Exhibit (a)(1)(ii)

Letter of Transmittal

For Tenders of

6.50% Series C Cumulative Redeemable Preferred Stock at a Cash Purchase Price of

$16.25 Per Share

and

7.25% Series B Cumulative Redeemable Preferred Stock at a Cash Purchase Price of

$17.75 Per Share

of Cedar Realty Trust, Inc.

Pursuant to the Offer to Purchase Dated February 21, 2025

|

THE OFFERS, PRORATION PERIOD AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON MARCH 21, 2025, OR ANY OTHER DATE AND TIME TO WHICH THE COMPANY EXTENDS EITHER OR BOTH OF THE OFFERS (SUCH DATE AND TIME WITH RESPECT TO EITHER OFFER, AS IT MAY BE EXTENDED, THE “EXPIRATION DATE”), UNLESS EARLIER TERMINATED. |

The undersigned represents that I (we) have full authority to tender without restriction the certificate(s) listed below. You are hereby authorized and instructed to deliver to the address indicated below (unless otherwise instructed in the boxes in the following page) a check representing a cash payment for shares of 6.50% Series C Cumulative Redeemable Preferred Stock (the “Series C Shares”), of Cedar Realty Trust, Inc. (“Cedar”), tendered pursuant to this Letter of Transmittal, for purchase by us at a price of $16.25 per Series C Share, and /or a check representing a cash payment for shares of 7.25% Series B Cumulative Redeemable Preferred Stock (the “Series B Shares,” and, together with the Series C Shares, the “Shares”) of Cedar, tendered pursuant to this Letter of Transmittal, for purchase by us at a price of $17.75 per Series B Share, in each case less any applicable withholding taxes and without interest, upon the terms and subject to the conditions in the Offer to Purchase, dated February 21, 2025 (as amended or supplemented from time to time, the “Offer to Purchase”) and this Letter of Transmittal (which together, as they may be amended or supplemented from time to time, constitute the “Offers”).

Method of delivery of the certificate(s) is at the option and risk of the owner thereof. See Instruction 2. Mail or deliver this Letter of Transmittal, together with the certificate(s) representing your Shares, to:

|

By Mail: BY 5:00 P.M. New York City time on Expiration Date Computershare c/o Voluntary Corporate Actions PO Box 43011 Providence, RI 02940-3011 |

By Overnight Courier: BY 5:00 P.M. New York City time on Expiration Date Computershare c/o Voluntary Corporate Actions 150 Royall Street, Suite V Canton, MA 02021 |

Pursuant to Cedar’s offer to purchase up to an aggregate amount paid of $9,500,000 of (i) up to 584,615 Series C Shares for a cash purchase price of $16.25 per share (the “Series C Offer”) and (ii) up to 535,211 Series B Shares for a cash purchase price of $17.75 per share (the “Series B Offer”), in each case less any applicable withholding taxes and without interest, upon the terms and subject to the conditions described in the Offer to Purchase, the undersigned encloses herewith and tenders the following certificates representing Shares of Cedar:

|

FOR OFFICE USE ONLY Approved W-9 Completed |

|||

|

DESCRIPTION OF SHARES TENDERED |

|||

|

NAME(S) AND ADDRESS(ES) OF |

CERTIFICATES TENDERED (ATTACH |

||

|

Certificate |

Total Number of |

Number of |

|

|

SERIES C SHARES |

|||

|

Total Series C Shares Tendered: |

|||

|

SERIES B SHARES |

|||

|

Total Series B Shares Tendered: |

|||

____________

(1) If Shares are held in Book-Entry form, you MUST indicate the number of Shares you are tendering. Otherwise, all Shares represented by Book-Entry delivered to the Depositary Agent will be deemed to have been tendered

(2) If you wish to tender fewer than all shares represented by any certificate listed above, please indicate in this column the number of Shares you wish to tender. Otherwise, all Shares represented by share certificates delivered to the Depositary Agent will be deemed to have been tendered. See Instruction 4.

☐ Lost Certificates. I have lost my certificate(s) for Shares and I require assistance in replacing the Shares (See Instruction 12).

THIS FORM SHOULD BE COMPLETED, SIGNED AND SENT, TOGETHER WITH ALL OTHER DOCUMENTS, INCLUDING YOUR CERTIFICATES FOR SHARES, TO COMPUTERSHARE INC. (THE “DEPOSITARY”) AT ONE OF THE ADDRESSES SET FORTH BELOW. DELIVERY OF THIS LETTER OF TRANSMITTAL OR OTHER DOCUMENTS TO AN ADDRESS OTHER THAN AS SET FORTH BELOW DOES NOT CONSTITUTE VALID DELIVERY. DELIVERIES TO CEDAR OR GEORGESON LLC (THE “INFORMATION AGENT”) WILL NOT BE FORWARDED TO THE DEPOSITARY AND THEREFORE WILL NOT CONSTITUTE VALID DELIVERY. DELIVERIES TO THE DEPOSITORY TRUST COMPANY WILL NOT CONSTITUTE VALID DELIVERY TO THE DEPOSITARY.

2

READ THE INSTRUCTIONS CAREFULLY BEFORE

COMPLETING THIS LETTER OF TRANSMITTAL

|

Indicate below the order (by certificate number) in which your Series C Shares and/or Series B Shares are to be purchased in the event of proration (attach additional signed list if necessary). If you do not designate an order and if less than all your Series C Shares and/or Series B Shares tendered are purchased due to proration, your Series C Shares and/or Series B Shares will be selected for purchase by the Depositary. See Instruction 14. |

|||||||

|

Series C Shares: |

|||||||

|

1st |

2nd |

3rd |

|||||

|

4th |

5th |

6th |

|||||

|

Series B Shares: |

|||||||

|

1st |

2nd |

3rd |

|||||

|

4th |

5th |

6th |

|||||

YOU MUST SIGN THIS LETTER OF TRANSMITTAL WHERE INDICATED BELOW AND COMPLETE THE IRS FORM W-9 PROVIDED BELOW OR APPROPRIATE IRS FORM W-8.

This Letter of Transmittal is to be used either if you hold certificates for the Series C Shares and/or the Series B Shares, or if your Shares are held in book entry form on the records of the Depositary or, unless an Agent’s Message (defined below) is utilized, if delivery of Shares is to be made by book-entry transfer to an account maintained by the Depositary at The Depository Trust Company, which is referred to as the Book-Entry Transfer Facility, pursuant to the procedures set forth in Section 3 of the Offer to Purchase. Tendering stockholders must deliver to the Depositary by 5:00 p.m., New York City time, on the Expiration Date either the certificates for, or timely confirmation of book-entry transfer in accordance with the procedures described in Section 3 of the Offer to Purchase with respect to, their Shares and all other documents required by this Letter of Transmittal. See Section 14 of the Offer to Purchase. Tendering stockholders whose certificates for Shares are not immediately available or who cannot deliver to the Depositary by the time provided immediately above either the certificates for, or timely confirmation of book-entry in accordance with the procedures described in Section 3 of the Offer to Purchase with respect to, their Shares and all other documents required by this Letter of Transmittal must tender their Shares in accordance with the guaranteed delivery procedures set forth in Section 3 of the Offer to Purchase. All capitalized terms not otherwise defined herein have the meaning ascribed to them in the Offer to Purchase.

If you want to retain the Series C Shares and Series B Shares you own, you do not need to take any action. If you wish to tender Shares of one series but not the other, you should use complete this Letter of Transmittal with respect to the Shares you wish to tender.

3

CONDITIONAL TENDER

(See Instruction 13)

A stockholder may tender Series C Shares subject to the condition that all, or a specified minimum number of, Series C Shares tendered pursuant to the Letter of Transmittal must be purchased in the Series C Offer if any Series C Shares are purchased, and may tender Series B Shares subject to the condition that all, or a specified minimum number of, Series B Shares tendered pursuant to the Letter of Transmittal must be purchased in the Series B Offer if any Series B Shares are purchased, all as described in the Offer to Purchase, particularly in Section 6 of the Offer to Purchase. Unless at least the minimum number of Series C Shares indicated below is purchased by Cedar pursuant to the terms of the Series C Offer, none of the Series C Shares tendered will be purchased. Unless at least the minimum number of Series B Shares indicated below are purchased by Cedar pursuant to the terms of the Series B Offer, none of the Series B Shares tendered will be purchased. It is the tendering stockholder’s responsibility to calculate the minimum number of Series C Shares that must be purchased if any are purchased or minimum number of Series B Shares that must be purchased if any are purchased. Cedar urges stockholders to consult their own financial and tax advisors before completing this section. Unless this box has been checked and a minimum specified, the tender will be deemed unconditional. A stockholder who tenders both Series C Shares and Series B Shares may specify a minimum number of Series C Shares to be tendered with respect to the Series C Offer and/or a minimum number of Series B Shares to be tendered pursuant to the Series B Offer. A stockholder who tenders both Series C Shares and Series B Shares may not tender Shares subject to the condition that a minimum number of Shares be purchased in both Offers if any Shares are purchased.

|

☐ |

The minimum number of Series C Shares that must be purchased, if any are purchased, is: __________ Series C Shares. |

|

|

☐ |

The minimum number of Series B Shares that must be purchased, if any are purchased, is: __________ Series B Shares. |

If, because of proration, the minimum number of Shares designated will not be purchased in either the Series C Offer or Series B Offer, Cedar may accept conditional tenders by random lot, if necessary. However, to be eligible for purchase by random lot, the tendering stockholder must have tendered all of his or her Shares of that series and checked this box:

|

☐ |

The tendered Series C Shares represent all Series C Shares held by the undersigned. |

|

|

☐ |

The tendered Series B Shares represent all Series B Shares held by the undersigned. |

4

LOST OR DESTROYED CERTIFICATE(S)

IF ANY STOCK CERTIFICATE REPRESENTING SHARES THAT YOU OWN HAS BEEN LOST, STOLEN OR DESTROYED, PLEASE CONTACT THE DEPOSITARY AT (800) 736-3001 PROMPTLY TO OBTAIN INSTRUCTIONS AS TO THE STEPS THAT MUST BE TAKEN IN ORDER TO REPLACE THE CERTIFICATE. THIS LETTER OF TRANSMITTAL AND RELATED DOCUMENTS CANNOT BE PROCESSED UNTIL THE PROCEDURES FOR REPLACING LOST OR DESTROYED CERTIFICATES HAVE BEEN FOLLOWED. PLEASE CONTACT THE DEPOSITARY IMMEDIATELY TO PERMIT TIMELY PROCESSING OF THE REPLACEMENT DOCUMENTATION. SEE INSTRUCTION 12.

5

NOTE: SIGNATURES MUST BE PROVIDED WHERE INDICATED BELOW.

PLEASE READ THE ACCOMPANYING INSTRUCTIONS CAREFULLY.

Ladies and Gentleman:

The undersigned hereby tenders to Cedar Realty Trust, Inc., a Maryland corporation (“Cedar”), the above-described shares of Cedar’s 6.50% Series C Cumulative Redeemable Preferred Stock (the “Series C Shares”) at a price of $16.25 per share and/or Cedar’s 7.25% Series B Cumulative Redeemable Preferred Stock (the “Series B Shares”) at a price of $17.75 per share, to the seller in cash, in each case less any applicable withholding taxes and without interest, upon the terms and subject to the conditions set forth in Cedar’s Offer to Purchase dated February 21, 2025 (as amended or supplemented from time to time, the “Offer to Purchase”) and this Letter of Transmittal (which together, as they may be amended or supplemented from time to time, constitute the “Offers”), receipt of which is hereby acknowledged.

Subject to and effective on acceptance for payment of, and payment for, the Shares tendered with this Letter of Transmittal in accordance with, and subject to, the terms of the Offers, the undersigned hereby sells, assigns and transfers to, or upon the order of, Cedar, all right, title and interest in and to all the Shares that are being tendered and irrevocably constitutes and appoints Cedar, the true and lawful agent and attorney-in-fact of the undersigned, with full power of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest), to the full extent of the undersigned’s rights with respect to such tendered Shares, to (a) deliver certificates for such tendered Shares or transfer ownership of such tendered Shares on the account books maintained by The Depository Trust Company (the “Book-Entry Transfer Facility”), together, in any such case, with all accompanying evidences of transfer and authenticity to, or upon the order of, Cedar upon receipt by the Depositary, as the undersigned’s agent, of the aggregate purchase price with respect to such tendered Shares, (b) present such tendered Shares for cancellation and transfer on Cedar’s books and (c) receive all benefits and otherwise exercise all rights of beneficial ownership of such tendered Shares, all in accordance with the terms of the Offers.

The undersigned hereby represents and warrants that the undersigned has full power and authority to tender, sell, assign and transfer the tendered Shares and, when the same are accepted for payment, Cedar will acquire good title thereto, free and clear of all liens, security interests, restrictions, charges, claims, encumbrances, conditional sales agreements or other similar obligations relating to the sale or transfer of the tendered Shares, and the same will not be subject to any adverse claim or right. The undersigned will, on request by the Depositary or Cedar, execute any additional documents deemed by the Depositary or Cedar to be necessary or desirable to complete the sale, assignment and transfer of the tendered Shares (and any and all such other Shares or other securities or rights), all in accordance with the terms of the Offers.

All authority conferred or agreed to be conferred pursuant to this Letter of Transmittal shall be binding on the successors, assigns, heirs, personal representatives, executors, administrators and other legal representatives of the undersigned and shall not be affected by, and shall survive, the death or incapacity of the undersigned. Except as stated in the Offer to Purchase, this tender is irrevocable.

The undersigned understands that:

1. The valid tender of Shares pursuant to any of the procedures described in Section 3 of the Offer to Purchase and in the instructions to this Letter of Transmittal constitutes the undersigned’s acceptance of the terms and conditions of the Offers. Cedar’s acceptance of the tendered Shares will constitute a binding agreement between the undersigned and Cedar on the terms and subject to the conditions of the Offers.

2. It is a violation of Rule 14e-4 promulgated under the Securities Exchange Act of 1934, as amended, for a person acting alone or in concert with others, directly or indirectly, to tender securities for such person’s own account unless at the time of tender and at the Expiration Date such person has a “net long position” in (a) the securities that is equal to or greater than the amount tendered and will deliver or cause to be delivered such securities for the purpose of tender within the period specified in the tender offer, or (b) other securities immediately convertible into, exercisable for or exchangeable into such securities (“Equivalent Securities”) that is equal to or greater than the amount tendered and, upon the acceptance of such tender, will acquire such securities by conversion, exchange or exercise of such Equivalent Securities to the extent required by the terms of the tender offer and will deliver or cause to be delivered such securities so acquired for the purpose of tender within the period specified in the tender offer. Rule 14e-4 also provides

6

a similar restriction applicable to the tender or guarantee of a tender on behalf of another person. A tender of Shares made pursuant to any method of delivery set forth in this Letter of Transmittal will constitute the tendering stockholder’s representation and warranty to Cedar that (x) such stockholder has a “net long position” in Shares or Equivalent Securities being tendered within the meaning of Rule 14e-4, and (y) such tender of Shares complies with Rule 14e-4. Cedar’s acceptance for payment of Shares tendered pursuant to the Offers will constitute a binding agreement between the tendering stockholder and Cedar upon the terms and subject to the conditions of the Offers.

3. Cedar will, upon the terms and subject to the conditions of the Offers, pay the per share price of $16.25 per Series C Share and $17.75 per Series B Share, in cash, in each case less any applicable withholding taxes and without interest, and will pay for Shares properly tendered and not properly withdrawn from the Offers, taking into account the number of Shares so tendered, by tendering stockholders, and any applicable proration.

4. Cedar reserves the right, in its sole discretion, to increase or decrease either or both of the per share purchase prices and to increase or decrease the maximum aggregate amount paid for Shares sought in the Offers. We may increase the aggregate amount paid for Shares sought in the Offers to an amount greater than $9,500,000, subject to applicable law. In accordance with the rules of the Securities and Exchange Commission, we may increase the number of Series C Shares and/or Series B Shares accepted for payment in the applicable Offer by no more than 2% of the outstanding Shares C Shares and Series B Shares, respectively, without extending such Offer. In case of such increase, we may increase the number of Series C Shares only or Series B Shares only, or may increase the number of both Series C Shares and Series B Shares accepted for payment.

5. Shares properly tendered prior to the Expiration Date and not properly withdrawn will be purchased in the Offers at the applicable per share price, upon the terms and subject to the conditions of the Offers, including the proration and conditional tender provisions described in the Offer to Purchase.

6. Cedar will return, at its expense, all Shares it does not purchase, including Shares not properly withdrawn and Shares not purchased because of proration or conditional tenders, promptly following the Expiration Date.

7. Under the circumstances set forth in the Offer to Purchase, Cedar expressly reserves the right, in its sole discretion, to terminate either or both Offers at any time and from time to time, upon the occurrence of any of the events set forth in Section 7 of the Offer to Purchase and to extend the period of time during which either or both of the Offers is open and thereby delay acceptance for payment of, and payment for, any Shares by giving oral or written notice of such extension to the Depositary and making a public announcement thereof. During any extension of either Offer, all Shares previously tendered pursuant to such Offer and not properly withdrawn will remain subject to the Offer, subject to such extension and to the rights of a tendering stockholder to withdraw such stockholder’s Shares.

8. Stockholders who cannot deliver their certificates and all other required documents to the Depositary or complete the procedures for book-entry transfer prior to the Expiration Date may tender their Shares by properly completing and duly executing the Notice of Guaranteed Delivery pursuant to the guaranteed delivery procedures set forth in Section 3 of the Offer to Purchase.

9. Cedar has advised the undersigned to consult with the undersigned’s own advisors as to the consequences of tendering Shares pursuant to the Offers.

10. WE ARE NOT MAKING THE OFFERS TO, AND WILL NOT ACCEPT ANY TENDERED SHARES FROM, STOCKHOLDERS IN ANY JURISDICTION OR IN ANY CIRCUMSTANCES WHERE IT WOULD BE ILLEGAL TO DO SO, PROVIDED THAT WE WILL COMPLY WITH THE REQUIREMENTS OF RULE 13E-4(F)(8) PROMULGATED UNDER THE EXCHANGE ACT. HOWEVER, WE MAY, AT OUR DISCRETION, TAKE ANY ACTIONS NECESSARY FOR US TO MAKE THE OFFERS TO STOCKHOLDERS IN ANY SUCH JURISDICTION.

7

The undersigned agrees to all of the terms and conditions of the Offers.

Unless otherwise indicated below in the section captioned “Special Payment Instructions,” please issue the check(s) for payment of the purchase price and/or return any certificates for Shares not tendered or accepted for payment in the name(s) of the registered holder(s) appearing under “Description of Shares Tendered.” Similarly, unless otherwise indicated under “Special Delivery Instructions,” please mail the check(s) for payment of the purchase price and/or return any certificates for Shares not tendered or accepted for payment (and accompanying documents, as appropriate) to the address(es) of the registered holder(s) appearing under “Description of Shares Tendered.” In the event that both the “Special Delivery Instructions” and the “Special Payment Instructions” are completed, please issue the check(s) for payment of the purchase price and/or return any certificates for Shares not tendered or accepted for payment (and any accompanying documents, as appropriate) in the name(s) of, and deliver such check(s) and/or return such certificates (and any accompanying documents, as appropriate) to, the person or persons so indicated. Appropriate medallion signature guarantees by an Eligible Institution (as defined in Instruction 1) have been included with respect to Shares for which Special Payment Instructions have been given. The undersigned recognizes that Cedar has no obligation pursuant to the “Special Payment Instructions” to transfer any Shares from the name of the registered holder(s) thereof if Cedar does not accept for payment any of the Shares.

8

IMPORTANT: STOCKHOLDERS SIGN HERE

(also please complete IRS Form W-9 below or appropriate IRS Form W-8)

|

Signature(s) of Owner(s): |

Dated:

(Must be signed by registered holder(s) exactly as name(s) appear(s) on stock certificate(s) or by person(s) authorized to become registered holder(s) of stock certificate(s) as evidenced by endorsement or stock powers transmitted herewith. If signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, the full title of the person should be set forth. See Instruction 5).

|

Name(s): |

|||

|

(Please Print) |

|||

|

Capacity (full title): |

|||

|

Address: |

|||

(Include Zip Code)

Complete accompanying IRS Form W-9 or appropriate IRS Form W-8.

GUARANTEE OF SIGNATURE(S)

(For use by Eligible Institutions only;

see Instructions 1 and 5)

|

Name of Firm: |

(Include Zip Code)

|

Authorized Signature: Name: |

(Please Type or Print)

|

Area Code and Telephone Number: |

||

|

Dated: |

|

NOTE: A notarization by a notary public is not acceptable. |

||

|

PLACE MEDALLION GUARANTEE IN SPACE BELOW |

9

INSTRUCTIONS

Forming Part of the Terms and Conditions of the Offers

1. Guarantee of Signatures. No signature guarantee is required on this Letter of Transmittal if (a) this Letter of Transmittal is signed by the registered holder(s) (which term, for purposes of this Instruction 1, includes any participant in the Book-Entry Transfer Facility’s system whose name appears on a security position listing as the owner of the Shares) of Shares tendered herewith, unless such registered holder(s) has (have) completed the section captioned “Special Payment Instructions” on this Letter of Transmittal or (b) such Shares are tendered for the account of a bank, broker, dealer, credit union, savings association or other entity that is a member in good standing of a medallion program approved by the Securities Transfer Agents Association, Inc., including the Securities Transfer Agents Medallion Program, the New York Stock Exchange, Inc. Medallion Signature Program or the Stock Exchange Medallion Program, or is otherwise an “eligible guarantor institution,” as the term is defined in Exchange Act Rule 17Ad-15, each of the foregoing constituting an “Eligible Institution.” In all other cases, all signatures on this Letter of Transmittal must be guaranteed by an Eligible Institution. See Instruction 5. If you have any questions regarding the need for a signature guarantee, please call the Information Agent at (866) 735-3807.

2. Requirements of Tender. This Letter of Transmittal is to be completed by stockholders either if certificates are to be forwarded herewith, shares are held in book-entry form on the records of the Depositary or, unless an Agent’s Message is utilized, if delivery of Shares is to be made pursuant to the procedures for book-entry transfer set forth in Section 3 of the Offer to Purchase. For a stockholder to validly tender Shares pursuant to the Offers, (a) a Letter of Transmittal, properly completed and duly executed, and the certificate(s) representing the tendered Shares, together with any required signature guarantees, and any other required documents, must be received by the Depositary at one of its addresses set forth on the back of this Letter of Transmittal prior to the Expiration Date, or (b) a Letter of Transmittal (or facsimile of the Letter of Transmittal), properly completed and duly executed, together with any required Agent’s Message and any other required documents, must be received by the Depositary at one of its addresses set forth on the back of this Letter of Transmittal prior to the Expiration Date and Shares must be delivered pursuant to the procedures for book-entry transfer set forth in this Letter of Transmittal (and a book-entry confirmation must be received by the Depositary) prior to the Expiration Date, or (c) the stockholder must comply with the guaranteed delivery procedures set forth below and in Section 3 of the Offer to Purchase.

Tenders of Shares made pursuant to an Offer may be withdrawn at any time prior to the Expiration Date for such Offer. A stockholder who has tendered both Series C Shares and Series B Shares may withdraw Shares of one series without withdrawing Shares of the other series. If Cedar extends either or both of the Offers beyond that time, Shares tendered pursuant to such Offer may be withdrawn at any time until the extended Expiration Date. Shares that have not previously been accepted by Cedar for payment may be withdrawn at any time after 5:00 p.m., New York City time, on April 21, 2025, the date that is 40 business days after the commencement of the Offers. To withdraw tendered Shares, stockholders must deliver a written notice of withdrawal to the Depositary within the prescribed time period at one of the addresses set forth in this Letter of Transmittal. Any notice of withdrawal must specify the name of the tendering stockholder, the series of Shares to be withdrawn, the number of Shares to be withdrawn, and the name of the registered holder of the Shares. In addition, if the certificates for Shares to be withdrawn have been delivered or otherwise identified to the Depositary, then, before the release of the certificates, the tendering stockholder must also submit the serial numbers shown on the particular certificates for Shares to be withdrawn. If Shares have been tendered pursuant to the procedures for book-entry transfer, the notice of withdrawal also must specify the name and the number of the account at Book-Entry Transfer Facility to be credited with the withdrawn Shares and otherwise comply with the procedures of that facility. Withdrawals may not be rescinded and any Shares withdrawn will not be properly tendered for purposes of the Offers unless the withdrawn Shares are properly re-tendered prior to the Expiration Date by following the procedures described above.

Stockholders whose certificates for Shares are not immediately available or who cannot deliver their certificates and all other required documents to the Depositary or complete the procedures for book-entry transfer prior to the Expiration Date may tender their Shares by properly completing and duly executing the Notice of Guaranteed Delivery pursuant to the guaranteed delivery procedures set forth in Section 3 of the Offer to Purchase. Pursuant to those procedures, (a) tender must be made by or through an Eligible Institution, (b) a properly completed and duly executed Notice of Guaranteed Delivery, substantially in the form provided by Cedar, must be received by the Depositary prior to the Expiration Date and (c) the certificates for all tendered Shares in proper form for transfer (or a book-entry confirmation with respect to all such Shares), together with a Letter of Transmittal (or facsimile of the Letter of Transmittal), properly completed and duly executed, with any required signature guarantees, or,

10

in the case of a book-entry transfer, an Agent’s Message, and any other required documents, must be received by the Depositary, in each case by 5:00 p.m., New York City time, within one trading day following the applicable Expiration Date as provided in Section 3 of the Offer to Purchase. A “trading day” is any day on which the New York Stock Exchange is open for business. The term “Agent’s Message” means a message transmitted by the Book-Entry Transfer Facility to, and received by, the Depositary, which states that the Book-Entry Transfer Facility has received an express acknowledgment from the participant in the Book-Entry Transfer Facility tendering the Shares that such participant has received and agrees to be bound by the terms of the Letter of Transmittal and that Cedar may enforce such agreement against the participant.

THE METHOD OF DELIVERY OF SHARES, THIS LETTER OF TRANSMITTAL AND ANY OTHER REQUIRED DOCUMENTS, INCLUDING DELIVERY THROUGH THE BOOK-ENTRY TRANSFER FACILITY, IS AT THE SOLE ELECTION AND RISK OF THE TENDERING STOCKHOLDER. SHARES, THIS LETTER OF TRANSMITTAL AND ALL OTHER DOCUMENTS WILL BE DEEMED DELIVERED ONLY WHEN ACTUALLY RECEIVED BY THE DEPOSITARY (INCLUDING, IN THE CASE OF A BOOK-ENTRY TRANSFER, BY BOOK-ENTRY CONFIRMATION). IF YOU ELECT TO DELIVER BY MAIL, WE RECOMMEND THAT YOU USE REGISTERED MAIL WITH RETURN RECEIPT REQUESTED, AND THAT YOU PROPERLY INSURE THE DOCUMENTS. IN ALL CASES, YOU SHOULD ALLOW SUFFICIENT TIME TO ENSURE TIMELY DELIVERY.

Except as specifically provided by the Offer to Purchase, no alternative, conditional or contingent tenders will be accepted. No fractional Shares will be purchased. All tendering stockholders, by execution of this Letter of Transmittal (or a facsimile of this Letter of Transmittal), waive any right to receive any notice of the acceptance for payment of their Shares.

3. Inadequate Space. If the space provided in this Letter of Transmittal is inadequate, the certificate numbers and/or the number of Shares should be listed on a separate signed schedule attached hereto.

4. Partial Tenders. If fewer than all of the Shares represented by any certificate or shares held in book-entry on the records of the Depositary submitted to the Depositary are to be tendered, fill in the number of Shares that are to be tendered in the box entitled “Description of Shares Tendered.” You MUST indicate the number of Shares you are tendering. Otherwise, all Shares represented by certificate(s) or book-entry delivered to the Depositary Agent will be deemed to have been tendered. In any such case, new certificate(s) for the remainder of the Shares that were evidenced by the old certificate(s) will be sent to the registered holder(s), unless otherwise provided in the appropriate box on this Letter of Transmittal, as soon as practicable after the acceptance for payment of, and payment for, the Shares tendered herewith. All Shares represented by certificates delivered to the Depositary will be deemed to have been tendered unless otherwise indicated.

5. Signatures on Letter of Transmittal, Stock Powers and Endorsements. If this Letter of Transmittal is signed by the registered holder(s) of the Shares tendered hereby, the signature(s) must correspond with the name(s) as written on the face of the certificate(s) without any change or alteration whatsoever.

If any of the Shares tendered hereby are owned of record by two or more joint owners, all such persons must sign this Letter of Transmittal.

If any Shares tendered hereby are registered in different names on several certificates, it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of certificates.

If this Letter of Transmittal or any certificate or stock power is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, he or she should so indicate when signing and submit proper evidence satisfactory to Cedar of his or her authority to so act.

If this Letter of Transmittal is signed by the registered owner(s) of the Shares tendered hereby, no endorsements of certificates or separate stock powers are required unless payment of the purchase price is to be made, or certificates for Shares not tendered or accepted for payment are to be issued, to a person other than the registered owner(s). Signatures on any such certificates or stock powers must be guaranteed by an Eligible Institution.

If this Letter of Transmittal is signed by a person other than the registered owner(s) of the Shares tendered hereby, the certificate(s) representing such Shares must be properly endorsed for transfer or accompanied by appropriate stock powers, in either case signed exactly as the name(s) of the registered owner(s) appear(s) on the certificates(s). The signature(s) on any such certificate(s) or stock power(s) must be guaranteed by an Eligible Institution.

11

6. Stock Transfer Taxes. Cedar will pay any stock transfer taxes with respect to the transfer and sale of Shares to it pursuant to the Offers. If, however, payment of the purchase price is to be made to, or if Shares not tendered or accepted for payment are to be registered in the name of, any person(s) other than the registered owner(s), or if Shares tendered hereby are registered in the name(s) of any person(s) other than the person(s) signing this Letter of Transmittal, the amount of any stock transfer taxes (whether imposed on the registered owner(s) or such other person(s)) payable on account of the transfer to such person(s) will be the responsibility of the registered owner.

Except as provided in this Instruction 6, it will not be necessary for transfer tax stamps to be affixed to the certificates listed in this Letter of Transmittal.

7. Special Payment and Delivery Instructions. If a check for the purchase price of any Shares accepted for payment is to be issued in the name of, and/or certificates for any Shares not accepted for payment or not tendered are to be issued in the name of and/or returned to, a person other than the signer of this Letter of Transmittal or if a check is to be sent, and/or such certificates are to be returned, to a person other than the signer of this Letter of Transmittal or to an address other than that shown above, the appropriate boxes on this Letter of Transmittal should be completed.

8. Waiver of Conditions; Irregularities. All questions as to the number of Shares to be accepted, the purchase price to be paid for Shares to be accepted, the validity, form, eligibility (including time of receipt) and acceptance for payment of any tender of Shares and the validity (including time of receipt) and form of any notice of withdrawal of tendered Shares will be determined by Cedar, in its sole discretion, and such determination will be final and binding on all parties absent a finding to the contrary by a court of competent jurisdiction, subject to a stockholder’s right to challenge our determination in a court of competent jurisdiction. Cedar may delegate power in whole or in part to the Depositary. Cedar reserves the absolute right to reject any or all tenders of any Shares that Cedar determines are not in proper form or the acceptance for payment of or payment for which may, in the opinion of Cedar’s counsel, be unlawful. Cedar reserves the absolute right to reject any notices of withdrawal that it determines are not in proper form. Cedar also reserves the absolute right, subject to the applicable rules and regulations of the Securities and Exchange Commission, to waive any of the conditions of the Offers prior to the Expiration Date, or any defect or irregularity in any tender or withdrawal with respect to any particular Shares or any particular stockholder (whether or not Cedar waives similar defects or irregularities in the case of other stockholders), and Cedar’s interpretation of the terms of the Offers (including these instructions) will be final and binding on all parties absent a finding to the contrary by a court of competent jurisdiction, subject to a stockholder’s right to challenge our determination in a court of competent jurisdiction. In the event a condition is waived with respect to any particular stockholder, the same condition will be waived with respect to all stockholders. No tender or withdrawal of Shares will be deemed to have been properly made until all defects or irregularities have been cured by the tendering or withdrawing stockholder or waived by Cedar. Cedar will not be liable for failure to waive any condition of the Offers, or any defect or irregularity in any tender or withdrawal of Shares. Unless waived, any defects or irregularities in connection with tenders or withdrawals must be cured within the period of time Cedar determines. None of Cedar, the Information Agent, the Depositary or any other person will be obligated to give notice of any defects or irregularities in any tender or withdrawal, nor will any of the foregoing incur any liability for failure to give any such notification.

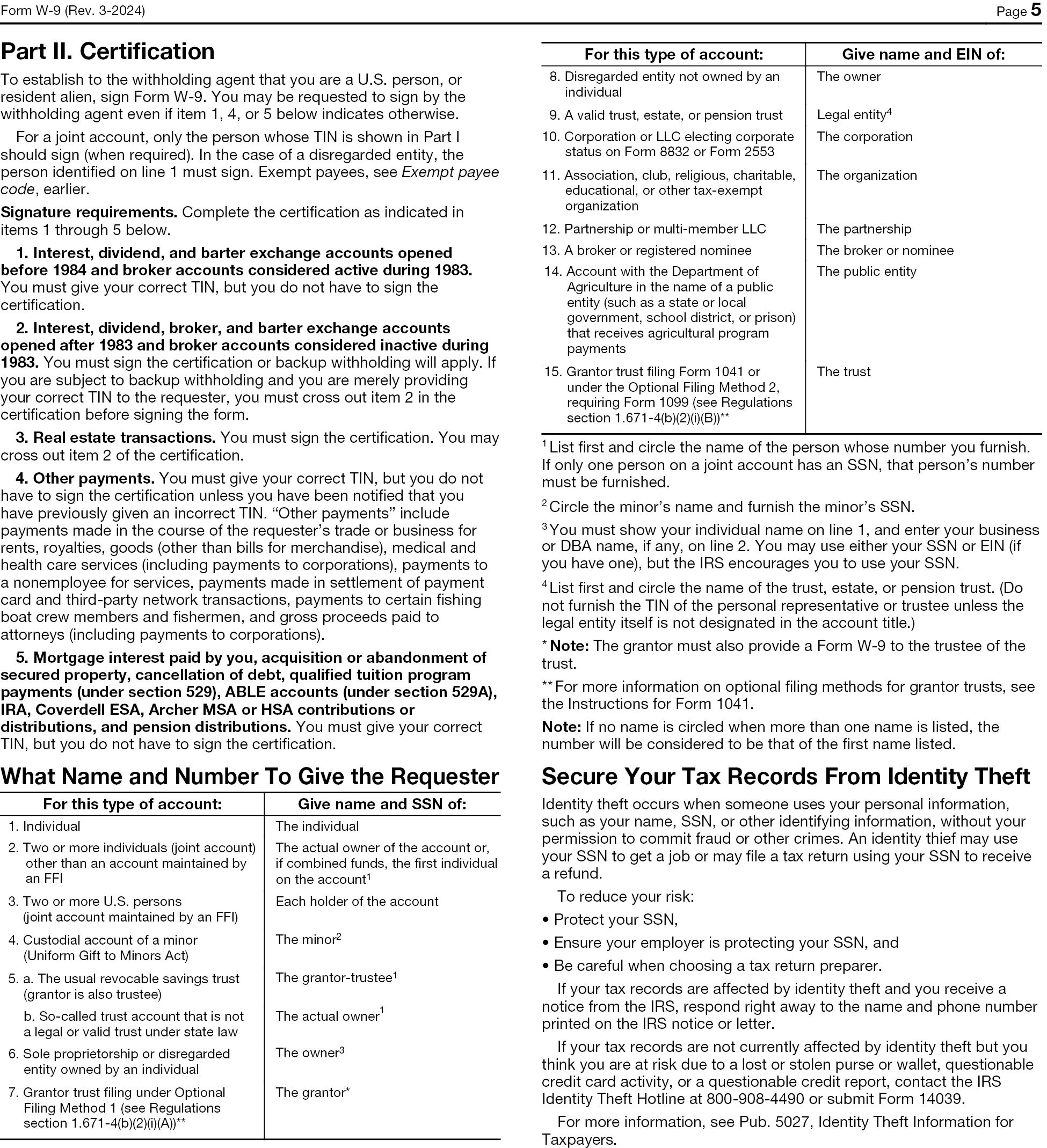

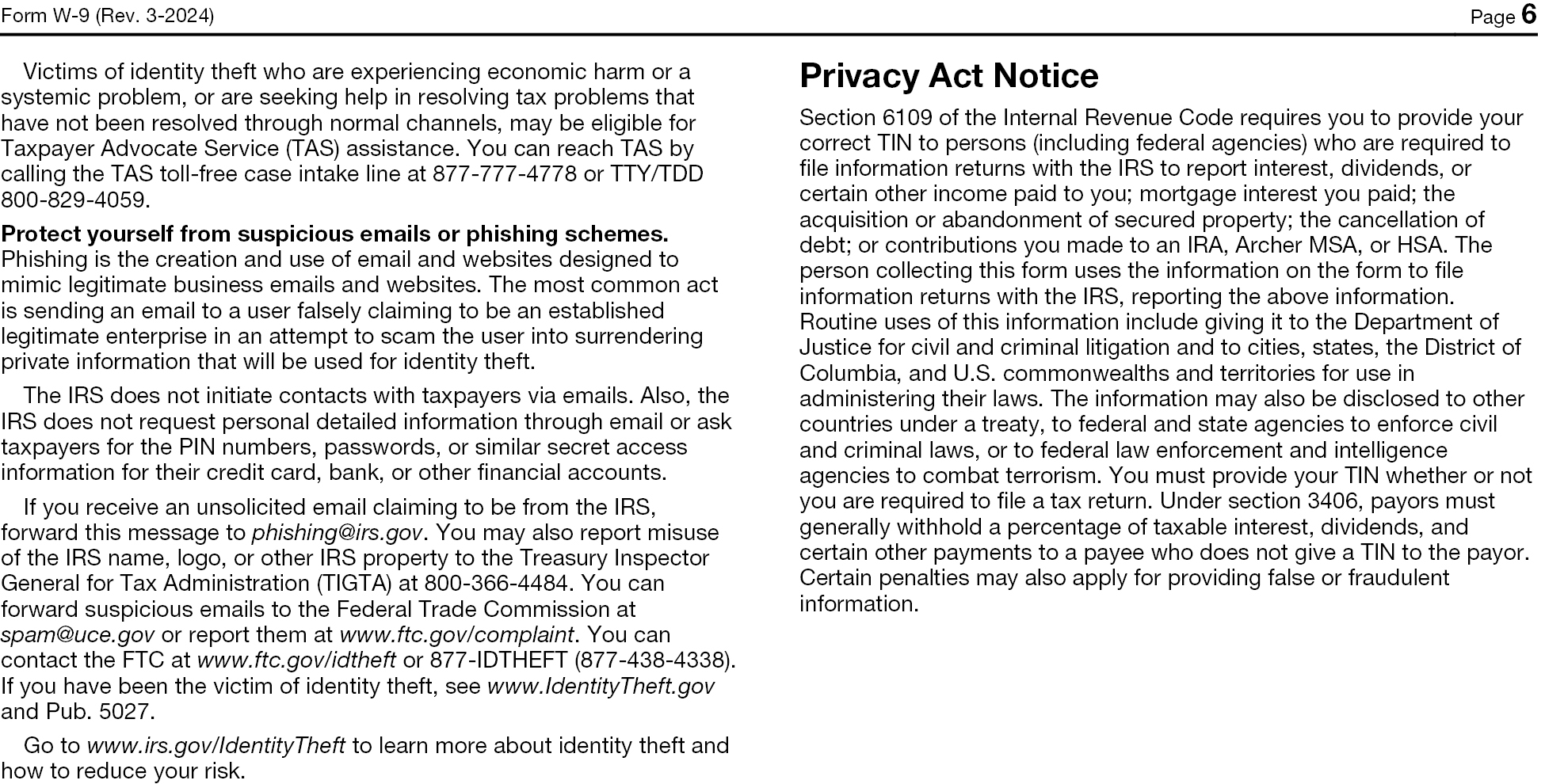

9. Backup Withholding. In order to avoid backup withholding of U.S. federal income tax on payments of cash pursuant to the Offers, a U.S. Stockholder (as defined below) tendering Shares in the Offers must (a) qualify for an exemption, as described below, or (b) timely provide the Depositary or other applicable withholding agent with such stockholder’s correct taxpayer identification number (“TIN”), certify under penalties of perjury that such TIN is correct (or that such stockholder is waiting for a TIN to be issued), and provide certain other certifications by completing the U.S. Internal Revenue Service (“IRS”) Form W-9 accompanying this Letter of Transmittal. If a U.S. Stockholder does not provide a correct TIN or fails to provide the certifications described above, the IRS may impose certain penalties on such U.S. Stockholder and payment of cash to such U.S. Stockholder pursuant to the Offers may be subject to backup withholding at the applicable statutory rate (currently 24%).

A “U.S. Stockholder” is any beneficial owner of Shares for U.S. federal income tax purposes that is (i) an individual who is a citizen or resident of the United States, (ii) a corporation or other entity treated as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United States, any state thereof or the District of Columbia, (iii) an estate, the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) a trust, if a U.S. court can exercise primary supervision over the trust’s administration and one or more United States persons (as determined for U.S. federal income tax purposes) are authorized to control all substantial decisions of the trust or the trust has a valid election in effect under applicable Treasury regulations to be treated as a

12

United States person (as determined for U.S. federal income tax purposes). If a partnership, including any entity that is treated as a partnership for U.S. federal income tax purposes, holds Shares, the U.S. federal income tax treatment of the partner in the partnership will generally depend on the status of the partner and the activities of the partnership. If you are a partner in a partnership that holds Shares, you should consult your tax advisor regarding the tax consequences of tendering Shares held by the partnership.

Backup withholding is not an additional tax. Rather, the amount of the backup withholding can be credited against the U.S. federal income tax liability of the person subject to the backup withholding, provided that the required information is timely given to the IRS. If backup withholding results in an overpayment of tax, a refund can be obtained upon timely filing an income tax return.

A tendering U.S. Stockholder is required to give the Depositary or other applicable withholding agent the TIN of the record owner of the Shares being tendered. If the Shares are held in more than one name or are not in the name of the actual owner, consult the instructions to the enclosed IRS Form W-9 for guidance on which number to report.

If a U.S. Stockholder has not been issued a TIN and has applied for one or intends to apply for one immediately, such U.S. Stockholder should write “Applied For” in the space provided for the TIN in Part I of the IRS Form W-9, and sign and date the IRS Form W-9. Writing “Applied For” means that a U.S. Stockholder has already applied for a TIN or that such U.S. Stockholder intends to apply for one soon. Notwithstanding that the U.S. Stockholder has written “Applied For” in Part I, the Depositary will withhold the applicable statutory rate (currently 24%) on all payments made prior to the time a properly certified TIN is provided to the Depositary.

Some U.S. Stockholders, including all corporations. are exempt from backup withholding. To prevent possible erroneous backup withholding, exempt stockholders should consult the instructions to the enclosed IRS Form W-9 for additional guidance.

A beneficial owner of Shares for U.S. federal income tax purposes that is not a U.S. Stockholder (a “non-U.S. Stockholder”), such as non-resident alien individuals and foreign entities, including a disregarded U.S. domestic entity that has a foreign owner, should not complete an IRS Form W-9. Instead, to establish an applicable withholding exemption from backup withholding, establish its status under the Foreign Account Tax Compliance Act (“FATCA”), and (if applicable) claim a reduced rate of, or exemption from, income tax withholding on amounts treated as dividends (if any), a non-U.S. Stockholder (or its non-U.S. designee, if any) should complete and submit IRS Form(s) W-8BEN, W-8BEN-E, W-8IMY (with any required attachments), W-8ECI, or W-8EXP, as applicable, signed under penalties of perjury, attesting to such non-U.S. Stockholder’s exemption from backup withholding and his, her or its FATCA status and (if applicable) claim a reduced rate of, or exemption from, income tax withholding on amounts treated as dividends (if any). The appropriate Form(s) W-8 may be obtained on the IRS website (www.irs.gov).

10. Withholding on Non-U.S. Stockholders. If you are a non-U.S. Stockholder, because it is unclear whether the cash you receive in connection with the Offers will be treated (i) as proceeds of a sale or exchange or (ii) as a distribution, it is possible that the Depositary or other applicable withholding agent may elect to treat such payment as a dividend distribution for withholding purposes. Accordingly, if you are a non-U.S. Stockholder, you may be subject to withholding on payments to you at a rate of 30% of the gross proceeds paid, unless the Depositary or other applicable withholding agent determines that a reduced rate of withholding is available to you pursuant to a tax treaty or that an exemption from withholding is applicable to you because such gross proceeds are effectively connected with your conduct of a trade or business within the United States. See Section 13 of the Offer to Purchase. In order to obtain a reduced rate of withholding pursuant to an applicable income tax treaty, a non-U.S. Stockholder must deliver to the Depositary, before the payment is made, a properly completed and executed IRS Form W-8BEN or W-8BEN-E claiming such reduction. In order to claim an exemption from withholding on the grounds that the gross proceeds paid pursuant to the Offers are effectively connected with the conduct of a trade or business within the United States, a non-U.S. Stockholder must deliver to the Depositary or other applicable withholding agent, before the payment is made, a properly completed and executed IRS Form W-8ECI. If the Company withholds on the payment, a non-U.S. Stockholder may be eligible to obtain a refund of all or a portion of any U.S. federal tax withheld if such non-U.S. Stockholder meets the “complete termination” or “not essentially equivalent to a dividend” tests described in Section 13 of the Offer to Purchase that will permit the Company to treat the transaction as a sale of the Shares in a transaction that is not taxable as a result of the applicable rules or is otherwise able to establish that such non-U.S. Stockholder is entitled to a reduced rate of withholding pursuant to any applicable income tax treaty and a higher rate was withheld.

13

Unless such non-U.S. Stockholder establishes his, her or its exemption from FATCA, or otherwise complies with FATCA reporting obligations, to comply with FATCA the Company may withhold 30% from such non-U.S. Stockholder’s proceeds on the basis of the assumption that the proceeds are treated as a dividend under the applicable tax rules. If the IRS were to determine that the proceeds are not properly treated as a dividend for U.S. federal income tax purposes, non-U.S. Stockholders may be subject to U.S. federal income tax, generally at the rates applicable to U.S. taxpayers, under the Foreign Investment in Real Property Tax Act of 1980, as amended (“FIRPTA”), plus an additional 30% “branch profits tax” for corporate non-U.S. Stockholders with respect to certain amounts. Amounts subject to tax under FIRPTA (or that may be taxed under FIRPTA) are generally subject to withholding at the rate of 15%, although the Company intends to withhold at the 30% rate, subject to reduction, as described above.

For withholding purposes, the Company will treat any proceeds received by a non-U.S. Stockholder pursuant to the Offers as a dividend for U.S. federal income tax purposes and the Company will withhold accordingly; provided, however, that in the case of a non-U.S. Stockholder that properly claims a reduced rate of, or exemption from, withholding on dividends, the Company may withhold at not less than the 15% withholding rate that may apply under FIRPTA to amounts not treated as dividends. Non-U.S. Stockholders should refer to Section 13 of the Offer to Purchase for a description of certain U.S. federal income tax considerations generally applicable to certain non-U.S. Stockholders tendering shares of Shares pursuant to the Offers.

NON-U.S. STOCKHOLDERS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL INCOME TAX WITHHOLDING RULES, INCLUDING ELIGIBILITY FOR A WITHHOLDING TAX REDUCTION OR EXEMPTION, AND THE REFUND PROCEDURE, AS WELL AS THE APPLICABILITY AND EFFECT OF STATE, LOCAL, FOREIGN AND OTHER TAX LAWS.

11. Requests for Assistance or Additional Copies. If you have questions or need assistance, you should contact the Information Agent at their address and telephone number set forth on the back cover of this Letter of Transmittal. If you require additional copies of the Offer to Purchase, this Letter of Transmittal, the Notice of Guaranteed Delivery, the IRS Form W-9 or other related materials, you should contact the Information Agent. Copies will be furnished promptly at Cedar’s expense.

12. Lost, Destroyed or Stolen Certificates. If any certificate representing Shares has been lost, destroyed or stolen, the stockholder should promptly notify the Depositary at the toll-free number (800) 736-3001. The stockholder will then be instructed by the Depositary as to the steps that must be taken in order to replace the certificate. This Letter of Transmittal and related documents cannot be processed until the procedures for replacing lost, destroyed or stolen certificates have been followed.

13. Conditional Tenders. As described in Sections 3 and 6 of the Offer to Purchase, stockholders may tender Series C Shares subject to the condition that all, or a specified minimum number of Series C Shares be purchased in the Series C Offer if any Series C Shares are purchased, and may tender Series B Shares subject to the condition that all, or a specified minimum number of Series B Shares be purchased in the Series B Offer if any Series B Shares are purchased.

If you wish to make a conditional tender you must indicate this in the box captioned “Conditional Tender” in this Letter of Transmittal and, if applicable, the Notice of Guaranteed Delivery. In this box in this Letter of Transmittal and, if applicable, the Notice of Guaranteed Delivery, you must calculate and appropriately indicate the minimum number of Shares that must be purchased if any are to be purchased.

As discussed in Sections 3 and 6 of the Offer to Purchase, proration may affect whether Cedar accepts conditional tenders and may result in Shares tendered pursuant to a conditional tender being deemed withdrawn if the minimum number of Shares would not be purchased. Upon the terms and subject to the conditions of the Offers, if, because of proration (because more than the number of Shares sought are properly tendered), the minimum number of Shares that you designate will not be purchased, Cedar may accept conditional tenders by random lot, if necessary. However, to be eligible for purchase by random lot, you must have tendered all of your Shares and check the box so indicating. Upon selection by lot, if any, Cedar will limit its purchase in each case to the designated minimum number of Shares.

All tendered Shares will be deemed unconditionally tendered unless the “Conditional Tender” box is completed.

The conditional tender alternative is made available so that a stockholder may seek to structure the purchase of Shares pursuant to the Offers in such a manner that the purchase will be treated as a sale of such Shares by the stockholder, rather than the payment of a dividend to the stockholder, for U.S. federal income tax purposes. It is the tendering

14

stockholder’s responsibility to calculate the minimum number of Shares that must be purchased from the stockholder in order for the stockholder to qualify for sale rather than dividend treatment. Each stockholder is urged to consult his or her own tax advisor. See Section 6 of the Offer to Purchase.

14. Order of Purchase in Event of Proration. As described in Section 1 of the Offer to Purchase, Stockholders tendering Series C Shares in the Series C Offer may specify the order in which the stockholder’s tendered Series C shares will be purchased in the event that, as a result of proration or otherwise, some but not all of the Series C Shares are purchased pursuant to the Series C Offer. Stockholders tendering Series B Shares in the Series B Offer may specify the order in which the stockholder’s tendered Series B Shares will be purchased in the event that, as a result of proration or otherwise, some but not all of the Series B Shares are purchased pursuant to the Series B Offer. In the event a stockholder does not designate such order and fewer than all of such stockholder’s Series C Shares or Series B Shares, the Depositary will select the order of Shares purchased within each series as applicable. A stockholder who tenders both Series C Shares and Series B Shares may not specify certain shares of one series be purchased prior to certain shares of another series. The order of purchase may have an effect on the U.S. federal income tax classification and the amount of any gain or loss on the Shares purchased. See Sections 1 and 13 of the Offer to Purchase.

IMPORTANT: THIS LETTER OF TRANSMITTAL (OR A MANUALLY SIGNED FACSIMILE OF THIS LETTER OF TRANSMITTAL), TOGETHER WITH ANY REQUIRED SIGNATURE GUARANTEES, OR, IN THE CASE OF A BOOK-ENTRY TRANSFER, AN AGENT’S MESSAGE, AND ANY OTHER REQUIRED DOCUMENTS, MUST BE RECEIVED BY THE DEPOSITARY PRIOR TO THE EXPIRATION DATE AND EITHER CERTIFICATES FOR TENDERED SHARES MUST BE RECEIVED BY THE DEPOSITARY OR SHARES MUST BE DELIVERED PURSUANT TO THE PROCEDURES FOR BOOK-ENTRY TRANSFER, IN EACH CASE PRIOR TO THE EXPIRATION DATE, OR THE TENDERING STOCKHOLDER MUST COMPLY WITH THE PROCEDURES FOR GUARANTEED DELIVERY.

Any questions or requests for assistance may be directed to the Information Agent at their telephone number and address set forth below. Requests for additional copies of the Offer to Purchase, this Letter of Transmittal, the Notice of Guaranteed Delivery or related documents may be directed to the Information Agent at its telephone numbers or address set forth below. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offers.

The Depositary for the Offers is:

|

Computershare Inc. |

||

|

By Mail: BY 5:00 P.M. New York City time |

By Overnight Courier: BY 5:00 P.M. New York City time |

|

The Information Agent for the Offers is:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Shareholders, Banks and Brokers

Call Toll Free: (866) 735-3807

15

Form W-9 Rev. March 2024) Department of the Treasury Internal Revenue Service Request for Taxpayer Identification Number and Certification Department of the Treasury Internal Revenue Service Go to www.irs.gov/FormW9 for instructions and the latest information. Give form to the requester. Do not send to the IRS. Before you begin. For guidance related to the purpose of Form W-9, see Purpose of Form, below. Print or type. See Specific Instructions on page 3. 1 Name of entity/individual. An entry is required. (For a sole proprietor or disregarded entity, enter the owner’s name on line 1, and enter the business/disregarded entity’s name on line 2.) 2 Business name/disregarded entity name, if different from above. 3a Check the appropriate box for federal tax classification of the entity/individual whose name is entered on line 1. Check only one of the following seven boxes. Individual/sole proprietor C corporation S corporation Partnership Trust/estate LLC. Enter the tax classification (C = C corporation, S = S corporation, P = Partnership) . . . . Note: Check the “LLC” box above and, in the entry space, enter the appropriate code (C, S, or P) for the tax classification of the LLC, unless it is a disregarded entity. A disregarded entity should instead check the appropriate box for the tax classification of its owner. Other (see instructions) 3b If on line 3a you checked “Partnership” or “Trust/estate,” or checked “LLC” and entered “P” as its tax classification, and you are providing this form to a partnership, trust, or estate in which you have an ownership interest, check this box if you have any foreign partners, owners, or beneficiaries. See instructions . . . . . . . . . 4 Exemptions (codes apply only to certain entities, not individuals; see instructions on page 3): Exempt payee code (if any) Exemption from Foreign Account Tax Compliance Act (FATCA) reporting code (if any) (Applies to accounts maintained outside the United States.) 5 Address (number, street, and apt. or suite no.). See instructions. 6 City, state, and ZIP code Requester’s name and address (optional) 7 List account number(s) here (optional) Part I Taxpayer Identification Number (TIN) Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals, this is generally your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN, later. Note: If the account is in more than one name, see the instructions for line 1. See also What Name and Number To Give the Requester for guidelines on whose number to enter. Social security number – – or Employer identification number Part II Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2. I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and 3. I am a U.S. citizen or other U.S. person (defined below); and 4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and, generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later. Sign Here Signature of U.S. person Date General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Future developments. For the latest information about developments related to Form W-9 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/FormW9. What’s New Line 3a has been modified to clarify how a disregarded entity completes this line. An LLC that is a disregarded entity should check the appropriate box for the tax classification of its owner. Otherwise, it should check the “LLC” box and enter its appropriate tax classification. New line 3b has been added to this form. A flow-through entity is required to complete this line to indicate that it has direct or indirect foreign partners, owners, or beneficiaries when it provides the Form W-9 to another flow-through entity in which it has an ownership interest. This change is intended to provide a flow-through entity with information regarding the status of its indirect foreign partners, owners, or beneficiaries, so that it can satisfy any applicable reporting requirements. For example, a partnership that has any indirect foreign partners may be required to complete Schedules K-2 and K-3. See the Partnership Instructions for Schedules K-2 and K-3 (Form 1065). Purpose of Form An individual or entity (Form W-9 requester) who is required to file an information return with the IRS is giving you this form because they

must obtain your correct taxpayer identification number (TIN), which may be your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but are not limited to, the following. • Form 1099-INT (interest earned or paid). • Form 1099-DIV (dividends, including those from stocks or mutual funds). • Form 1099-MISC (various types of income, prizes, awards, or gross proceeds). • Form 1099-NEC (nonemployee compensation). • Form 1099-B (stock or mutual fund sales and certain other transactions by brokers). • Form 1099-S (proceeds from real estate transactions). • Form 1099-K (merchant card and third-party network transactions). • Form 1098 (home mortgage interest), 1098-E (student loan interest), and 1098-T (tuition). • Form 1099-C (canceled debt). • Form 1099-A (acquisition or abandonment of secured property). Use Form W-9 only if you are a U.S. person (including a resident alien), to provide your correct TIN. Caution: If you don’t return Form W-9 to the requester with a TIN, you might be subject to backup withholding. See What is backup withholding, later. By signing the filled-out form, you: 1. Certify that the TIN you are giving is correct (or you are waiting for a number to be issued); 2. Certify that you are not subject to backup withholding; or 3. Claim exemption from backup withholding if you are a U.S. exempt payee; and 4. Certify to your non-foreign status for purposes of withholding under chapter 3 or 4 of the Code (if applicable); and 5. Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting is correct. See What Is FATCA Reporting, later, for further information. Note: If you are a U.S. person and a requester gives you a form other than Form W-9 to request your TIN, you must use the requester’s form if it is substantially similar to this Form W-9. Definition of a U.S. person. For federal tax purposes, you are considered a U.S. person if you are: • An individual who is a U.S. citizen or U.S. resident alien; • A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States; • An estate (other than a foreign estate); or • A domestic trust (as defined in Regulations section 301.7701-7). Establishing U.S. status for purposes of chapter 3 and chapter 4 withholding. Payments made to foreign persons, including certain distributions, allocations of income, or transfers of sales proceeds, may be subject to withholding under chapter 3 or chapter 4 of the Code (sections 1441–1474). Under those rules, if a Form W-9 or other certification of non-foreign status has not been received, a withholding agent, transferee, or partnership (payor) generally applies presumption rules that may require the payor to withhold applicable tax from the recipient, owner, transferor, or partner (payee). See Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. The following persons must provide Form W-9 to the payor for purposes of establishing its non-foreign status. • In the case of a disregarded entity with a U.S. owner, the U.S. owner of the disregarded entity and not the disregarded entity. • In the case of a grantor trust with a U.S. grantor or other U.S. owner, generally, the U.S. grantor or other U.S. owner of the grantor trust and not the grantor trust. • In the case of a U.S. trust (other than a grantor trust), the U.S. trust and not the beneficiaries of the trust. See Pub. 515 for more information on providing a Form W-9 or a certification of non-foreign status to avoid withholding. Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person (under Regulations section 1.1441-1(b)(2)(iv) or other applicable section for chapter 3 or 4 purposes), do not use Form W-9. Instead, use the appropriate Form W-8 or Form 8233 (see Pub. 515). If you are a qualified foreign pension fund under Regulations section 1.897(l)-1(d), or a partnership that is wholly owned by qualified foreign pension funds, that is treated as a non-foreign person for purposes of section 1445 withholding, do not use Form W-9. Instead, use Form W-8EXP (or other certification of non-foreign status). Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a saving clause. Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes. If you are a U.S. resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from U.S. tax on certain types of income, you must attach a statement to Form W-9 that specifies the following five items. 1. The treaty country. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien. 2. The treaty article addressing the income. 3. The article number (or location) in the tax treaty that contains the saving clause and its exceptions. 4. The type and amount of income that qualifies for the exemption from tax. 5. Sufficient facts to justify the exemption from tax under the terms of the treaty article. Example. Article 20 of the U.S.-China income tax treaty allows an exemption from tax for scholarship income received by a Chinese student temporarily present in the United States. Under U.S. law, this student will become a resident alien for tax purposes if their stay in the United States exceeds 5 calendar years. However, paragraph 2 of the first Protocol to the U.S.-China treaty (dated April 30, 1984) allows the provisions of Article 20 to continue to apply even after the Chinese student becomes a resident alien of the United States. A Chinese student who qualifies for this exception (under paragraph 2 of the first Protocol) and is relying on this exception to claim an exemption from tax on their scholarship or fellowship income would attach to Form W-9 a statement that includes the information described above to support that exemption. If you are a nonresident alien or a foreign entity, give the requester the appropriate completed Form W-8 or Form 8233. Backup Withholding What is backup withholding? Persons making certain payments to you must under certain conditions withhold and pay to the IRS 24% of such payments. This is called “backup withholding.” Payments that may be subject to backup withholding include, but are not limited to, interest, tax-exempt interest, dividends, broker and barter exchange transactions, rents, royalties, nonemployee pay, payments made in settlement of payment card and third-party network transactions, and certain payments from fishing boat operators. Real estate transactions are not subject to backup withholding. You will not be subject to backup withholding on payments you receive if you give the requester your correct TIN, make the proper certifications, and report all your taxable interest and dividends on your tax return. Payments you receive will be subject to backup withholding if: 1. You do not furnish your TIN to the requester; 2. You do not certify your TIN when required (see the instructions for Part II for details); 3. The IRS tells the requester that you furnished an incorrect TIN; 4. The IRS tells you that you are subject to backup withholding because you did not report all your interest and dividends on your tax return (for reportable interest and dividends only); or 5. You do not certify to the requester that you are not subject to backup withholding, as described in item 4 under “By signing the filled-out form” above (for reportable interest and dividend accounts opened after 1983 only).

Certain payees and payments are exempt from backup withholding. See Exempt payee code, later, and the separate Instructions for the Requester of Form W-9 for more information. See also Establishing U.S. status for purposes of chapter 3 and chapter 4 withholding, earlier. What Is FATCA Reporting? The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all U.S. account holders that are specified U.S. persons. Certain payees are exempt from FATCA reporting. See Exemption from FATCA reporting code, later, and the Instructions for the Requester of Form W-9 for more information. Updating Your Information You must provide updated information to any person to whom you claimed to be an exempt payee if you are no longer an exempt payee and anticipate receiving reportable payments in the future from this person. For example, you may need to provide updated information if you are a C corporation that elects to be an S corporation, or if you are no longer tax exempt. In addition, you must furnish a new Form W-9 if the name or TIN changes for the account, for example, if the grantor of a grantor trust dies. Penalties Failure to furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. Civil penalty for false information with respect to withholding. If you make a false statement with no reasonable basis that results in no backup withholding, you are subject to a $500 penalty. Criminal penalty for falsifying information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment. Misuse of TINs. If the requester discloses or uses TINs in violation of federal law, the requester may be subject to civil and criminal penalties. Specific Instructions Line 1 You must enter one of the following on this line; do not leave this line blank. The name should match the name on your tax return. If this Form W-9 is for a joint account (other than an account maintained by a foreign financial institution (FFI)), list first, and then circle, the name of the person or entity whose number you entered in Part I of Form W-9. If you are providing Form W-9 to an FFI to document a joint account, each holder of the account that is a U.S. person must provide a Form W-9. Individual. Generally, enter the name shown on your tax return. If you have changed your last name without informing the Social Security Administration (SSA) of the name change, enter your first name, the last name as shown on your social security card, and your new last name. Note for ITIN applicant: Enter your individual name as it was entered on your Form W-7 application, line 1a. This should also be the same as the name you entered on the Form 1040 you filed with your application. Sole proprietor. Enter your individual name as shown on your Form 1040 on line 1. Enter your business, trade, or “doing business as” (DBA) name on line 2. Partnership, C corporation, S corporation, or LLC, other than a disregarded entity. Enter the entity’s name as shown on the entity’s tax return on line 1 and any business, trade, or DBA name on line 2. Other entities. Enter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown on the charter or other legal document creating the entity. Enter any business, trade, or DBA name on line 2. Disregarded entity. In general, a business entity that has a single owner, including an LLC, and is not a corporation, is disregarded as an entity separate from its owner (a disregarded entity). See Regulations section 301.7701-2(c)(2). A disregarded entity should check the appropriate box for the tax classification of its owner. Enter the owner’s name on line 1. The name of the owner entered on line 1 should never be a disregarded entity. The name on line 1 should be the name shown on the income tax return on which the income should be reported. For example, if a foreign LLC that is treated as a disregarded entity for U.S. federal tax purposes has a single owner that is a U.S. person, the U.S. owner’s name is required to be provided on line 1. If the direct owner of the entity is also a disregarded entity, enter the first owner that is not disregarded for federal tax purposes. Enter the disregarded entity’s name on line 2. If the owner of the disregarded entity is a foreign person, the owner must complete an appropriate Form W-8 instead of a Form W-9. This is the case even if the foreign person has a U.S. TIN. Line 2 If you have a business name, trade name, DBA name, or disregarded entity name, enter it on line 2. Line 3a Check the appropriate box on line 3a for the U.S. federal tax classification of the person whose name is entered on line 1. Check only one box on line 3a. IF the entity/individual on line 1 is a(n) . . . THEN check the box for . . . Corporation Corporation. Individual or Sole proprietorship Individual/sole proprietor. LLC classified as a partnership for U.S. federal tax purposes or LLC that has filed Form 8832 or 2553 electing to be taxed as a corporation Limited liability company and enter the appropriate tax classification: P = Partnership, C = C corporation, or S = S corporation. Partnership Partnership. Trust/estate Trust/estate. Line 3b Check this box if you are a partnership (including an LLC classified as a partnership for U.S. federal tax purposes), trust, or estate that has any foreign partners, owners, or beneficiaries, and you are providing this form to a partnership, trust, or estate, in which you have an ownership interest. You must check the box on line 3b if you receive a Form W-8 (or documentary evidence) from any partner, owner, or beneficiary establishing foreign status or if you receive a Form W-9 from any partner, owner, or beneficiary that has checked the box on line 3b. Note: A partnership that provides a Form W-9 and checks box 3b may be required to complete Schedules K-2 and K-3 (Form 1065). For more information, see the Partnership Instructions for Schedules K-2 and K-3 (Form 1065). If you are required to complete line 3b but fail to do so, you may not receive the information necessary to file a correct information return with the IRS or furnish a correct payee statement to your partners or beneficiaries. See, for example, sections 6698, 6722, and 6724 for penalties that may apply. Line 4 Exemptions If you are exempt from backup withholding and/or FATCA reporting, enter in the appropriate space on line 4 any code(s) that may apply to you. Exempt payee code. Generally, individuals (including sole proprietors) are not exempt from backup withholding. Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Corporations are not exempt from backup withholding for payments made in settlement of payment card or third-party network transactions. Corporations are not exempt from backup withholding with respect to attorneys’ fees or gross proceeds paid to attorneys, and corporations that provide medical or health care services are not exempt with respect to payments reportable on Form 1099-MISC. The following codes identify payees that are exempt from backup withholding. Enter the appropriate code in the space on line 4. 1—An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2).