2018

Dear Fellow Stockholders:

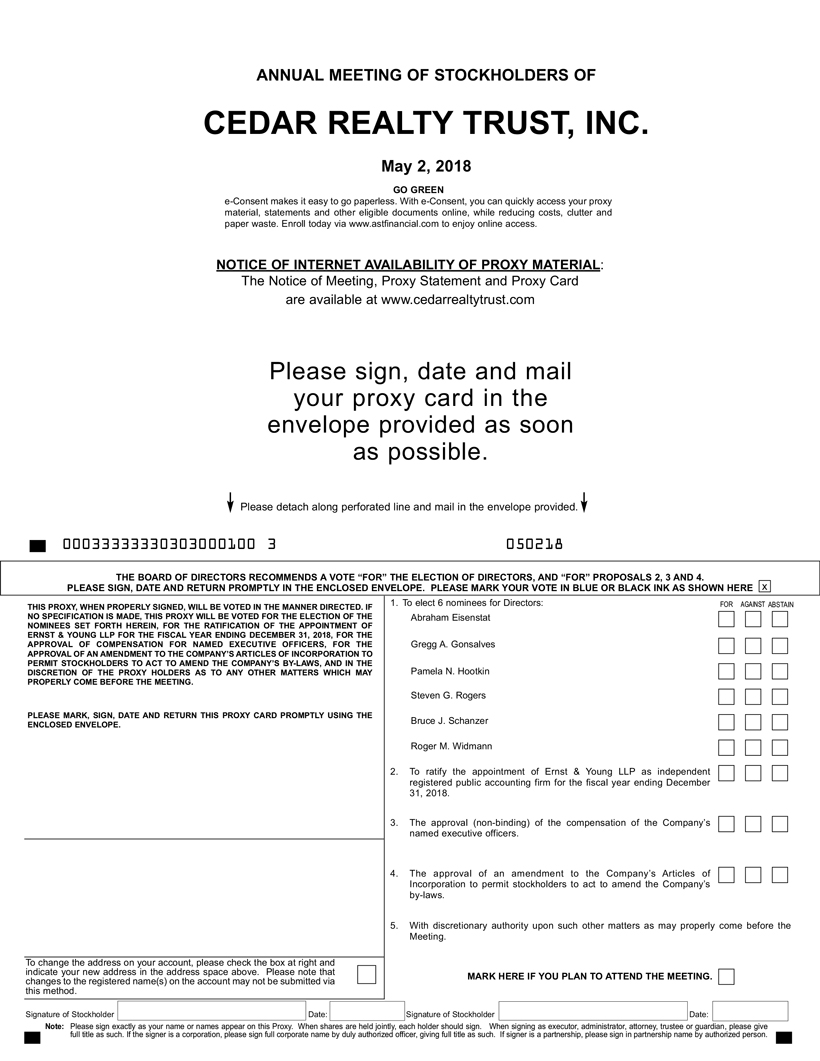

Please join my fellow directors and me at our 2018 Annual Meeting of Stockholders, which will be held on Wednesday, May 2, 2018, at our corporate headquarters in Port Washington, New York. The business we will conduct at the meeting is described in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

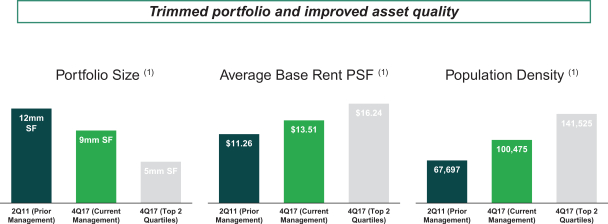

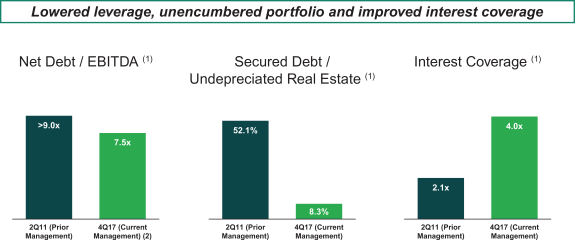

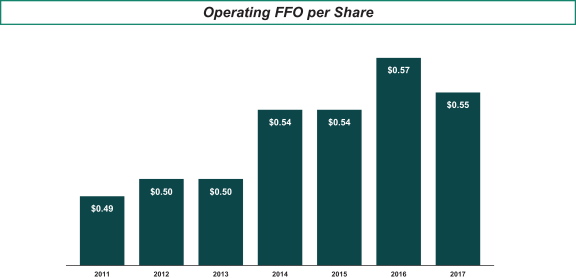

2017 was a pivotal year in the continued transformation of Cedar Realty Trust into a leading shopping center REIT, and we worked tirelessly in 2017 toward implementing this objective for our stockholders. Notwithstanding headwinds in the retail sector created by changes in consumer behavior, shifting demographics into urban markets, and shrinking margins driven by technological advances and e-commerce, the important decisions we made back in 2011 to reinforce our balance sheet and prune our portfolio to better withstand these types of secular disruptions are showing their strength in these challenging times.

While we look to the year ahead full of confidence and excitement as we continue to execute on our vision of unlocking value for our stockholders, we are wistful to bid farewell to our esteemed director, Senator Paul Kirk, who has advised us of his intention to retire from our Board as of the 2018 Annual Meeting. Paul has served this Board and Company faithfully and honorably over these past thirteen years, including as Chair of our Nominating/Corporate Governance Committee. It has been our honor and privilege to have Paul on our Board, and we wish him well in his retirement in as much as we are sad to see him go. We expect to announce our new director appointment in due course, as our search is already underway.

We welcome the opportunity to present you with the information contained in our Proxy Statement and we hope that, after you review it, you will vote at the Annual Meeting (either in person or by proxy) in accordance with the Board of Directors’ recommendations.

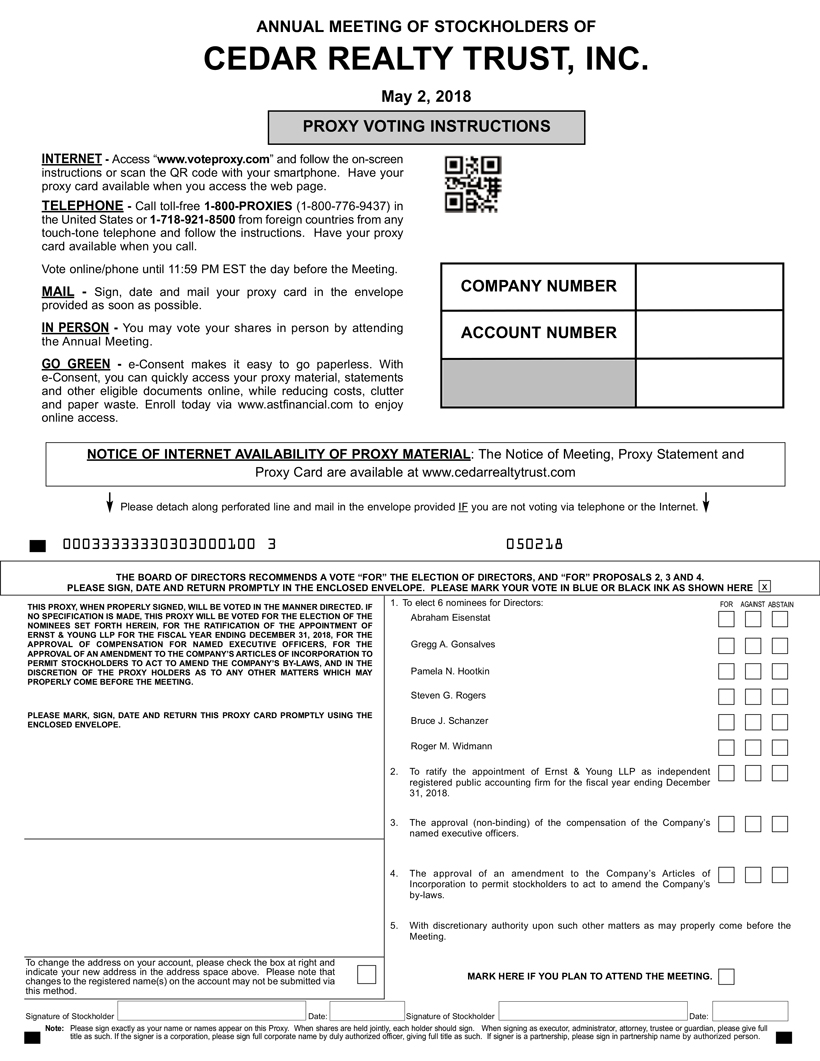

Your vote is extremely important. Whether or not you plan to attend the meeting, please vote your shares as soon as possible electronically through the Internet, by telephone or by completing, signing and returning the enclosed proxy card. If you vote electronically or by telephone, you do not need to return the enclosed proxy card. More detailed instructions on how to vote are provided on pages 6-9 of the Proxy Statement.

I, together with the Board, thank you for your continued investment, loyalty and support.

| Sincerely,

|

|

| BRUCE J. SCHANZER |

| President and Chief Executive Officer |

2018 Proxy Statement | i

2018 Proxy Statement | i