Exhibit 99.2

Supplemental Financial Information

June 30, 2012

(unaudited)

Cedar Realty Trust, Inc.

44 South Bayles Avenue

Port Washington, NY 11050-3765

Tel: (516) 767-6492 Fax: (516) 767-6497

www.cedarrealtytrust.com

CEDAR REALTY TRUST, INC.

Supplemental Financial Information

June 30, 2012

(unaudited)

TABLE OF CONTENTS

| Consolidated Financial Information |

||||

| Consolidated Balance Sheets |

3 | |||

| Consolidated Statements of Operations |

4 | |||

| Supporting Schedules to Consolidated Statements |

5-6 | |||

| Funds From Operations and Additional Disclosures |

7 | |||

| Earnings Before Interest, Taxes, Depreciation and Amortization |

8 | |||

| Summary of Outstanding Debt |

9-10 | |||

| Summaries of Debt Maturities |

11 | |||

| Consolidated Operating Portfolio Information |

||||

| Real Estate Summary |

12-14 | |||

| Leasing Activity |

15 | |||

| Tenant Concentration |

16 | |||

| Lease Expirations |

17 | |||

| Property Net Operating Income |

18 | |||

| Dispositions |

19 | |||

| Unconsolidated Cedar/RioCan Joint Venture |

||||

| Balance Sheets |

21 | |||

| Statements of Income |

22 | |||

| Real Estate Summary |

23-24 | |||

| Summary of Outstanding Debt |

25 | |||

| Summary of Debt Maturities |

26 | |||

| Properties Held for Sale/Conveyance |

||||

| Real Estate Summary |

28 | |||

| Summary of Outstanding Debt |

29 | |||

| Summary of Debt Maturities |

30 | |||

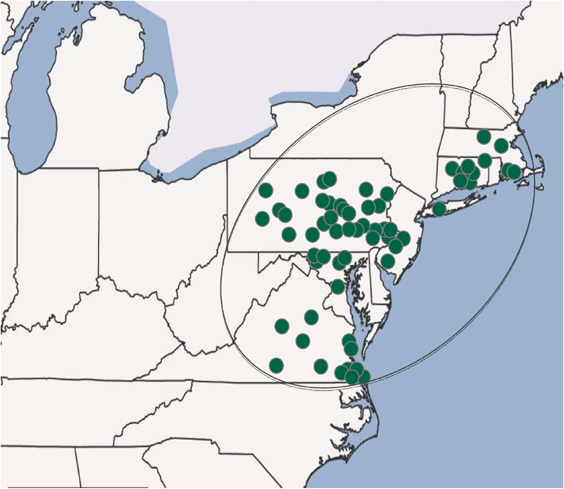

| Portfolio Map Excluding Assets Held For Sale |

31 | |||

| Non-GAAP Financial Disclosures |

32 | |||

Forward-Looking Statements

The information contained in this Supplemental Financial Information is unaudited and does not purport to disclose all items required by accounting principles generally accepted in the United States (“GAAP”). In addition, statements made or incorporated by reference herein may include certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and, as such, may involve known and unknown risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “may”, “will”, “should”, “estimates”, “projects”, “anticipates”, “believes”, “expects”, “intends”, “future”, and words of similar import, or the negative thereof. Factors which could have a material adverse effect on the operations and future prospects of the Company include, but are not limited to, those set forth under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K. Accordingly, the information contained herein should be read in conjunction with the Company’s Form 10-K for the year ended December 31, 2011 and Form 10-Q for the quarter ended June 30, 2012.

2

CEDAR REALTY TRUST, INC.

Consolidated Balance Sheets

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Assets: |

||||||||

| Real estate |

||||||||

| Land |

$ | 268,934,000 | $ | 268,982,000 | ||||

| Buildings and improvements |

1,109,130,000 | 1,099,456,000 | ||||||

|

|

|

|

|

|||||

| 1,378,064,000 | 1,368,438,000 | |||||||

| Less accumulated depreciation |

(221,443,000 | ) | (197,578,000 | ) | ||||

|

|

|

|

|

|||||

| Real estate, net |

1,156,621,000 | 1,170,860,000 | ||||||

| Real estate held for sale/conveyance |

191,538,000 | 207,553,000 | ||||||

| Investment in Cedar/RioCan joint venture |

43,173,000 | 44,743,000 | ||||||

| Cash and cash equivalents |

7,594,000 | 12,070,000 | ||||||

| Restricted cash |

15,657,000 | 14,707,000 | ||||||

| Receivables |

24,557,000 | 26,127,000 | ||||||

| Other assets and deferred charges, net |

26,190,000 | 33,804,000 | ||||||

| Assets relating to real estate held for sale/conveyance |

— | 2,299,000 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,465,330,000 | $ | 1,512,163,000 | ||||

|

|

|

|

|

|||||

| Liabilities and equity: |

||||||||

| Mortgage loans payable |

$ | 562,248,000 | $ | 588,516,000 | ||||

| Mortgage loans payable — real estate held for sale/conveyance |

113,384,000 | 123,115,000 | ||||||

| Secured credit facilities |

179,500,000 | 166,317,000 | ||||||

| Accounts payable and accrued liabilities |

25,989,000 | 32,404,000 | ||||||

| Unamortized intangible lease liabilities |

32,318,000 | 35,017,000 | ||||||

| Liabilities relating to real estate held for sale/conveyance |

6,339,000 | 6,406,000 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

919,778,000 | 951,775,000 | ||||||

|

|

|

|

|

|||||

| Noncontrolling interest — limited partners’ mezzanine OP Units |

658,000 | 4,616,000 | ||||||

| Commitments and contingencies |

— | — | ||||||

| Equity: |

||||||||

| Cedar Realty Trust, Inc. shareholders’ equity: |

||||||||

| Preferred stock |

159,564,000 | 158,575,000 | ||||||

| Common stock and other shareholders’ equity |

329,422,000 | 335,268,000 | ||||||

|

|

|

|

|

|||||

| Total Cedar Realty Trust, Inc. shareholders’ equity |

488,986,000 | 493,843,000 | ||||||

|

|

|

|

|

|||||

| Noncontrolling interests: |

||||||||

| Minority interests in consolidated joint ventures |

54,653,000 | 56,511,000 | ||||||

| Limited partners’ OP Units |

1,255,000 | 5,418,000 | ||||||

|

|

|

|

|

|||||

| Total noncontrolling interests |

55,908,000 | 61,929,000 | ||||||

|

|

|

|

|

|||||

| Total equity |

544,894,000 | 555,772,000 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 1,465,330,000 | $ | 1,512,163,000 | ||||

|

|

|

|

|

|||||

3

CEDAR REALTY TRUST, INC.

Consolidated Statements of Operations

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Revenues: |

||||||||||||||||

| Rents |

$ | 26,988,000 | $ | 25,914,000 | $ | 53,683,000 | $ | 51,587,000 | ||||||||

| Expense recoveries |

6,360,000 | 5,894,000 | 13,323,000 | 14,047,000 | ||||||||||||

| Other |

3,642,000 | 770,000 | 4,461,000 | 1,454,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

36,990,000 | 32,578,000 | 71,467,000 | 67,088,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Property operating expenses: |

||||||||||||||||

| Operating, maintenance and management |

5,510,000 | 5,858,000 | 11,886,000 | 14,284,000 | ||||||||||||

| Real estate and other property-related taxes |

4,262,000 | 4,043,000 | 8,655,000 | 8,198,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total property operating expenses |

9,772,000 | 9,901,000 | 20,541,000 | 22,482,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Property operating income |

27,218,000 | 22,677,000 | 50,926,000 | 44,606,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other expenses: |

||||||||||||||||

| General and administrative |

3,737,000 | 2,691,000 | 7,362,000 | 5,205,000 | ||||||||||||

| Management transition charges |

— | 6,350,000 | — | 6,530,000 | ||||||||||||

| Acquisition transaction costs and terminated projects |

— | 73,000 | — | 1,242,000 | ||||||||||||

| Depreciation and amortization |

9,796,000 | 9,311,000 | 25,522,000 | 18,030,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expenses |

13,533,000 | 18,425,000 | 32,884,000 | 31,007,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

13,685,000 | 4,252,000 | 18,042,000 | 13,599,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-operating income and expense: |

||||||||||||||||

| Interest expense, including amortization of deferred financing costs |

(9,744,000 | ) | (10,177,000 | ) | (19,923,000 | ) | (20,667,000 | ) | ||||||||

| Accelerated write-off of deferred financing costs |

— | — | (2,607,000 | ) | — | |||||||||||

| Interest income |

62,000 | 129,000 | 124,000 | 177,000 | ||||||||||||

| Unconsolidated joint ventures: |

||||||||||||||||

| Equity in income |

576,000 | 34,000 | 1,021,000 | 825,000 | ||||||||||||

| Write-off of investment |

— | (7,961,000 | ) | — | (7,961,000 | ) | ||||||||||

| Gain on sales |

79,000 | — | 79,000 | 28,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total non-operating income and expense |

(9,027,000 | ) | (17,975,000 | ) | (21,306,000 | ) | (27,598,000 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from continuing operations |

4,658,000 | (13,723,000 | ) | (3,264,000 | ) | (13,999,000 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Discontinued operations: |

||||||||||||||||

| Income from operations |

944,000 | 778,000 | 2,403,000 | 2,247,000 | ||||||||||||

| Impairment (charges)/reversals |

— | (12,258,000 | ) | 1,138,000 | (22,544,000 | ) | ||||||||||

| Gain on sales |

293,000 | 474,000 | 750,000 | 474,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total discontinued operations |

1,237,000 | (11,006,000 | ) | 4,291,000 | (19,823,000 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

5,895,000 | (24,729,000 | ) | 1,027,000 | (33,822,000 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less, net (income) loss attributable to noncontrolling interests: |

||||||||||||||||

| Minority interests in consolidated joint ventures |

(662,000 | ) | 22,000 | (1,708,000 | ) | 47,000 | ||||||||||

| Limited partners’ interest in Operating Partnership |

(8,000 | ) | 579,000 | 97,000 | 839,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total net (income) loss attributable to noncontrolling interests |

(670,000 | ) | 601,000 | (1,611,000 | ) | 886,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to Cedar Realty Trust, Inc. |

5,225,000 | (24,128,000 | ) | (584,000 | ) | (32,936,000 | ) | |||||||||

| Preferred stock dividends |

(3,607,000 | ) | (3,540,000 | ) | (7,138,000 | ) | (7,041,000 | ) | ||||||||

| Preferred stock redemption costs |

(382,000 | ) | — | (382,000 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to common shareholders |

$ | 1,236,000 | $ | (27,668,000 | ) | $ | (8,104,000 | ) | $ | (39,977,000 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per common share attributable to common shareholders (basic and diluted): |

||||||||||||||||

| Continuing operations |

$ | 0.01 | $ | (0.25 | ) | $ | (0.16 | ) | $ | (0.30 | ) | |||||

| Discontinued operations |

0.00 | (0.16 | ) | 0.03 | (0.29 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 0.01 | $ | (0.41 | ) | $ | (0.13 | ) | $ | (0.59 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average number of common shares—basic and diluted |

68,038,000 | 68,099,000 | 67,787,000 | 67,664,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

4

CEDAR REALTY TRUST, INC.

Supporting Schedules to Consolidated Statements

Balance Sheets Detail

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Construction in process (included in buildings and improvements) |

$ | 12,369,000 | $ | 24,475,000 | ||||

|

|

|

|

|

|||||

| Receivables |

||||||||

| Rents and other tenant receivables, net |

$ | 5,650,000 | $ | 6,882,000 | ||||

| Straight-line rents |

13,993,000 | 13,435,000 | ||||||

| Other |

4,914,000 | 5,810,000 | ||||||

|

|

|

|

|

|||||

| $ | 24,557,000 | $ | 26,127,000 | |||||

|

|

|

|

|

|||||

| Other assets and deferred charges, net |

||||||||

| Lease origination costs |

$ | 14,204,000 | $ | 14,266,000 | ||||

| Financing costs |

6,162,000 | 6,249,000 | ||||||

| Prepaid expenses |

2,328,000 | 5,857,000 | ||||||

| Investments related to deferred compensation liabilities |

416,000 | 3,562,000 | ||||||

| Property and other deposits |

748,000 | 1,430,000 | ||||||

| Leasehold improvements, furniture and fixtures |

1,224,000 | 1,035,000 | ||||||

| Other |

1,108,000 | 1,405,000 | ||||||

|

|

|

|

|

|||||

| $ | 26,190,000 | $ | 33,804,000 | |||||

|

|

|

|

|

|||||

| Minority interests in consolidated joint ventures |

||||||||

| Operating joint venture properties: |

||||||||

| New London Mall and San Souci Plaza |

5,871,000 | 6,805,000 | ||||||

| Upland Square |

1,048,000 | 1,048,000 | ||||||

| Homburg (two properties) |

13,771,000 | 13,909,000 | ||||||

| Held-for-sale joint venture properties: |

||||||||

| Homburg (seven properties) |

34,044,000 | 34,774,000 | ||||||

| CVS at Naugatuck |

— | 56,000 | ||||||

| Heritage Crossing |

(81,000 | ) | (81,000 | ) | ||||

|

|

|

|

|

|||||

| $ | 54,653,000 | $ | 56,511,000 | |||||

|

|

|

|

|

|||||

5

CEDAR REALTY TRUST, INC.

Supporting Schedules to Consolidated Statements

Statements of Operations Detail

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Rents |

||||||||||||||||

| Base rents |

$ | 24,835,000 | $ | 24,060,000 | $ | 49,667,000 | $ | 48,022,000 | ||||||||

| Percentage rent |

174,000 | 220,000 | 464,000 | 384,000 | ||||||||||||

| Straight-line rents |

247,000 | 365,000 | 562,000 | 746,000 | ||||||||||||

| Amortization of intangible lease liabilities |

1,732,000 | 1,269,000 | 2,990,000 | 2,435,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 26,988,000 | $ | 25,914,000 | $ | 53,683,000 | $ | 51,587,000 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other revenues |

||||||||||||||||

| Lease termination fees |

$ | 3,029,000 | $ | — | $ | 3,029,000 | $ | — | ||||||||

| RioCan management fees |

631,000 | 452,000 | 1,277,000 | 986,000 | ||||||||||||

| Miscellaneous |

(18,000 | ) | 318,000 | 155,000 | 468,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 3,642,000 | $ | 770,000 | $ | 4,461,000 | $ | 1,454,000 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Equity in income of unconsolidated joint ventures: |

||||||||||||||||

| Cedar/RioCan |

$ | 576,000 | $ | 195,000 | $ | 1,021,000 | $ | 523,000 | ||||||||

| Philadelphia redevelopment project |

— | (161,000 | ) | — | 302,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 576,000 | $ | 34,000 | $ | 1,021,000 | $ | 825,000 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (income) loss attributable to noncontrolling interests—minority interests in consolidated joint ventures |

||||||||||||||||

| Operating joint venture properties: |

||||||||||||||||

| New London Mall and San Souci Plaza |

$ | 218,000 | $ | 128,000 | $ | 420,000 | $ | 324,000 | ||||||||

| Homburg (two properties) |

(89,000 | ) | (91,000 | ) | (237,000 | ) | (224,000 | ) | ||||||||

| Held-for-sale joint venture properties: |

||||||||||||||||

| Homburg (seven properties) |

(791,000 | ) | (247,000 | ) | (1,567,000 | ) | (473,000 | ) | ||||||||

| CVS at Naugatuck |

— | (8,000 | ) | (324,000 | ) | (9,000 | ) | |||||||||

| Columbia Mall |

— | 240,000 | — | 429,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | (662,000 | ) | $ | 22,000 | $ | (1,708,000 | ) | $ | 47,000 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

6

CEDAR REALTY TRUST, INC.

Funds From Operations and Additional Disclosures

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Net income (loss) attributable to Company’s common shareholders |

$ | 1,236,000 | $ | (27,668,000 | ) | $ | (8,104,000 | ) | $ | (39,977,000 | ) | |||||

| Real estate depreciation and amortization |

9,712,000 | 10,939,000 | 25,392,000 | 21,349,000 | ||||||||||||

| Limited partners’ interest |

8,000 | (579,000 | ) | (97,000 | ) | (839,000 | ) | |||||||||

| Impairment charges/(reversals) |

— | 20,247,000 | (1,138,000 | ) | 30,533,000 | |||||||||||

| Gain on sales |

(372,000 | ) | (474,000 | ) | (829,000 | ) | (502,000 | ) | ||||||||

| Consolidated minority interest: |

||||||||||||||||

| Share of income (loss) |

662,000 | (22,000 | ) | 1,708,000 | (47,000 | ) | ||||||||||

| Share of FFO |

(1,377,000 | ) | (1,476,000 | ) | (2,791,000 | ) | (2,980,000 | ) | ||||||||

| Unconsolidated joint ventures: |

||||||||||||||||

| Share of income |

(576,000 | ) | (34,000 | ) | (1,021,000 | ) | (825,000 | ) | ||||||||

| Share of FFO |

1,587,000 | 1,182,000 | 3,056,000 | 3,064,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Funds From Operations (“FFO”) |

10,880,000 | 2,115,000 | 16,176,000 | 9,776,000 | ||||||||||||

| Adjustments for items affecting comparability: |

||||||||||||||||

| Management transition charges and employee termination costs |

— | 6,350,000 | — | 6,875,000 | ||||||||||||

| Accelerated write-off of deferred financing costs |

— | — | 2,607,000 | — | ||||||||||||

| Share-based compensation mark-to-market adjustments |

(20,000 | ) | (551,000 | ) | 10,000 | (701,000 | ) | |||||||||

| Preferred stock redemption costs |

382,000 | — | 382,000 | — | ||||||||||||

| Acquisition transaction costs and terminated projects, including Company share from the Cedar/RioCan joint venture |

— | 234,000 | — | 1,487,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Funds From Operations (“Operating FFO”) |

$ | 11,242,000 | $ | 8,148,000 | $ | 19,175,000 | $ | 17,437,000 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| FFO per diluted share: |

$ | 0.15 | $ | 0.03 | $ | 0.23 | $ | 0.14 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating FFO per diluted share: |

$ | 0.16 | $ | 0.12 | $ | 0.27 | $ | 0.25 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average number of diluted common shares: |

||||||||||||||||

| Common shares |

71,136,000 | 68,099,000 | 70,850,000 | 67,664,000 | ||||||||||||

| OP Units |

462,000 | 1,415,000 | 637,000 | 1,415,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 71,598,000 | 69,514,000 | 71,487,000 | 69,079,000 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Additional Disclosures (Pro-Rata Share): |

||||||||||||||||

| Straight-line rents |

$ | 288,000 | $ | 452,000 | $ | 685,000 | $ | 927,000 | ||||||||

| Amortization of intangible lease liabilities |

1,879,000 | 1,463,000 | 3,205,000 | 2,834,000 | ||||||||||||

| Lease termination income |

3,029,000 | — | 3,029,000 | — | ||||||||||||

| Non-real estate amortization |

642,000 | 1,162,000 | 1,357,000 | 2,242,000 | ||||||||||||

| Share-based compensation other than mark-to-market adjustments |

845,000 | 787,000 | 1,736,000 | 1,766,000 | ||||||||||||

| Maintenance capital expenditures |

1,295,000 | 644,000 | 2,135,000 | 1,053,000 | ||||||||||||

| Development and redevelopment capital expenditures |

5,233,000 | 8,567,000 | 8,015,000 | 12,550,000 | ||||||||||||

| Capitalized interest and financing costs |

450,000 | 818,000 | 745,000 | 1,142,000 | ||||||||||||

7

CEDAR REALTY TRUST, INC.

Earnings Before Interest, Taxes, Depreciation and Amortization

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| EBITDA Calculation |

||||||||||||||||

| Income (loss) from continuing operations |

$ | 4,658,000 | $ | (13,723,000 | ) | $ | (3,264,000 | ) | $ | (13,999,000 | ) | |||||

| Add (deduct): |

||||||||||||||||

| Interest expense and amortization of financing costs, net |

9,744,000 | 10,177,000 | 19,923,000 | 20,667,000 | ||||||||||||

| Accelerated write-off of deferred financing costs |

— | — | 2,607,000 | — | ||||||||||||

| Depreciation and amortization |

9,796,000 | 9,311,000 | 25,522,000 | 18,030,000 | ||||||||||||

| Minority interests share of consolidated joint venture EBITDA |

(3,023,000 | ) | (3,174,000 | ) | (6,113,000 | ) | (6,360,000 | ) | ||||||||

| Discontinued operations: |

||||||||||||||||

| Income from operations |

944,000 | 778,000 | 2,403,000 | 2,247,000 | ||||||||||||

| Interest expense and amortization of financing costs, net |

1,891,000 | 2,146,000 | 3,847,000 | 4,416,000 | ||||||||||||

| Depreciation and amortization |

— | 1,768,000 | 21,000 | 3,604,000 | ||||||||||||

| Pro-rata share attributable to Cedar/RioCan joint venture: |

||||||||||||||||

| Depreciation and amortization |

1,011,000 | 1,035,000 | 2,034,000 | 2,028,000 | ||||||||||||

| Interest expense |

844,000 | 937,000 | 1,731,000 | 1,816,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA |

25,865,000 | 9,255,000 | 48,711,000 | 32,449,000 | ||||||||||||

| Adjustments for items affecting comparability: |

||||||||||||||||

| Share-based compensation mark-to-market adjustments |

(20,000 | ) | (551,000 | ) | 10,000 | (701,000 | ) | |||||||||

| Management transition charges and employee termination costs |

6,350,000 | — | 6,875,000 | |||||||||||||

| Write-off of investment in unconsolidated joint venture |

— | 7,961,000 | — | 7,961,000 | ||||||||||||

| Acquisition transaction costs and terminated projects, including Company share from the Cedar/RioCan joint venture |

— | 234,000 | — | 1,487,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | 25,845,000 | $ | 23,249,000 | $ | 48,721,000 | $ | 48,071,000 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro-rata share of outstanding debt (a) |

$ | 805,471,000 | $ | 843,108,000 | $ | 805,471,000 | $ | 843,108,000 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fixed charges (a) |

||||||||||||||||

| Interest expense |

$ | 11,476,000 | $ | 11,234,000 | $ | 23,228,000 | $ | 23,082,000 | ||||||||

| Interest expense — consolidated minority interests share |

(1,629,000 | ) | (1,661,000 | ) | (3,289,000 | ) | (3,308,000 | ) | ||||||||

| Interest expense — Cedar/RioCan joint venture |

844,000 | 937,000 | 1,731,000 | 1,816,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Interest Expense |

10,691,000 | 10,510,000 | 21,670,000 | 21,590,000 | ||||||||||||

| Preferred stock dividends |

3,607,000 | 3,540,000 | 7,138,000 | 7,041,000 | ||||||||||||

| Pro-rata share of scheduled mortgage repayments |

2,576,000 | 2,246,000 | 5,216,000 | 4,483,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fixed charges |

$ | 16,874,000 | $ | 16,296,000 | $ | 34,024,000 | $ | 33,114,000 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Debt and Coverage Ratios (b) |

||||||||||||||||

| Debt to Adjusted EBITDA (c) |

8.7 | x | 9.1 | x | 8.7 | x | 8.9 | x | ||||||||

| Interest coverage ratio (Based on Adjusted EBITDA) |

2.1 | x | 2.2 | x | 2.1 | x | 2.2 | x | ||||||||

| Fixed charge coverage ratio (Based on Adjusted EBITDA) |

1.4 | x | 1.4 | x | 1.3 | x | 1.5 | x | ||||||||

| (a) | Includes properties “held for sale/conveyance”. |

| (b) | Ratios exclude lease termination income. |

| (c) | The amounts used in the calculation of debt to Adjusted EBITDA ratio have been adjusted to exclude (i) the results of properties sold during each of the respective periods as the related debt is no longer outstanding at the end of such period and (ii) for the 2012 periods, the results and debt related to the four properties in the process of being conveyed to their respective lenders. |

8

CEDAR REALTY TRUST, INC.

Summary of Outstanding Debt

As of June 30, 2012

| Percent | Maturity | Interest | Stated | |||||||||||||

| Property |

Owned | Date | rate (a) | contract amounts | ||||||||||||

| Fixed-rate mortgages: |

||||||||||||||||

| Consolidated Properties: |

||||||||||||||||

| Washington Center Shoppes |

100 | % | Dec 2012 | 5.9 | % | $ | 8,253,000 | |||||||||

| Fort Washington |

100 | % | Jan 2013 | 5.4 | % | 5,466,000 | ||||||||||

| Fairview Plaza |

100 | % | Feb 2013 | 5.7 | % | 5,193,000 | ||||||||||

| Academy Plaza |

100 | % | Mar 2013 | 7.3 | % | 8,766,000 | ||||||||||

| General Booth Plaza |

100 | % | Aug 2013 | 6.1 | % | 5,020,000 | ||||||||||

| Kempsville Crossing |

100 | % | Aug 2013 | 6.1 | % | 5,664,000 | ||||||||||

| Port Richmond Village |

100 | % | Aug 2013 | 6.5 | % | 14,015,000 | ||||||||||

| Smithfield Plaza |

100 | % | Aug 2013 | 6.1 | % | 3,234,000 | ||||||||||

| Suffolk Plaza |

100 | % | Aug 2013 | 6.1 | % | 4,246,000 | ||||||||||

| Virginia Little Creek |

100 | % | Aug 2013 | 6.1 | % | 4,541,000 | ||||||||||

| Timpany Plaza |

100 | % | Jan 2014 | 6.1 | % | 7,835,000 | ||||||||||

| Trexler Mall |

100 | % | May 2014 | 5.5 | % | 20,347,000 | ||||||||||

| Coliseum Marketplace |

100 | % | Jul 2014 | 6.1 | % | 11,382,000 | ||||||||||

| Fieldstone Marketplace |

20 | % | Jul 2014 | 6.0 | % | 17,516,000 | ||||||||||

| King’s Plaza |

100 | % | Jul 2014 | 6.0 | % | 7,465,000 | ||||||||||

| Liberty Marketplace |

100 | % | Jul 2014 | 6.1 | % | 8,563,000 | ||||||||||

| Yorktowne Plaza |

100 | % | Jul 2014 | 6.0 | % | 19,528,000 | ||||||||||

| Mechanicsburg Giant |

100 | % | Nov 2014 | 5.5 | % | 8,857,000 | ||||||||||

| Elmhurst Square Shopping Center |

100 | % | Dec 2014 | 5.4 | % | 3,852,000 | ||||||||||

| New London Mall |

40 | % | Apr 2015 | 4.9 | % | 27,365,000 | ||||||||||

| Carbondale Plaza |

100 | % | May 2015 | 6.4 | % | 4,818,000 | ||||||||||

| Oak Ridge Shopping Center |

100 | % | May 2015 | 5.5 | % | 3,323,000 | ||||||||||

| Pine Grove Plaza |

100 | % | Sep 2015 | 5.0 | % | 5,516,000 | ||||||||||

| Groton Shopping Center |

100 | % | Oct 2015 | 5.3 | % | 11,570,000 | ||||||||||

| Southington Shopping Center |

100 | % | Nov 2015 | 5.1 | % | 5,521,000 | ||||||||||

| Jordan Lane |

100 | % | Dec 2015 | 5.5 | % | 12,508,000 | ||||||||||

| Oakland Mills |

100 | % | Jan 2016 | 5.5 | % | 4,703,000 | ||||||||||

| Smithfield Plaza |

100 | % | May 2016 | 6.2 | % | 6,845,000 | ||||||||||

| West Bridgewater |

100 | % | Sep 2016 | 6.2 | % | 10,651,000 | ||||||||||

| Carman’s Plaza |

100 | % | Oct 2016 | 6.2 | % | 33,500,000 | ||||||||||

| Hamburg Commons |

100 | % | Oct 2016 | 6.1 | % | 4,973,000 | ||||||||||

| Meadows Marketplace |

20 | % | Nov 2016 | 5.6 | % | 9,914,000 | ||||||||||

| San Souci Plaza |

40 | % | Dec 2016 | 6.2 | % | 27,200,000 | ||||||||||

| Camp Hill Shopping Center |

100 | % | Jan 2017 | 5.5 | % | 64,661,000 | ||||||||||

| Golden Triangle |

100 | % | Feb 2018 | 6.0 | % | 20,222,000 | ||||||||||

| East Chestnut |

100 | % | Apr 2018 | 7.4 | % | 1,582,000 | ||||||||||

| Townfair Center |

100 | % | Jul 2021 | 5.2 | % | 16,213,000 | ||||||||||

| Gold Star Plaza |

100 | % | May 2019 | 7.3 | % | 1,833,000 | ||||||||||

| Newport Plaza |

100 | % | Jan 2020 | 5.9 | % | 5,411,000 | ||||||||||

| Halifax Plaza |

100 | % | Apr 2020 | 6.3 | % | 4,135,000 | ||||||||||

| Swede Square |

100 | % | Nov 2020 | 5.5 | % | 10,383,000 | ||||||||||

| Colonial Commons |

100 | % | Feb 2021 | 5.5 | % | 27,504,000 | ||||||||||

| Virginia Little Creek |

100 | % | Sep 2021 | 8.0 | % | 334,000 | ||||||||||

| Metro Square |

100 | % | Nov 2029 | 7.5 | % | 8,637,000 | ||||||||||

|

|

|

|||||||||||||||

| Total Fixed-Rate Mortgages |

4.0 years | 5.8 | % | $ | 499,065,000 | |||||||||||

|

|

|

|||||||||||||||

| weighted average | ||||||||||||||||

9

CEDAR REALTY TRUST, INC.

Summary of Outstanding Debt (Continued)

As of June 30, 2012

| Property |

Percent Owned |

Maturity Date |

Interest rate (a) |

Stated contract amounts |

||||||||||||

| Variable-rate mortgage: |

||||||||||||||||

| Upland Square |

100 | %(b) | Oct 2013 | 3.0 | % | 63,326,000 | ||||||||||

|

|

|

|||||||||||||||

| Total mortgages at stated contract amounts |

3.7 years | 5.5 | % | 562,391,000 | ||||||||||||

| weighted average | ||||||||||||||||

| Unamortized discount/premium |

(143,000 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Total mortgage debt (including unamortized discount/premium) |

562,248,000 | |||||||||||||||

|

|

|

|||||||||||||||

| Corporate Credit Facility: |

||||||||||||||||

| Revolving facility |

Jan 2015 | 3.0 | % | 104,500,000 | ||||||||||||

| Term loan |

Jan 2016 | 3.0 | % | 75,000,000 | ||||||||||||

|

|

|

|||||||||||||||

| 3.0 years | 3.0 | % | 179,500,000 | |||||||||||||

|

|

|

|||||||||||||||

| weighted average | ||||||||||||||||

| Total Consolidated Debt (Excluding Held for Sale/Conveyance Mortgage Debt) |

3.6 years | 4.9 | % | $ | 741,748,000 | |||||||||||

|

|

|

|||||||||||||||

| weighted average | ||||||||||||||||

| Pro-rata share of total debt reconciliation: |

||||||||||||||||

| Total consolidated debt (excluding held for sale/conveyance mortgage debt) |

$ | 741,748,000 | ||||||||||||||

| Less pro-rata share attributable to consolidated joint venture minority interests |

(54,334,000 | ) | ||||||||||||||

| Plus pro-rata share attributable to the unconsolidated Cedar/RioCan joint venture (c) |

62,979,000 | |||||||||||||||

| Plus pro-rata share attributable to properties held for sale/conveyance (d) |

55,078,000 | |||||||||||||||

|

|

|

|||||||||||||||

| Pro-rata share of total debt |

$ | 805,471,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Pro-rata share of fixed debt |

$ | 543,745,000 | ||||||||||||||

| Pro-rata share of variable debt |

261,726,000 | |||||||||||||||

|

|

|

|||||||||||||||

| Pro-rata share of total debt |

$ | 805,471,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Percentage of pro-rata fixed debt |

67.5 | % | ||||||||||||||

| Percentage of pro-rata variable debt |

32.5 | % | ||||||||||||||

|

|

|

|||||||||||||||

| 100.0 | % | |||||||||||||||

|

|

|

|||||||||||||||

| (a) | For variable rate debt, rate in effect as of June 30, 2012. |

| (b) | Although the ownership percentages for this joint venture is 60%, the Company has included 100% of this joint venture's debt and results of operations in its pro-rata calculations, based on partnership earnings promotes, a loan guaranty, and/or other terms of the related joint venture agreement. |

| (c) | See “Summary of Outstanding Joint Venture Debt.” |

| (d) | See “Summary of Outstanding Debt—Held for Sale Properties.” |

10

CEDAR REALTY TRUST, INC.

Summaries of Debt Maturities

As of June 30, 2012

| Consolidated Properties Including Properties Held for Sale |

||||||||||||||||||||||||||||||||

| Maturity | Cedar pro-rata share of: | JV Partners pro-rata share of: | ||||||||||||||||||||||||||||||

| schedule | Scheduled | Balloon | Credit | Scheduled | Balloon | |||||||||||||||||||||||||||

| by year |

Amortization | Payments | Facility | Total | Amortization | Payments | Total | Total | ||||||||||||||||||||||||

| 2012 |

$ | 4,512,000 | $ | 38,200,000 | (a) | $ | — | $ | 42,712,000 | $ | 661,000 | $ | — | $ | 661,000 | $ | 43,373,000 | |||||||||||||||

| 2013 |

8,225,000 | 117,107,000 | (b) | — | 125,332,000 | 1,410,000 | — | 1,410,000 | 126,742,000 | |||||||||||||||||||||||

| 2014 |

5,943,000 | 89,421,000 | — | 95,364,000 | 1,279,000 | 22,571,000 | 23,850,000 | 119,214,000 | ||||||||||||||||||||||||

| 2015 |

4,628,000 | 61,476,000 | 104,500,000 | 170,604,000 | 916,000 | 36,783,000 | 37,699,000 | 208,303,000 | ||||||||||||||||||||||||

| 2016 |

4,575,000 | 80,657,000 | (a) | 75,000,000 | 160,232,000 | 449,000 | 31,275,000 | 31,724,000 | 191,956,000 | |||||||||||||||||||||||

| 2017 |

2,659,000 | 67,073,000 | (a) | — | 69,732,000 | 112,000 | 17,184,000 | 17,296,000 | 87,028,000 | |||||||||||||||||||||||

| 2018 |

1,964,000 | 32,905,000 | — | 34,869,000 | — | — | — | 34,869,000 | ||||||||||||||||||||||||

| 2019 |

1,592,000 | — | — | 1,592,000 | — | — | — | 1,592,000 | ||||||||||||||||||||||||

| 2020 |

1,419,000 | 12,169,000 | — | 13,588,000 | — | — | — | 13,588,000 | ||||||||||||||||||||||||

| 2021 |

604,000 | 22,383,000 | — | 22,987,000 | — | — | — | 22,987,000 | ||||||||||||||||||||||||

| Thereafter |

5,008,000 | 472,000 | — | 5,480,000 | — | — | — | 5,480,000 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 41,129,000 | $ | 521,863,000 | $ | 179,500,000 | $ | 742,492,000 | $ | 4,827,000 | $ | 107,813,000 | $ | 112,640,000 | $ | 855,132,000 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Consolidated Properties Excluding Properties Held for Sale |

||||||||||||||||||||||||||||||||

| Maturity | Cedar pro-rata share of: | JV Partners pro-rata share of: | ||||||||||||||||||||||||||||||

| schedule | Scheduled | Balloon | Credit | Scheduled | Balloon | |||||||||||||||||||||||||||

| by year |

Amortization | Payments | Facility | Total | Amortization | Payments | Total | Total | ||||||||||||||||||||||||

| 2012 |

$ | 4,363,000 | $ | 8,195,000 | $ | — | $ | 12,558,000 | $ | 140,000 | $ | — | $ | 140,000 | $ | 12,698,000 | ||||||||||||||||

| 2013 |

7,906,000 | 117,107,000 | (b) | — | 125,013,000 | 302,000 | — | 302,000 | 125,315,000 | |||||||||||||||||||||||

| 2014 |

5,616,000 | 87,154,000 | — | 92,770,000 | 151,000 | 13,502,000 | 13,653,000 | 106,423,000 | ||||||||||||||||||||||||

| 2015 |

4,392,000 | 56,385,000 | 104,500,000 | 165,277,000 | 125,000 | 16,419,000 | 16,544,000 | 181,821,000 | ||||||||||||||||||||||||

| 2016 |

3,707,000 | 71,520,000 | 75,000,000 | 150,227,000 | 150,000 | 23,545,000 | 23,695,000 | 173,922,000 | ||||||||||||||||||||||||

| 2017 |

2,600,000 | 60,478,000 | — | 63,078,000 | — | — | — | 63,078,000 | ||||||||||||||||||||||||

| 2018 |

1,964,000 | 32,905,000 | — | 34,869,000 | — | — | — | 34,869,000 | ||||||||||||||||||||||||

| 2019 |

1,592,000 | — | — | 1,592,000 | — | — | — | 1,592,000 | ||||||||||||||||||||||||

| 2020 |

1,419,000 | 12,169,000 | — | 13,588,000 | — | — | — | 13,588,000 | ||||||||||||||||||||||||

| 2021 |

604,000 | 22,383,000 | — | 22,987,000 | — | — | — | 22,987,000 | ||||||||||||||||||||||||

| Thereafter |

4,983,000 | 472,000 | — | 5,455,000 | — | — | — | 5,455,000 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 39,146,000 | $ | 468,768,000 | $ | 179,500,000 | $ | 687,414,000 | $ | 868,000 | $ | 53,466,000 | $ | 54,334,000 | $ | 741,748,000 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (a) | Includes amounts relating to properties in the process of being conveyed to their respective lenders (2012- $11.1 million, 2016- $7.9 million and 2017- $2.5 million). |

| (b) | Includes $62.2 million of property-specific construction financing, due in October 2013, subject to a one-year extension option. |

11

CEDAR REALTY TRUST, INC.

Real Estate Summary

As of June 30, 2012

| Average | ||||||||||||||||||||||||||||

| Percent | Year | % | base rent per | Major Tenants (a) | ||||||||||||||||||||||||

| Property Description |

State | owned | acquired | GLA | occupied | leased sq. ft. | Name | GLA | ||||||||||||||||||||

| Connecticut |

||||||||||||||||||||||||||||

| Groton Shopping Center |

CT | 100 | % | 2007 | 117,986 | 89.4 | % | $ | 11.06 | TJ Maxx | 30,000 | |||||||||||||||||

| Jordan Lane |

CT | 100 | % | 2005 | 181,730 | 96.8 | % | 10.87 | Stop & Shop | 60,632 | ||||||||||||||||||

| CW Price | 39,280 | |||||||||||||||||||||||||||

| Retro Fitness | 20,283 | |||||||||||||||||||||||||||

| New London Mall |

CT | 40 | % | 2009 | 259,293 | 91.8 | % | 14.08 | Shoprite | 64,017 | ||||||||||||||||||

| Marshalls | 30,354 | |||||||||||||||||||||||||||

| Homegoods | 25,432 | |||||||||||||||||||||||||||

| Petsmart | 23,500 | |||||||||||||||||||||||||||

| AC Moore | 20,932 | |||||||||||||||||||||||||||

| Oakland Commons |

CT | 100 | % | 2007 | 90,100 | 39.1 | % | 0.17 | Bristol Ten Pin | 35,189 | ||||||||||||||||||

| Southington Shopping Center |

CT | 100 | % | 2003 | 155,842 | 100.0 | % | 6.86 | Wal-Mart | 95,482 | ||||||||||||||||||

| NAMCO | 20,000 | |||||||||||||||||||||||||||

| The Brickyard |

CT | 100 | % | 2004 | 249,200 | 44.6 | % | 7.89 | Home Depot | 103,003 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Total Connecticut |

1,054,151 | 77.9 | % | 10.20 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Maryland |

||||||||||||||||||||||||||||

| Kenley Village |

MD | 100 | % | 2005 | 51,894 | 73.7 | % | 8.77 | Food Lion | 29,000 | ||||||||||||||||||

| Metro Square |

MD | 100 | % | 2008 | 71,896 | 100.0 | % | 18.79 | Shoppers Food Warehouse | 58,668 | ||||||||||||||||||

| Oakland Mills |

MD | 100 | % | 2005 | 58,224 | 100.0 | % | 13.61 | Food Lion | 43,470 | ||||||||||||||||||

| San Souci Plaza |

MD | 40 | % | 2009 | 264,134 | 86.4 | % | 9.65 | Shoppers Food Warehouse | 61,466 | ||||||||||||||||||

| Marshalls | 27,000 | |||||||||||||||||||||||||||

| Maximum Health and Fitness | 15,612 | |||||||||||||||||||||||||||

| St. James Square |

MD | 100 | % | 2005 | 39,903 | 100.0 | % | 11.40 | Food Lion | 33,000 | ||||||||||||||||||

| Valley Plaza |

MD | 100 | % | 2003 | 190,939 | 100.0 | % | 4.98 | K-Mart | 95,810 | ||||||||||||||||||

| Ollie’s Bargain Outlet | 41,888 | |||||||||||||||||||||||||||

| Tractor Supply | 32,095 | |||||||||||||||||||||||||||

| Yorktowne Plaza |

MD | 100 | % | 2007 | 158,982 | 96.3 | % | 13.80 | Food Lion | 37,692 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Total Maryland |

835,972 | 93.4 | % | 10.51 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Massachusetts |

||||||||||||||||||||||||||||

| Fieldstone Marketplace |

MA | 20 | % | 2005 | 193,970 | 95.8 | % | 11.32 | Shaw’s | 68,000 | ||||||||||||||||||

| Flagship Cinema | 41,975 | |||||||||||||||||||||||||||

| New Bedford Wine and Spirits | 15,180 | |||||||||||||||||||||||||||

| Kings Plaza |

MA | 100 | % | 2007 | 168,243 | 97.2 | % | 6.09 | Work Out World | 42,997 | ||||||||||||||||||

| CW Price | 28,504 | |||||||||||||||||||||||||||

| Ocean State Job Lot | 20,300 | |||||||||||||||||||||||||||

| Savers | 19,339 | |||||||||||||||||||||||||||

| Norwood Shopping Center |

MA | 100 | % | 2006 | 102,459 | 98.2 | % | 7.74 | Hannaford Brothers | 42,598 | ||||||||||||||||||

| Rocky’s Ace Hardware | 18,830 | |||||||||||||||||||||||||||

| Dollar Tree | 16,798 | |||||||||||||||||||||||||||

| Price Chopper Plaza |

MA | 100 | % | 2007 | 101,824 | 91.1 | % | 10.95 | Price Chopper | 58,545 | ||||||||||||||||||

| The Shops at Suffolk Downs |

MA | 100 | % | 2005 | 121,251 | 86.8 | % | 12.70 | Stop & Shop | 74,977 | ||||||||||||||||||

| Timpany Plaza |

MA | 100 | % | 2007 | 183,775 | 93.1 | % | 6.72 | Stop & Shop | 59,947 | ||||||||||||||||||

| Big Lots | 28,027 | |||||||||||||||||||||||||||

| Gardner Theater | 27,576 | |||||||||||||||||||||||||||

| West Bridgewater Plaza |

MA | 100 | % | 2007 | 133,039 | 96.9 | % | 9.04 | Shaw’s | 57,315 | ||||||||||||||||||

| Big Lots | 25,000 | |||||||||||||||||||||||||||

| Planet Fitness | 15,000 | |||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Total Massachusetts |

1,004,561 | 94.4 | % | 9.01 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| New Jersey |

||||||||||||||||||||||||||||

| Carll’s Corner |

NJ | 100 | % | 2007 | 129,582 | 85.4 | % | 8.83 | Acme Markets | 55,000 | ||||||||||||||||||

| Peebles | 18,858 | |||||||||||||||||||||||||||

| Pine Grove Plaza |

NJ | 100 | % | 2003 | 86,089 | 84.7 | % | 10.79 | Peebles | 24,963 | ||||||||||||||||||

| Washington Center Shoppes |

NJ | 100 | % | 2001 | 157,394 | 94.3 | % | 8.79 | Acme Markets | 66,046 | ||||||||||||||||||

| Planet Fitness | 20,742 | |||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Total New Jersey |

373,065 | 89.0 | % | 9.24 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

12

CEDAR REALTY TRUST, INC.

Real Estate Summary (Continued)

As of June 30, 2012

| Average | ||||||||||||||||||||||||||||

| Percent | Year | % | base rent per | Major Tenants (a) |

||||||||||||||||||||||||

| Property Description |

State | owned | acquired | GLA | occupied | leased sq. ft. | Name |

GLA | ||||||||||||||||||||

| New York |

||||||||||||||||||||||||||||

| Carman’s Plaza |

NY | 100 | % | 2007 | 194,512 | 91.6 | % | 16.93 | Pathmark | 52,211 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Extreme Fitness | 27,598 | |||||||||||||||||||||||||||

| Home Goods | 25,806 | |||||||||||||||||||||||||||

| Department of Motor Vehicle | 19,310 | |||||||||||||||||||||||||||

| Pennsylvania |

||||||||||||||||||||||||||||

| Academy Plaza |

PA | 100 | % | 2001 | 151,977 | 82.1 | % | 13.46 | Acme Markets | 50,918 | ||||||||||||||||||

| Camp Hill |

PA | 100 | % | 2002 | 470,117 | 99.3 | % | 13.50 | Boscov’s | 167,597 | ||||||||||||||||||

| Giant Foods | 92,939 | |||||||||||||||||||||||||||

| LA Fitness | 45,000 | |||||||||||||||||||||||||||

| Orthopedic Inst of PA | 40,904 | |||||||||||||||||||||||||||

| Barnes & Noble | 24,908 | |||||||||||||||||||||||||||

| Staples | 20,000 | |||||||||||||||||||||||||||

| Carbondale Plaza |

PA | 100 | % | 2004 | 121,135 | 90.0 | % | 6.78 | Weis Markets | 52,720 | ||||||||||||||||||

| Peebles | 18,000 | |||||||||||||||||||||||||||

| Circle Plaza |

PA | 100 | % | 2007 | 92,171 | 100.0 | % | 2.74 | K-Mart | 92,171 | ||||||||||||||||||

| Colonial Commons |

PA | 100 | % | 2011 | 474,765 | 84.1 | % | 12.75 | Giant Foods | 67,815 | ||||||||||||||||||

| Dick’s Sporting Goods | 56,000 | |||||||||||||||||||||||||||

| L.A. Fitness | 41,325 | |||||||||||||||||||||||||||

| Ross Dress For Less | 30,000 | |||||||||||||||||||||||||||

| Marshalls | 27,000 | |||||||||||||||||||||||||||

| JoAnn Fabrics | 25,500 | |||||||||||||||||||||||||||

| David’s Furniture | 24,970 | |||||||||||||||||||||||||||

| Office Max | 23,500 | |||||||||||||||||||||||||||

| Crossroads II |

PA | 100 | % (b) | 2008 | 133,188 | 90.5 | % | 20.00 | Giant Foods | 78,815 | ||||||||||||||||||

| East Chestnut |

PA | 100 | % | 2005 | 21,180 | 100.0 | % | 13.39 | Rite Aid | 11,180 | ||||||||||||||||||

| Fairview Commons |

PA | 100 | % | 2007 | 42,314 | 56.2 | % | 9.45 | Family Dollar | 10,789 | ||||||||||||||||||

| Fairview Plaza |

PA | 100 | % | 2003 | 71,979 | 100.0 | % | 11.94 | Giant Foods | 61,637 | ||||||||||||||||||

| Fort Washington |

PA | 100 | % | 2002 | 41,000 | 100.0 | % | 19.90 | LA Fitness | 41,000 | ||||||||||||||||||

| Gold Star Plaza |

PA | 100 | % | 2006 | 71,720 | 82.2 | % | 8.91 | Redner’s | 48,920 | ||||||||||||||||||

| Golden Triangle |

PA | 100 | % | 2003 | 202,943 | 98.2 | % | 12.47 | LA Fitness | 44,796 | ||||||||||||||||||

| Marshalls | 30,000 | |||||||||||||||||||||||||||

| Staples | 24,060 | |||||||||||||||||||||||||||

| Just Cabinets | 18,665 | |||||||||||||||||||||||||||

| Aldi | 15,242 | |||||||||||||||||||||||||||

| Halifax Plaza |

PA | 100 | % | 2003 | 51,510 | 100.0 | % | 11.81 | Giant Foods | 32,000 | ||||||||||||||||||

| Hamburg Commons |

PA | 100 | % | 2004 | 99,580 | 97.3 | % | 6.59 | Redner’s | 56,780 | ||||||||||||||||||

| Peebles | 19,683 | |||||||||||||||||||||||||||

| Huntingdon Plaza |

PA | 100 | % | 2004 | 142,845 | 71.9 | % | 5.32 | Sears | 26,150 | ||||||||||||||||||

| Peebles | 22,060 | |||||||||||||||||||||||||||

| Lake Raystown Plaza |

PA | 100 | % | 2004 | 142,559 | 95.7 | % | 12.31 | Giant Foods | 63,835 | ||||||||||||||||||

| Tractor Supply | 32,711 | |||||||||||||||||||||||||||

| Liberty Marketplace |

PA | 100 | % | 2005 | 68,200 | 91.2 | % | 17.47 | Giant Foods | 55,000 | ||||||||||||||||||

| Meadows Marketplace |

PA | 20 | % | 2004 | 91,518 | 100.0 | % | 15.42 | Giant Foods | 67,907 | ||||||||||||||||||

| Mechanicsburg Giant |

PA | 100 | % | 2005 | 51,500 | 100.0 | % | 21.78 | Giant Foods | 51,500 | ||||||||||||||||||

| Newport Plaza |

PA | 100 | % | 2003 | 64,489 | 100.0 | % | 11.52 | Giant Foods | 43,400 | ||||||||||||||||||

| Northside Commons |

PA | 100 | % | 2008 | 64,710 | 96.1 | % | 9.89 | Redner's Market | 48,519 | ||||||||||||||||||

| Palmyra Shopping Center |

PA | 100 | % | 2005 | 111,051 | 72.9 | % | 6.28 | Weis Markets | 46,912 | ||||||||||||||||||

| Rite Aid | 18,104 | |||||||||||||||||||||||||||

| Port Richmond Village |

PA | 100 | % | 2001 | 154,908 | 96.8 | % | 12.51 | Thriftway | 40,000 | ||||||||||||||||||

| Pep Boys | 20,615 | |||||||||||||||||||||||||||

| City Stores, Inc. | 15,200 | |||||||||||||||||||||||||||

| River View Plaza I, II and III |

PA | 100 | % | 2003 | 244,034 | 84.1 | % | 18.59 | United Artists | 77,700 | ||||||||||||||||||

| Avalon Carpet | 25,000 | |||||||||||||||||||||||||||

| Pep Boys | 22,000 | |||||||||||||||||||||||||||

| Staples | 18,000 | |||||||||||||||||||||||||||

| South Philadelphia |

PA | 100 | % | 2003 | 283,415 | 82.3 | % | 14.22 | Shop Rite | 54,388 | ||||||||||||||||||

| Ross Dress For Less | 31,349 | |||||||||||||||||||||||||||

| Bally’s Total Fitness | 31,000 | |||||||||||||||||||||||||||

| Modell’s | 20,000 | |||||||||||||||||||||||||||

13

CEDAR REALTY TRUST, INC.

Real Estate Summary (Continued)

As of June 30, 2012

| Average | ||||||||||||||||||||||||||||||

| Percent | Year | % | base rent per | Major Tenants (a) |

||||||||||||||||||||||||||

| Property Description |

State | owned | acquired | GLA | occupied | leased sq. ft. | Name |

GLA | ||||||||||||||||||||||

| Pennsylvania (continued) |

||||||||||||||||||||||||||||||

| Swede Square |

PA | 100 | % | 2003 | 100,816 | 95.0 | % | 15.99 | LA Fitness | 37,200 | ||||||||||||||||||||

| The Commons |

PA | 100 | % | 2004 | 203,426 | 87.5 | % | 9.32 | Bon-Ton | 54,500 | ||||||||||||||||||||

| Shop’n Save | 52,654 | |||||||||||||||||||||||||||||

| TJ Maxx | 24,404 | |||||||||||||||||||||||||||||

| The Point |

PA | 100 | % | 2000 | 268,037 | 99.0 | % | 12.41 | Burlington Coat Factory | 76,665 | ||||||||||||||||||||

| Giant Foods | 76,627 | |||||||||||||||||||||||||||||

| AC Moore | 24,890 | |||||||||||||||||||||||||||||

| Staples | 24,000 | |||||||||||||||||||||||||||||

| Townfair Center |

PA | 100 | % | 2004 | 218,662 | 97.2 | % | 8.67 | Lowe’s Home Centers | 95,173 | ||||||||||||||||||||

| Giant Eagle | 83,821 | |||||||||||||||||||||||||||||

| Michael’s Store | 17,592 | |||||||||||||||||||||||||||||

| Trexler Mall |

PA | 100 | % | 2005 | 339,363 | 90.2 | % | 9.58 | Kohl’s | 88,248 | ||||||||||||||||||||

| Bon-Ton | 62,000 | |||||||||||||||||||||||||||||

| Lehigh Wellness Partners | 30,594 | |||||||||||||||||||||||||||||

| Trexlertown Fitness Club | 28,870 | |||||||||||||||||||||||||||||

| Marshall’s | 28,591 | |||||||||||||||||||||||||||||

| Trexlertown Plaza |

PA | 100 | % | 2006 | 316,143 | 78.1 | % | 13.19 | Giant Foods | 78,335 | ||||||||||||||||||||

| Redner’s | 47,900 | |||||||||||||||||||||||||||||

| Big Lots | 33,824 | |||||||||||||||||||||||||||||

| Sears | 22,500 | |||||||||||||||||||||||||||||

| Tractor Supply | 19,097 | |||||||||||||||||||||||||||||

| Upland Square |

PA | 100 | % (b) | 2007 | 391,578 | 91.8 | % | 16.79 | Giant Foods | 78,900 | ||||||||||||||||||||

| Carmike Cinema | 45,276 | |||||||||||||||||||||||||||||

| LA Fitness | 42,000 | |||||||||||||||||||||||||||||

| Best Buy | 30,000 | |||||||||||||||||||||||||||||

| TJ Maxx | 25,000 | |||||||||||||||||||||||||||||

| Bed, Bath & Beyond | 24,721 | |||||||||||||||||||||||||||||

| A.C. Moore | 21,600 | |||||||||||||||||||||||||||||

| Staples | 18,336 | |||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

| Total Pennsylvania |

5,302,833 | 90.2 | % | 12.59 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

| Virginia |

||||||||||||||||||||||||||||||

| Annie Land Plaza |

VA | 100 | % | 2006 | 42,500 | 97.2 | % | 9.38 | Food Lion | 29,000 | ||||||||||||||||||||

| Coliseum Marketplace |

VA | 100 | % | 2005 | 105,998 | 100.0 | % | 15.82 | Farm Fresh | 57,662 | ||||||||||||||||||||

| Michael’s | 23,981 | |||||||||||||||||||||||||||||

| Elmhurst Square |

VA | 100 | % | 2006 | 66,250 | 89.1 | % | 9.30 | Food Lion | 38,272 | ||||||||||||||||||||

| General Booth Plaza |

VA | 100 | % | 2005 | 71,639 | 100.0 | % | 13.03 | Farm Fresh | 53,758 | ||||||||||||||||||||

| Kempsville Crossing |

VA | 100 | % | 2005 | 94,477 | 97.3 | % | 11.16 | Farm Fresh | 73,878 | ||||||||||||||||||||

| Martin's at Glen Allen |

VA | 100 | % | 2005 | 63,328 | 100.0 | % | 6.61 | Martin’s | 63,328 | ||||||||||||||||||||

| Oak Ridge Shopping Center |

VA | 100 | % | 2006 | 38,700 | 100.0 | % | 10.62 | Food Lion | 33,000 | ||||||||||||||||||||

| Smithfield Plaza |

VA | 100 | % | 2005/2008 | 134,664 | 95.3 | % | 9.30 | Farm Fresh | 45,544 | ||||||||||||||||||||

| Maxway | 21,600 | |||||||||||||||||||||||||||||

| Peebles | 21,600 | |||||||||||||||||||||||||||||

| Suffolk Plaza |

VA | 100 | % | 2005 | 67,216 | 100.0 | % | 9.40 | Farm Fresh | 67,216 | ||||||||||||||||||||

| Ukrop's at Fredericksburg |

VA | 100 | % | 2005 | 63,000 | 100.0 | % | 17.42 | Ukrop’s Supermarket | 63,000 | ||||||||||||||||||||

| Virginia Little Creek |

VA | 100 | % | 2005 | 69,620 | 100.0 | % | 11.12 | Farm Fresh | 66,120 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

| Total Virginia |

817,392 | 97.9 | % | 11.37 | ||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

| Total Consolidated Properties, Excluding Held for Sale/Conveyance Properties — “Operating Portfolio” |

9,582,486 | 90.2 | % | 11.63 | ||||||||||||||||||||||||||

| Total Cedar/RioCan Unconsolidated Joint Venture (c) |

20 | % | 3,711,274 | 96.4 | % | 13.41 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

| Total “Managed Portfolio” |

13,293,760 | 91.9 | % | $ | 12.15 | |||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

| (a) | Major tenants are determined as tenants with 15,000 or more sq.ft of GLA, tenants at single-tenant properties, or the largest tenant at a property. |

| (b) | Although the ownership percentages for these joint ventures is 60%, the Company has included 100% of these joint ventures debt and results of operations in its pro-rata calculations, based on partnership earnings promotes, loan guaranties, and/or other terms of the related joint venture agreements. |

| (c) | See “Joint Venture Real Estate Summary”, for details of the Cedar/RioCan portfolio. |

14

CEDAR REALTY TRUST, INC.

Leasing Activity

| Three months ended | Year to date | |||||||

| June 30, 2012 | June 30, 2012 | |||||||

| Renewals (a) |

||||||||

| Leases signed |

31 | 58 | ||||||

| Square feet |

74,000 | 203,000 | ||||||

| New rent per sq.ft (b) |

$ | 13.13 | $ | 12.45 | ||||

| Prior rent per sq. ft (b) |

$ | 12.10 | $ | 11.62 | ||||

| Cash basis % change |

8.6 | % | 7.1 | % | ||||

| Tenant improvements per sq. ft. |

$ | 0.00 | $ | 0.00 | ||||

| Average lease term (years) |

2.5 | 3.9 | ||||||

| New Leases |

||||||||

| Leases signed |

13 | 24 | ||||||

| Square feet |

62,000 | 138,000 | ||||||

| New rent per sq.ft (b) |

$ | 13.08 | $ | 12.89 | ||||

| Tenant improvements per sq. ft. (c) |

$ | 11.76 | $ | 6.70 | ||||

| Average lease term (years) |

6.7 | 10.3 | ||||||

| Renewals and New Leases |

||||||||

| Leases signed |

44 | 82 | ||||||

| Square feet |

136,000 | 341,000 | ||||||

| New rent per sq.ft (b) |

$ | 13.11 | $ | 12.63 | ||||

| Tenant improvements per sq. ft. (c) |

$ | 5.36 | $ | 2.70 | ||||

| Average lease term (years) |

4.5 | 6.5 | ||||||

| (a) | Includes leases that renewed with no increase pursuant to their terms. The renewal results, excluding such leases with no contractual increase, would have been as follows: |

| Three months ended | Year to date | |||||||

| June 30, 2012 | June 30, 2012 | |||||||

| Leases signed |

24 | 45 | ||||||

| Square feet |

45,000 | 157,000 | ||||||

| Cash basis % change |

11.6 | % | 8.7 | % | ||||

| (b) | New rent per sq. ft. represents the minimum cash rent under the new lease for the first 12 months of the term. Prior rent per sq. ft. represents the minimum cash rent under the prior lease for the last 12 months of the previous term. |

| (c) | Includes tenant allowance and landlord work. Excludes first generation space. |

15

CEDAR REALTY TRUST, INC.

Tenant Concentration (Based on Annualized Base Rent)

As of June 30, 2012

| Number | Annualized | Percentage | ||||||||||||||||||||||

| of | Annualized | base rent | annualized | |||||||||||||||||||||

| Tenant |

stores | GLA | % of GLA | base rent | per sq. ft. | base rents | ||||||||||||||||||

| Top twenty tenants (a): |

||||||||||||||||||||||||

| Giant Foods |

14 | 912,000 | 9.5 | % | $ | 13,759,000 | $ | 15.09 | 13.7 | % | ||||||||||||||

| LA Fitness |

7 | 282,000 | 2.9 | % | 4,447,000 | 15.77 | 4.4 | % | ||||||||||||||||

| Farm Fresh |

6 | 364,000 | 3.8 | % | 3,909,000 | 10.74 | 3.9 | % | ||||||||||||||||

| Dollar Tree |

19 | 194,000 | 2.0 | % | 1,928,000 | 9.94 | 1.9 | % | ||||||||||||||||

| Food Lion |

7 | 243,000 | 2.5 | % | 1,925,000 | 7.92 | 1.9 | % | ||||||||||||||||

| Stop & Shop |

3 | 196,000 | 2.0 | % | 1,802,000 | 9.19 | 1.8 | % | ||||||||||||||||

| Shop Rite |

2 | 118,000 | 1.2 | % | 1,695,000 | 14.36 | 1.7 | % | ||||||||||||||||

| Staples |

5 | 104,000 | 1.1 | % | 1,692,000 | 18.80 | 1.7 | % | ||||||||||||||||

| Redner’s |

4 | 202,000 | 2.1 | % | 1,514,000 | 7.50 | 1.5 | % | ||||||||||||||||

| United Artists |

1 | 78,000 | 0.8 | % | 1,411,000 | 18.09 | 1.4 | % | ||||||||||||||||

| Shaw’s |

2 | 125,000 | 1.3 | % | 1,389,000 | 11.11 | 1.4 | % | ||||||||||||||||

| Shoppers Food Warehouse |

2 | 120,000 | 1.3 | % | 1,237,000 | 10.31 | 1.2 | % | ||||||||||||||||

| Ukrop’s |

1 | 63,000 | 0.7 | % | 1,098,000 | 17.43 | 1.1 | % | ||||||||||||||||

| Marshalls |

5 | 143,000 | 1.5 | % | 1,097,000 | 7.67 | 1.1 | % | ||||||||||||||||

| Carmike Cinema |

1 | 45,000 | 0.5 | % | 1,034,000 | 22.98 | 1.0 | % | ||||||||||||||||

| Rite Aid |

6 | 65,000 | 0.7 | % | 943,000 | 14.51 | 0.9 | % | ||||||||||||||||

| Giant Eagle |

1 | 84,000 | 0.9 | % | 922,000 | 10.98 | 0.9 | % | ||||||||||||||||

| Dick’s Sporting Goods |

1 | 56,000 | 0.6 | % | 812,000 | 14.50 | 0.8 | % | ||||||||||||||||

| Home Depot |

1 | 103,000 | 1.1 | % | 773,000 | 7.50 | 0.8 | % | ||||||||||||||||

| Acme Markets |

3 | 172,000 | 1.8 | % | 756,000 | 4.40 | 0.8 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Sub-total top twenty tenants |

91 | 3,669,000 | 38.3 | % | 44,143,000 | 12.03 | 43.9 | % | ||||||||||||||||

| Remaining tenants |

768 | 4,973,000 | 51.9 | % | 56,355,000 | 11.33 | 56.1 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Sub-total all tenants (b) |

859 | 8,642,000 | 90.2 | % | $ | 100,498,000 | $ | 11.63 | 100.0 | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Vacant space |

N/A | 940,000 | 9.8 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

859 | 9,582,000 | 100.0 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| (a) | Several of the tenants listed above share common ownership with other tenants: |

(1) Giant Foods, Stop & Shop, and Martin’s at Glen Allen (GLA of 63,000; annualized base rent of $418,000), and (2) Farm Fresh, Shaw’s, Shop’n Save (GLA of 53,000; annualized base rent of $532,000) , Shoppers Food Warehouse, and Acme Markets.

| (b) | Comprised of large tenants (greater than 15,000 sq. ft.) and small tenants as follows: |

| Annualized | Annualized base rent |

Percentage annualized |

||||||||||||||||||

| GLA | % of GLA | base rent | per sq. ft. | base rents | ||||||||||||||||

| Large tenants |

6,091,000 | 70.5 | % | $ | 60,767,000 | $ | 9.98 | 60.5 | % | |||||||||||

| Small tenants |

2,551,000 | 29.5 | % | 39,731,000 | 15.57 | 39.5 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

8,642,000 | 100.0 | % | $ | 100,498,000 | $ | 11.63 | 100.0 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16

CEDAR REALTY TRUST, INC.

Lease Expirations

As of June 30, 2012

| Year of lease expiration |

Number of leases expiring |

GLA expiring |

Percentage of GLA expiring |

Annualized expiring base rents |

Annualized expiring base rents per sq. ft. |

Percentage of annualized expiring base rents |

||||||||||||||||||

| Month-To-Month |

22 | 55,000 | 0.6 | % | $ | 795,000 | $ | 14.45 | 0.8 | % | ||||||||||||||

| 2012 |

54 | 163,000 | 1.9 | % | 1,873,000 | 11.49 | 1.9 | % | ||||||||||||||||

| 2013 |

120 | 546,000 | 6.3 | % | 7,363,000 | 13.49 | 7.3 | % | ||||||||||||||||

| 2014 |

131 | 1,185,000 | 13.7 | % | 10,664,000 | 9.00 | 10.6 | % | ||||||||||||||||

| 2015 |

143 | 1,278,000 | 14.8 | % | 13,561,000 | 10.61 | 13.5 | % | ||||||||||||||||

| 2016 |

105 | 878,000 | 10.2 | % | 9,367,000 | 10.67 | 9.3 | % | ||||||||||||||||

| 2017 |

93 | 883,000 | 10.2 | % | 10,914,000 | 12.36 | 10.9 | % | ||||||||||||||||

| 2018 |

40 | 489,000 | 5.7 | % | 6,597,000 | 13.49 | 6.6 | % | ||||||||||||||||

| 2019 |

25 | 335,000 | 3.9 | % | 3,856,000 | 11.51 | 3.8 | % | ||||||||||||||||

| 2020 |

31 | 882,000 | 10.2 | % | 8,093,000 | 9.18 | 8.1 | % | ||||||||||||||||

| 2021 |

30 | 401,000 | 4.6 | % | 5,821,000 | 14.52 | 5.8 | % | ||||||||||||||||

| 2022 |

19 | 131,000 | 1.5 | % | 1,666,000 | 12.72 | 1.7 | % | ||||||||||||||||

| Thereafter |

46 | 1,416,000 | 16.4 | % | 19,928,000 | 14.07 | 19.8 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| All tenants |

859 | 8,642,000 | 100.0 | % | $ | 100,498,000 | $ | 11.63 | 100.0 | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Vacant space |

N/A | 940,000 | N/A | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total portfolio |

859 | 9,582,000 | N/A | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

17

CEDAR REALTY TRUST, INC.

Property Net Operating Income (“NOI”)

Same-Property (a)

| Three months ended June 30, | Percent | |||||||||||

| 2012 | 2011 | Change | ||||||||||

| Rental revenues and expense recoveries (b) |

$ | 24,827,000 | $ | 24,488,000 | 1.4 | % | ||||||

| Operating expenses (c) |

7,111,000 | 6,969,000 | 2.0 | % | ||||||||

|

|

|

|

|

|||||||||

| $ | 17,716,000 | $ | 17,519,000 | 1.1 | % | |||||||

|

|

|

|

|

|||||||||

| Occupancy |

92.4 | % | 92.5 | % | ||||||||

| No. of properties |

60 | 60 | ||||||||||

| Six months ended June 30, | Percent | |||||||||||

| 2012 | 2011 | Change | ||||||||||

| Rental revenues and expense recoveries (b) |

$ | 50,330,000 | $ | 50,997,000 | -1.3 | % | ||||||

| Operating expenses (c) |

14,580,000 | 16,127,000 | -9.6 | % | ||||||||

|

|

|

|

|

|||||||||

| $ | 35,750,000 | $ | 34,870,000 | 2.5 | % | |||||||

|

|

|

|

|

|||||||||

| Occupancy |

92.4 | % | 92.5 | % | ||||||||

| No. of properties |

60 | 60 | ||||||||||

| (a) | Same properties include only those consolidated properties that were owned and operated for the entirety of both comparative periods, and exclude ground-up developments and redevelopment properties, and properties treated as “held for sale/conveyance”. |

| (b) | Rental revenues and expense recoveries exclude the effects of straight-line rent adjustments, amortization of intangible lease liabilities, and lease termination income. |

| (c) | Operating expenses include intercompany management fee expense. |

18

CEDAR REALTY TRUST, INC.

Dispositions

| Percent | Date | Sales | ||||||||||||||||

| Property |

owned | Location | GLA | Sold | Price | |||||||||||||

| Hilliard Discount Drug Mart Plaza |

100 | % | Hilliard, OH | 40,988 | 2/7/2012 | $ | 1,434,000 | |||||||||||

| First Merit Bank at Akron |

100 | % | Akron, OH | 3,200 | 2/23/2012 | 633,000 | ||||||||||||

| Grove City Discount Drug Mart Plaza |

100 | % | Grove City, OH | 40,848 | 3/12/2012 | 1,925,000 | ||||||||||||

| CVS at Naugatuck |

50 | % | Naugatuck, CT | 13,225 | 3/20/2012 | 3,350,000 | ||||||||||||

| CVS at Bradford |

100 | % | Bradford, PA | 10,722 | 3/30/2012 | 967,000 | ||||||||||||

| CVS at Celina |

100 | % | Celina, OH | 10,195 | 3/30/2012 | 1,449,000 | ||||||||||||

| CVS at Erie |

100 | % | Erie, PA | 10,125 | 3/30/2012 | 1,278,000 | ||||||||||||

| CVS at Portage Trail |

100 | % | Akron, OH | 10,722 | 3/30/2012 | 1,061,000 | ||||||||||||

| Rite Aid at Massillon |

100 | % | Massillon, OH | 10,125 | 3/30/2012 | 1,492,000 | ||||||||||||

| Kingston Plaza |

100 | % | Kingston, NY | 5,324 | 4/12/2012 | 1,182,000 | ||||||||||||

| Stadium Plaza |

100 | % | East Lansing, MI | 77,688 | 5/3/2012 | 5,400,000 | ||||||||||||

| Blue Mountain Commons (land parcel) |

100 | % | Harrisburg, PA | N/A | 6/19/2012 | 102,000 | ||||||||||||

| Oregon Pike (land parcel) |

100 | % | Lancaster, PA | N/A | 6/28/2012 | 1,100,000 | ||||||||||||

|

|

|

|||||||||||||||||

| Total |

$ | 21,373,000 | ||||||||||||||||

|

|

|

|||||||||||||||||

19

Cedar/RioCan Unconsolidated 20%-Owned Joint Venture

20

CEDAR REALTY TRUST, INC.

Cedar/RioCan Joint Venture

Balance Sheets

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Assets: |

||||||||

| Real estate, net |

$ | 523,159,000 | $ | 532,071,000 | ||||

| Cash and cash equivalents |

11,581,000 | 12,797,000 | ||||||

| Restricted cash |

3,195,000 | 3,689,000 | ||||||

| Rents and other receivables |

1,650,000 | 2,419,000 | ||||||

| Straight-line rents |

3,523,000 | 2,743,000 | ||||||

| Deferred charges, net |

11,856,000 | 12,682,000 | ||||||

| Other assets |

4,144,000 | 5,549,000 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 559,108,000 | $ | 571,950,000 | ||||

|

|

|

|

|

|||||

| Liabilities and partners’ capital: |

||||||||

| Mortgage loans payable |

$ | 314,895,000 | $ | 317,293,000 | ||||

| Due to the Company |

527,000 | 1,203,000 | ||||||

| Unamortized intangible lease liabilities |

20,451,000 | 22,182,000 | ||||||

| Other liabilities |

7,282,000 | 8,248,000 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

343,155,000 | 348,926,000 | ||||||

| Preferred stock |

97,000 | 97,000 | ||||||

| Partners’ capital |

215,856,000 | 222,927,000 | ||||||

|

|

|

|

|

|||||

| Total liabilities and partners’ capital |

$ | 559,108,000 | $ | 571,950,000 | ||||

|

|

|

|

|

|||||

| The Company’s share of partners’ capital |

$ | 43,173,000 | $ | 44,743,000 | ||||

|

|

|

|

|

|||||

21

CEDAR REALTY TRUST, INC.

Cedar/RioCan Joint Venture

Statements of Income

| Three months ended June 30, | ||||||||

| 2012 | 2011 | |||||||

| Revenues |

$ | 16,012,000 | $ | 15,296,000 | ||||

| Property operating and other expenses |

(1,403,000 | ) | (1,307,000 | ) | ||||

| Management fees |

(463,000 | ) | (483,000 | ) | ||||

| Real estate taxes |

(1,937,000 | ) | (1,819,000 | ) | ||||

| Acquisition transaction costs |

— | (790,000 | ) | |||||

| General and administrative |

(67,000 | ) | (61,000 | ) | ||||

| Depreciation and amortization |

(5,056,000 | ) | (5,177,000 | ) | ||||

| Interest and other non-operating expenses, net |

(4,219,000 | ) | (4,684,000 | ) | ||||

|

|

|

|

|

|||||

| Net income |

$ | 2,867,000 | $ | 975,000 | ||||

|

|

|

|

|

|||||

| The Company’s share of net income |

$ | 576,000 | $ | 195,000 | ||||

|

|

|

|

|

|||||

| Six months ended June 30, | ||||||||

| 2012 | 2011 | |||||||

| Revenues |

$ | 31,944,000 | $ | 31,289,000 | ||||

| Property operating and other expenses |

(2,968,000 | ) | (3,966,000 | ) | ||||

| Management fees |

(1,052,000 | ) | (950,000 | ) | ||||

| Real estate taxes |

(3,862,000 | ) | (3,551,000 | ) | ||||

| Acquisition transaction costs |

— | (858,000 | ) | |||||

| General and administrative |

(135,000 | ) | (132,000 | ) | ||||

| Depreciation and amortization |

(10,170,000 | ) | (10,140,000 | ) | ||||

| Interest and other non-operating expenses, net |

(8,654,000 | ) | (9,079,000 | ) | ||||

|

|

|

|

|

|||||

| Net income |

$ | 5,103,000 | $ | 2,613,000 | ||||

|

|

|

|

|

|||||

| The Company’s share of net income |

$ | 1,021,000 | $ | 523,000 | ||||

|

|

|

|

|

|||||

22

CEDAR REALTY TRUST, INC.

Cedar/RioCan Joint Venture

Real Estate Summary–As of June 30, 2012

| Percent | Average | |||||||||||||||||||||||

| owned | % | base rent per | Major Tenants (a) | |||||||||||||||||||||

| Property Description |

by Cedar | State | GLA | occupied | leased sq. ft. | Name | GLA | |||||||||||||||||

| Connecticut |

||||||||||||||||||||||||

| Montville Commons |

20% | CT | 117,916 | 97.5% | $ | 16.02 | Stop & Shop | 63,000 | ||||||||||||||||

| Stop & Shop Plaza |

20% | CT | 54,510 | 100.0% | 16.69 | Stop & Shop | 54,510 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total Connecticut |

172,426 | 98.3% | 16.24 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Maryland |

||||||||||||||||||||||||

| Marlboro Crossroads |

20% | MD | 67,975 | 100.0% | 15.07 | Giant Foods | 60,951 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Massachusetts |

||||||||||||||||||||||||

| Franklin Village Plaza |

20% | MA | 304,347 | 92.9% | 20.20 | Stop & Shop | 75,000 | |||||||||||||||||

| Marshalls | 26,890 | |||||||||||||||||||||||

| Team Fitness | 15,807 | |||||||||||||||||||||||

| Northwoods Crossing |

20% | MA | 159,562 | 100.0% | 11.72 | BJ’s Wholesale Club | 115,367 | |||||||||||||||||

| Tractor Supply | 19,097 | |||||||||||||||||||||||

| Raynham Commons |

20% | MA | 176,609 | 97.7% | 11.89 | Shaw’s | 60,748 | |||||||||||||||||

| Marshall’s | 25,752 | |||||||||||||||||||||||

| JoAnn Fabrics | 15,775 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total Massachusetts |

640,518 | 96.0% | 15.67 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| New Jersey |

||||||||||||||||||||||||

| Cross Keys Place |

20% | NJ | 148,173 | 99.1% | 16.19 | Sports Authority | 42,000 | |||||||||||||||||

| Bed Bath & Beyond | 35,005 | |||||||||||||||||||||||

| AC Moore | 21,305 | |||||||||||||||||||||||

| Old Navy | 19,234 | |||||||||||||||||||||||

| Petco | 16,500 | |||||||||||||||||||||||

| Sunrise Plaza |

20% | NJ | 261,060 | 97.6% | 8.04 | Home Depot | 130,601 | |||||||||||||||||

| Kohl’s Department Store | 96,171 | |||||||||||||||||||||||

| Staples | 20,388 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total New Jersey |

409,233 | 98.1% | 11.02 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Pennsylvania |

||||||||||||||||||||||||

| Blue Mountain Commons |

20% | PA | 123,353 | 95.5% | 25.32 | Giant Foods | 100,107 | |||||||||||||||||

| Columbus Crossing |

20% | PA | 142,166 | 100.0% | 17.42 | Super Fresh | 61,506 | |||||||||||||||||

| Old Navy | 25,000 | |||||||||||||||||||||||

| AC Moore | 22,000 | |||||||||||||||||||||||

| Creekview Plaza |

20% | PA | 136,423 | 81.7% | 16.53 | Giant Foods | 48,966 | |||||||||||||||||

| L.A. Fitness | 38,000 | |||||||||||||||||||||||