioCan

Joint Venture (d) |

|

|

|

63,792,000 |

|

|

|

58,680,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-rata share of total debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

854,337,000 |

|

|

$ |

778,327,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-rata share of fixed debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

605,352,000 |

|

|

$ |

562,153,000 |

|

Pro-rata share of variable debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

248,985,000 |

|

|

$ |

216,174,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-rata share of total debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

854,337,000 |

|

|

$ |

778,327,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of pro-rata fixed debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

71 |

% |

|

|

72 |

% |

Percentage of pro-rata variable debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

% |

|

|

28 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

% |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| (a) |

|

Effective rate as of September 30, 2011. |

| |

| (b) |

|

Subsequent to September 30, 2011, the Company concluded a two-year extension of this facility. |

| |

| (c) |

|

See “Summary of Outstanding Debt — Held for Sale Properties.” |

| |

| (d) |

|

See “Summary of Outstanding Joint Venture Debt.” |

9

CEDAR REALTY TRUST, INC.

Summaries of Debt Maturities

As of September 30, 2011

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Properties Including Properties Held for Sale |

|

| Maturity |

|

Cedar pro-rata share of: |

|

|

JV Partners pro-rata share of: |

|

|

|

|

| schedule |

|

Scheduled |

|

|

Balloon |

|

|

|

|

|

|

Scheduled |

|

|

Balloon |

|

|

|

|

|

|

|

| by year |

|

Amortization |

|

|

Payments |

|

|

Total |

|

|

Amortization |

|

|

Payments |

|

|

Total |

|

|

Consolidated Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

$ |

2,077,000 |

|

|

$ |

63,768,000 |

(a) |

|

$ |

65,845,000 |

|

|

$ |

480,000 |

|

|

$ |

— |

|

|

$ |

480,000 |

|

|

$ |

66,325,000 |

|

2012 |

|

|

9,686,000 |

|

|

|

227,720,000 |

(b) |

|

|

237,406,000 |

|

|

|

1,247,000 |

|

|

|

— |

|

|

|

1,247,000 |

|

|

|

238,653,000 |

|

2013 |

|

|

8,856,000 |

|

|

|

54,945,000 |

|

|

|

63,801,000 |

|

|

|

1,442,000 |

|

|

|

— |

|

|

|

1,442,000 |

|

|

|

65,243,000 |

|

2014 |

|

|

7,375,000 |

|

|

|

89,421,000 |

|

|

|

96,796,000 |

|

|

|

1,312,000 |

|

|

|

22,571,000 |

|

|

|

23,883,000 |

|

|

|

120,679,000 |

|

2015 |

|

|

5,843,000 |

|

|

|

79,295,000 |

|

|

|

85,138,000 |

|

|

|

951,000 |

|

|

|

36,783,000 |

|

|

|

37,734,000 |

|

|

|

122,872,000 |

|

2016 |

|

|

4,901,000 |

|

|

|

80,657,000 |

|

|

|

85,558,000 |

|

|

|

486,000 |

|

|

|

31,275,000 |

|

|

|

31,761,000 |

|

|

|

117,319,000 |

|

2017 |

|

|

3,484,000 |

|

|

|

67,072,000 |

|

|

|

70,556,000 |

|

|

|

151,000 |

|

|

|

17,184,000 |

|

|

|

17,335,000 |

|

|

|

87,891,000 |

|

2018 |

|

|

2,693,000 |

|

|

|

32,905,000 |

|

|

|

35,598,000 |

|

|

|

41,000 |

|

|

|

— |

|

|

|

41,000 |

|

|

|

35,639,000 |

|

2019 |

|

|

2,105,000 |

|

|

|

5,630,000 |

|

|

|

7,735,000 |

|

|

|

36,000 |

|

|

|

892,000 |

|

|

|

928,000 |

|

|

|

8,663,000 |

|

2020 |

|

|

1,459,000 |

|

|

|

12,169,000 |

|

|

|

13,628,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,628,000 |

|

Thereafter |

|

|

5,629,000 |

|

|

|

22,855,000 |

|

|

|

28,484,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28,484,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

54,108,000 |

|

|

$ |

736,437,000 |

|

|

$ |

790,545,000 |

|

|

$ |

6,146,000 |

|

|

$ |

108,705,000 |

|

|

$ |

114,851,000 |

|

|

$ |

905,396,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Properties Excluding Properties Held for Sale |

|

| Maturity |

|

Cedar pro-rata share of: |

|

|

JV Partners pro-rata share of: |

|

|

|

|

| schedule |

|

Scheduled |

|

|

Balloon |

|

|

|

|

|

|

Scheduled |

|

|

Balloon |

|

|

|

|

|

|

|

| by year |

|

Amortization |

|

|

Payments |

|

|

Total |

|

|

Amortization |

|

|

Payments |

|

|

Total |

|

|

Consolidated Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

$ |

1,707,000 |

|

|

$ |

63,768,000 |

(a) |

|

$ |

65,475,000 |

|

|

$ |

269,000 |

|

|

$ |

— |

|

|

$ |

269,000 |

|

|

$ |

65,744,000 |

|

2012 |

|

|

8,141,000 |

|

|

|

195,955,000 |

(b) |

|

|

204,096,000 |

|

|

|

276,000 |

|

|

|

— |

|

|

|

276,000 |

|

|

|

204,372,000 |

|

2013 |

|

|

7,196,000 |

|

|

|

54,945,000 |

|

|

|